Budget 2021: Stamp duty holiday extension welcomed by house-buyers

- Published

Helen Ramsay and Danny Whinn - and their dog Ruby - are taking advantage of the stamp duty discount to move home

Chancellor Rishi Sunak has extended the stamp duty holiday in the Budget. Anyone buying a home worth up to £500,000 before the end of June will now not pay the tax, and could save up to £15,000, with a reduced discount available until the end of September. So how have prospective house-hunters reacted?

"Massive relief"

Danny Whinn, 31, and Helen Ramsay, 35, moved into their one-bedroom flat in converted maltings near Oulton Broad in Suffolk three and a half years ago, but now want more space to start a family.

They were prompted to move after Mr Sunak announced the first stamp duty discount last summer, and found a buyer within a week of putting their property on the market.

When the move is completed, they will save about £1,000 by not having to pay stamp duty on a £175,000 three-bedroom house in nearby Lowestoft.

"We probably wouldn't have gone to the price we have, if we couldn't save any money in other areas, and stamp duty is obviously the biggest factor so far," said Mr Whinn.

"It's a massive relief for people like us who haven't got thousands of pounds in the bank to throw at a property."

The couple, who work in the leisure sector, have been flexi-furloughed and are now hoping to return to work next month.

Choreographer Ms Ramsay said they both needed to show a month's wage slip without furlough payments in order to qualify for a new mortgage and complete the transaction.

"The extension gives us more breathing space to qualify for the mortgage we need," she said.

'Need more space'

Fliss and Vijay Jethwa said they would save "quite a considerable amount" in stamp duty if they closed their deal before 31 March

Fliss Jethwa, 33, and her husband Vijay, 37, would like to sell their London flat - worth £475,000 - and for the same price buy a three or four-bedroom property in Leighton Buzzard, Bedfordshire.

"With lockdown and being in the flat for the last year we've realised we need a lot more space," said Mrs Jethwa.

Their two-bedroom flat in Herne Hill has no garden, which Mrs Jethwa said had been particularly hard during last year's hot months in lockdown.

"Since the news about the possibility of a [stamp duty] extension, we thought 'right, let's get our act together and put the flat on the market'."

Mrs Jethwa said the extension was "great news".

"We're conscious we'll have to find our new home and agree an offer quite quickly to ensure we beat the new deadline and make the full £15,000 saving.

"Failing that, if we can't act quickly enough, it's reassuring to know we've got until the end of September to benefit from a smaller stamp duty saving.

"We will be paying out for rail fares [to commute to work] but hoping that we'll have more flexible working so it won't be five days a week," she added.

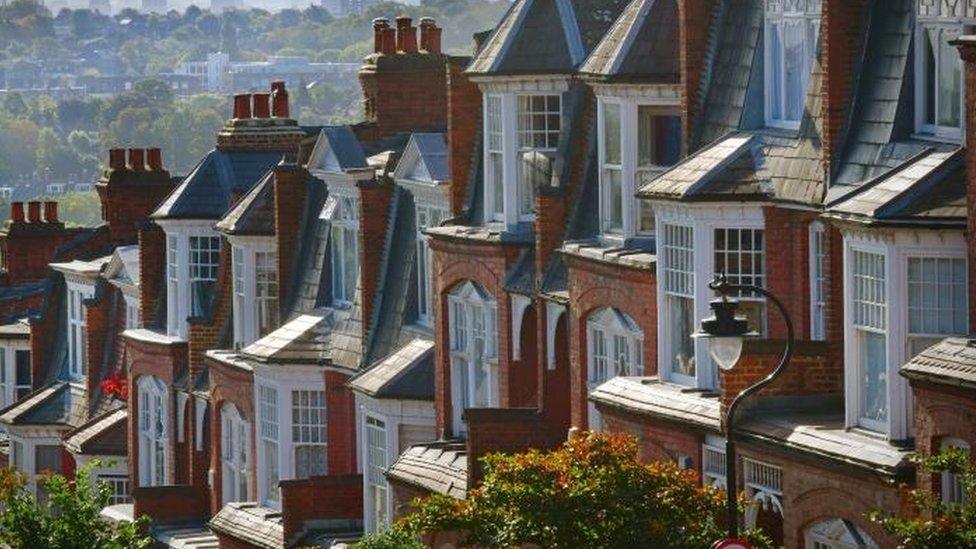

Home buyers have welcomed the extension of the stamp duty discount

What is stamp duty?

Stamp duty is a tax paid by house buyers, dependent upon the price of the property.

The nil-rate tax break was introduced last year to stimulate the housing market and has been extended until the end of September by the chancellor in the latest Budget.

The relief is being staggered and between March and June will remain at 0% on properties up to £500,000.

From June, the first £250,000 of the purchase price will be exempt from the tax, before the allowance returns to its pre-pandemic level of £125,000 from the start of October.

Since the discount was introduced it has cost the Treasury an estimated £3.8bn in revenue - about 2% of the government's total tax take.

Housing market impact

Minors and Brady estate agent Jamie Minors has noticed a spike in sales due to the duty discount

East Anglian estate agent Jamie Minors said the stamp duty discount had "definitely spurred interest".

"People who were perhaps unsure or uncertain or worried about the state of the economy - that's given them the boost to go out there and move homes," he said.

He said lockdown had driven prices up as more people sought homes with "studies, gardens, outbuildings and larger plots".

Mr Minors said the government-backed 95% mortgages announced in the Budget would "help hundreds of thousands of first-time buyers get on to the ladder".

"This is a huge, huge step forward for 'Generation Buy', and not 'Generation Rent'," he said. "The market will now continue to be phenomenally active."

Property website Zoopla has estimated that 46% of house sales in England to the end of September will benefit from full or partial stamp duty exemption.

Duncan Baker, Conservative MP for North Norfolk, said he was a supporter of continuing the tax break.

"The biggest stimulus that this is providing is for all the ancillary services connected to buying a home," he said.

"Whether that's retailing, professional services or construction, to that regard, it's very much stimulated the economy."

But the Leader of the Opposition, Labour's Sir Keir Starmer, said there should have been plans announced for a "generation of genuinely affordable council housing".

He argued the government's mortgage guarantee would drive up home prices for first-time buyers.

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story suggestion email eastofenglandnews@bbc.co.uk

- Published2 April

- Published26 February 2021

- Published30 December 2020

- Published8 July 2020