How the taxpayer is helping people buy their homes

- Published

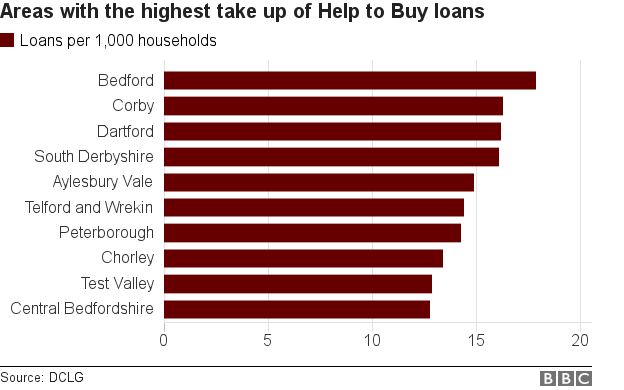

With almost a third of new build homes outside London sold with the help of government-backed loans, the taxpayer has given more than 100,000 home owners a leg up on to the property ladder.

What is the Help to Buy scheme and how does it work?

There were four branches of former Prime Minister David Cameron's flagship scheme for new homeowners.

One, the mortgage guarantee, saw the government offer lenders the option to purchase a guarantee on mortgages where the borrower had a deposit of between 5% and 20%. This meant lenders were able to offer mortgages to people with smaller deposits. The scheme ended in December 2016.

Other aspects of Help to Buy still in place are:

Equity loans, external: The government lends buyers up to 20% of the cost of a newly built home, with a price of up to £600,000 (this was increased to 40% for Greater London, external properties in February 2016). Borrowers are not charged loan fees on that 20% for the first five years of home ownership.

Help to Buy ISA, external: People saving for a deposit into a Help to Buy ISA get an additional 25% from the government upon the purchase of their home. The maximum bonus is capped at £3,000 and the bonus can only be obtained on properties worth up to £250,000 (or £450,000 in London).

Shared ownership, external: For people who cannot afford the full mortgage, the shared ownership scheme allows them to buy between 25% and 75% of their home's value and pay rent on the rest. It is available to people with a household income of £80,000 a year or less (£90,000 in London) as well as first time buyers, people who used to own a home but cannot afford to buy one now or existing shared owners looking to move.