Soaring petrol costs drive UK inflation to 30-year high

- Published

- comments

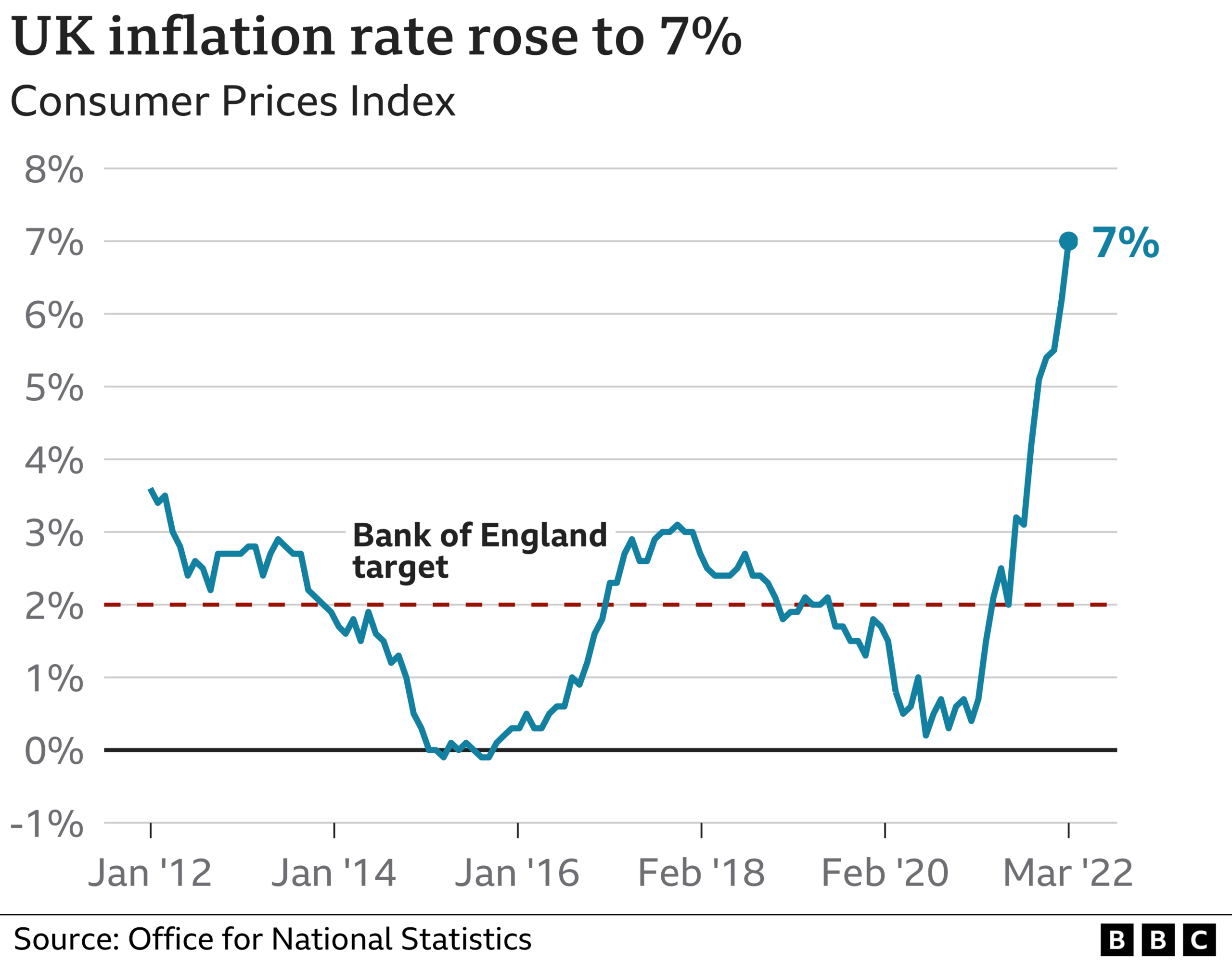

Prices are rising at their fastest rate for 30 years, driven by a sharp increase in petrol and diesel costs.

The UK inflation rate rose to 7% in the year to March, the highest rate since 1992 and up from 6.2% in February.

Prices are rising faster than wages and there is pressure on the government to do more to help those struggling.

The cost of living is expected to rise even further after the energy price cap was increased, driving up gas and electricity bills for millions.

Inflation is the rate at which prices rise. If a bottle of milk costs £1 and that rises by 5p, then milk inflation is 5%.

Fuel had the biggest impact on the inflation rate, with average petrol prices rising by 12.6p per litre between February and March, the largest monthly rise since records began in 1990, the Office for National Statistics (ONS) said, external.

This compares with a rise of 3.5p per litre between the same months of 2021.

