Birmingham high-rise flat owners face £500,000 insurance hike

- Published

Michelle Henry has lived at Brindley House since 2011

Flat owners at a tower block in Birmingham say they face a joint insurance bill of about £500,000 due to changes brought in the wake of the Grenfell Tower tragedy.

Last year, owners of the 182 flats in Brindley House paid £43,000.

They have called for government funding help similar to that provided to people living in flood-risk areas.

The Association of British Insurers said members were working to make sure all high-rises could be insured.

However, the industry body said insurers were taking a more detailed view of buildings with combustible materials on them and were working with owners to "ensure alternative fire risk measures are in place until remediation happens".

The management of the 60m-high building in Newhall Street was taken over by flat owners in 2016 and it falls to them to pay the costs.

Flat owner Katie Illingworth said the issue was "consuming" her

Although cladding and insulation met standards when the tower was built in the 1970s, it fails to meet the latest regulations.

As well as increased premiums, insurers are demanding insulation and cladding are replaced at a cost expected to be in the region of £5m to £10m.

The exact type of insulation was only revealed in more invasive tests last year as required under new guidelines.

Michelle Henry, on the Brindley House Right to Manage Board, said: "The insulation that we have is classed as combustible. For the first 15 floors we have a concrete render with polystyrene insulation behind it. On the top two floors, we have HPL cladding which is combustible as well as the insulation behind it."

Tom Brothwell, a director of the right to manage board, said steps had been taken to improve safety at the building, including a "waking watch" of two wardens who monitor fire risks 24 hours a day.

"I can't get my head round it," Ms Henry said.

"The building is the safest it's ever been. To me it seems like profiteering."

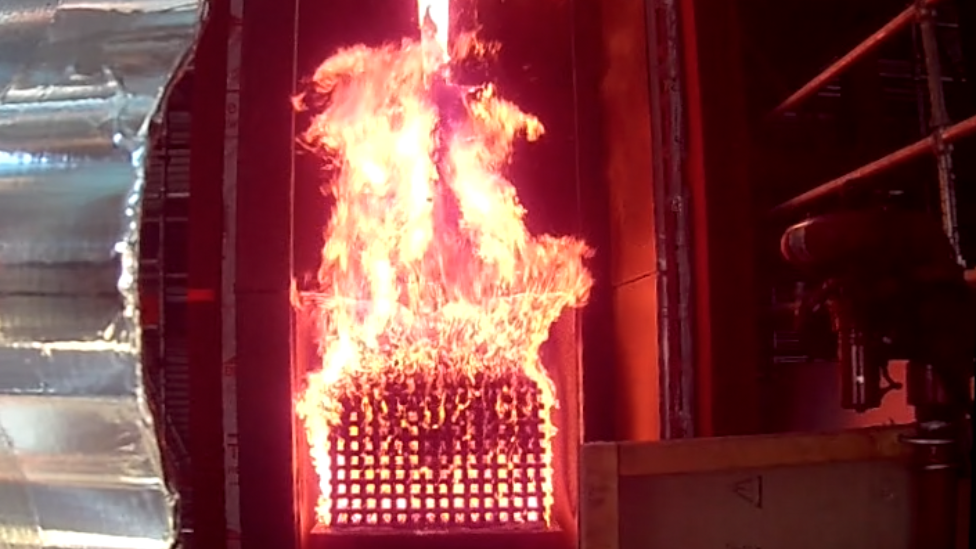

High-rise buildings across the country have been undergoing more stringent tests in the wake of the fire at Grenfell Tower

Katie Illingworth, who rents out her apartment as a retirement income, said the issue "is consuming my entire existence at the moment".

She said: "I was hanging back from telling my family because I didn't want to worry them. It just changes your personality, so that instead of being an upbeat, positive kind of person, you become someone who is consumed by financial worries."

Resident Hana Imaan said her husband has been furloughed and she is facing redundancy.

"Where are we going to get that money? The government have to step in and help us," she said.

Resident Hana Imaan said the government should step in and help

The Ministry of Housing, Communities and Local Government said decisions concerning the pricing and availability of insurance were a commercial decision for lenders.

Despite the announcement of a £1bn government fund for external wall remediation, the flat owners do not yet know if they will be eligible for funding.

They are calling for a scheme to be introduced similar to Flood Re, which was set up to provide insurance for people living in flood risk areas.

Ritu Saha, from the UK Cladding Action Group, said they were seeing cases across the country of insurance premiums increasing and some flat owners feared losing their homes and bankruptcy due to the costs.

The action group said it had held talks with the government and would continue to push for it to underwrite premiums.

Follow BBC West Midlands on Facebook, external, Twitter, external and Instagram, external. Send your story ideas to: newsonline.westmidlands@bbc.co.uk , external

- Published8 February 2020

- Published30 March 2020

- Published15 November 2019

- Published14 October 2017