Help to Buy Isa scheme: Your stories

- Published

Savers want to see the cap on the Help to Buy Isa raised.

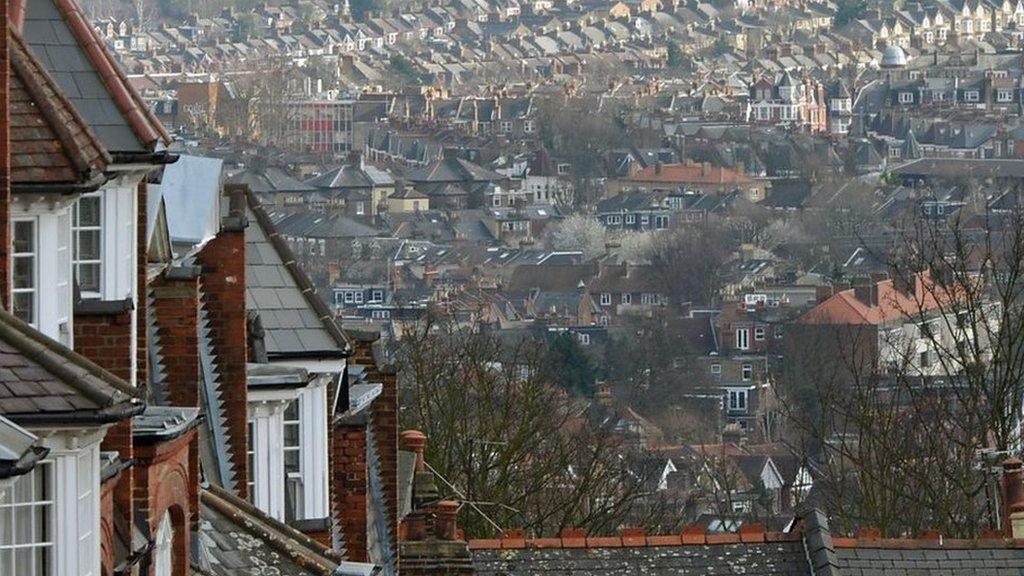

Housing is "too expensive" for would-be buyers to take advantage of the government's Help to Buy Isa (HTB Isa), savers have told the BBC.

A BBC investigation found found in many areas the average price of a starter home exceeds the maximum purchase cap permitted under the scheme.

Here we share your stories.

Solicitor Claire Etheridge wants to see the cap raised in areas surrounding London

Claire Etheridge, from Greenwich, south-east London, works in the capital but cannot afford to buy a home there.

The 28-year-old solicitor believes areas surrounding London should have the £250,000 cap raised.

"I am looking to buy in St Albans and commute in," she said. "However, this falls outside of London and therefore what I have been saving in the Isa I will not be able use, as the properties I am looking at are just over the £250,000 cap for outside of London.

"It's a great scheme for outside of London but I really think the surrounding areas of London such as Kent or Hertfordshire, there should be some allowance for the fact prices are still high and therefore the £250,000 cap does not assist."

Liane Reilly, of Hemel Hempstead in Hertfordshire, said she and her partner did not have enough money left to save after bills.

The 30-year-old said: "We are renting a 1-bedroom flat at £900 per month. This takes up almost one of our salaries, we will never be able to save to be able to afford to buy. Our salaries go on bills and rent."

Matthew and Anne Taylor used Help to Buy

The HTB Isa is the latest part of the overall Help to Buy scheme, where the government also offers equity loans to cover up to 20% of the cost of a newly built home. Borrowers are not charged fees on the loan for the first five years.

Management consultant Matthew Taylor, aged 27, and his wife Anne, a research client manager, used the loan scheme to buy a house in Dartford, Kent.

"Help to Buy genuinely works," he said. "Perhaps people need to think about the practical side of why this scheme was implemented.

"I'd love to live in central London in a house with a garden. The reality is that that just isn't possible.

"So we looked out to where it was possible; in our case this turned out to be Dartford in Kent. We secured an amazing new build three-bedroom house with a garden and moved in three weeks ago.

"Living and working in London brings a compromise, generally you choose the perfect location with a compromise on the property or a great property with a compromise on the location. The Help to Buy scheme isn't there to just hand perfect homes to people, it's to help them start the home -ownership journey by helping us get onto the first rung of the housing ladder."

Catharina, who did not want to give her last name, told BBC News she feared house prices would rise too fast for her savings to make a difference.

"I am using the Help to Buy Isa but would struggle to buy even a small one-bedroom flat with those savings in London.

"Even if properties now were available within the cap, historical data suggests that by the time I fill up my Help to Buy Isa, they wouldn't be."

The challenge of buying a starter home

- Published20 June 2016

- Published26 August 2016

- Published20 June 2016