Diesel prices also rose by 18.8p per litre this year, compared with a rise of 3.5p per litre a year ago.

The rise in the inflation rate was higher than the 6.7% expected by analysts and was also driven up by furniture, restaurant and food prices.

The figures for March do not yet reflect the average £700-a-year increase in energy bills that took place from 1 April when the energy price cap was raised.

Sara Gerritsma says her petrol costs have shot up by about £120 a month

Since late last year, prices have been rising fast as pandemic restrictions have been eased and firms face higher energy and shipping costs which they have passed on to consumers.

Russia's invasion of Ukraine is now adding to the pain, as the price of oil and other commodities climb higher.

Russia is one of the world's largest oil exporters and demand for oil from other producers has increased since the invasion, leading to higher prices.

Although the UK imports just 6% of its crude oil from Russia, it is still affected when global prices rise.

Ukraine and Russia are also the world's main suppliers of sunflower oil and the war has hit prices.

In the UK, the price of oils and fats for food increased by 7.2% in March, according to the ONS.

Andrew Selley, chief executive of wholesaler BidFood, which supplies 45,000 caterers and food service businesses across the UK, said increasing electricity, fuel and packaging costs were impacting the price of all its products.

But he told the BBC products affected by the war in Ukraine, such as wheat-based foods, sunflower oil, chicken and white fish, were particularly hard hit.

"I've been in the business for over 30 years. I've never seen a situation where everything seems to be going up [in price]," he said, adding that some of these costs would ultimately be passed on to consumers.

The firm had previously sourced a lot of its chicken from Poland but Ukrainian workers had returned to fight in the war and the country was keeping more of its chicken to feed refugees meaning it was now sourcing from other countries, driving prices up by a fifth.

Sara Gerritsma, a student from Leicestershire with a partner and six year-old child, said she may have to give up her paramedic degree due to the rising cost of fuel.

The 32-year-old only started the three-year course in October but she has a 2.5 hour roundtrip each day to get to university in Northampton, and her petrol costs have shot up by about £120 a month.

"It would be really frustrating giving up my course. It was a big decision changing my career at 32," Sara told the BBC.

"But recently we have sat down and gone through everything and thought, can I afford to be a full-time student?"

The sharp rise in prices is also putting pressure on businesses.

Paul White, who owns the pizzeria 6/CUT in Eccles, Greater Manchester, said the increase in the minimum wage, the end of VAT relief, and rising fuel and food prices have all hit his company. The restaurant is also spending £500 more a week on its energy bills.

"We need to find an extra £1,400 a week to cover the costs of everything that's come on in the last few weeks," he told the BBC.

He says he will have to put up prices, and is looking to charge each customer about 50p to £1 extra to cover his rising overheads.

But he is also worried people might start eating out less as their budgets are squeezed.

This is no longer a cost of living squeeze, but a financial throttling for many people. Price rises are accelerating and their wages, benefits and pensions are failing to keep pace.

In the words of the ONS, there were "no large offsetting downward contributions" to the inflation rate. In other words, nothing is getting significantly cheaper.

So avoidance of price rises is impossible. Even if you do not have a car and are avoiding surging fuel costs, lots of other necessities are getting more expensive.

Experts say the only option is trying to budget as best we can, across every part of our lives. Most importantly, they also stress the importance of seeking early, and free, help before falling into unmanageable debt.

Research for the consultancy Retail Economics found the least affluent UK households saw discretionary income fall by 5.2% or £26 in March, compared with the same month last year. The Retail Economics-HyperJar Cost of Living Tracker said households on average incomes had £52 each less spare cash, a fall of £52.

Chief executive Richard Lim said it was a "real concern to see the least affluent families under this amount of pressure even before accounting for the energy price hikes".

"The most disadvantaged households will experience the brunt of the crisis," he added.

Jack Leslie, senior economist at the Resolution Foundation think tank, which focuses on those on lower incomes, warned the cost of living crisis would "continue to worsen before it starts to ease at some point next year".

He said with wages not keeping pace with rising prices, people were facing "the biggest squeeze since the mid-70s."

Chancellor Rishi Sunak said: "I know this is a worrying time for many families, which is why we are taking action to ease the burdens by providing support worth around £22bn in this financial year, including for the most vulnerable through our Household Support Fund."

But Labour criticised the government for increasing taxes when "the cost of living is hitting households hard".

Liberal Democrats leader Ed Davey called for "unfair tax hikes" to be immediately reversed and said people needed "urgent help" with energy bills.

And the SNP said the "cost of living crisis continues to spiral out of control with no sign of the UK government stepping up to the challenge to protect families and households".

- Published13 April 2022

- Published13 April 2022

- Published12 April 2022

- Published15 March 2022

- Published1 April 2022

- Published14 August 2023