'We can't afford broadband, so run the baby monitor on 4G'

- Published

"Taught how to budget but her skills are being put to the test"

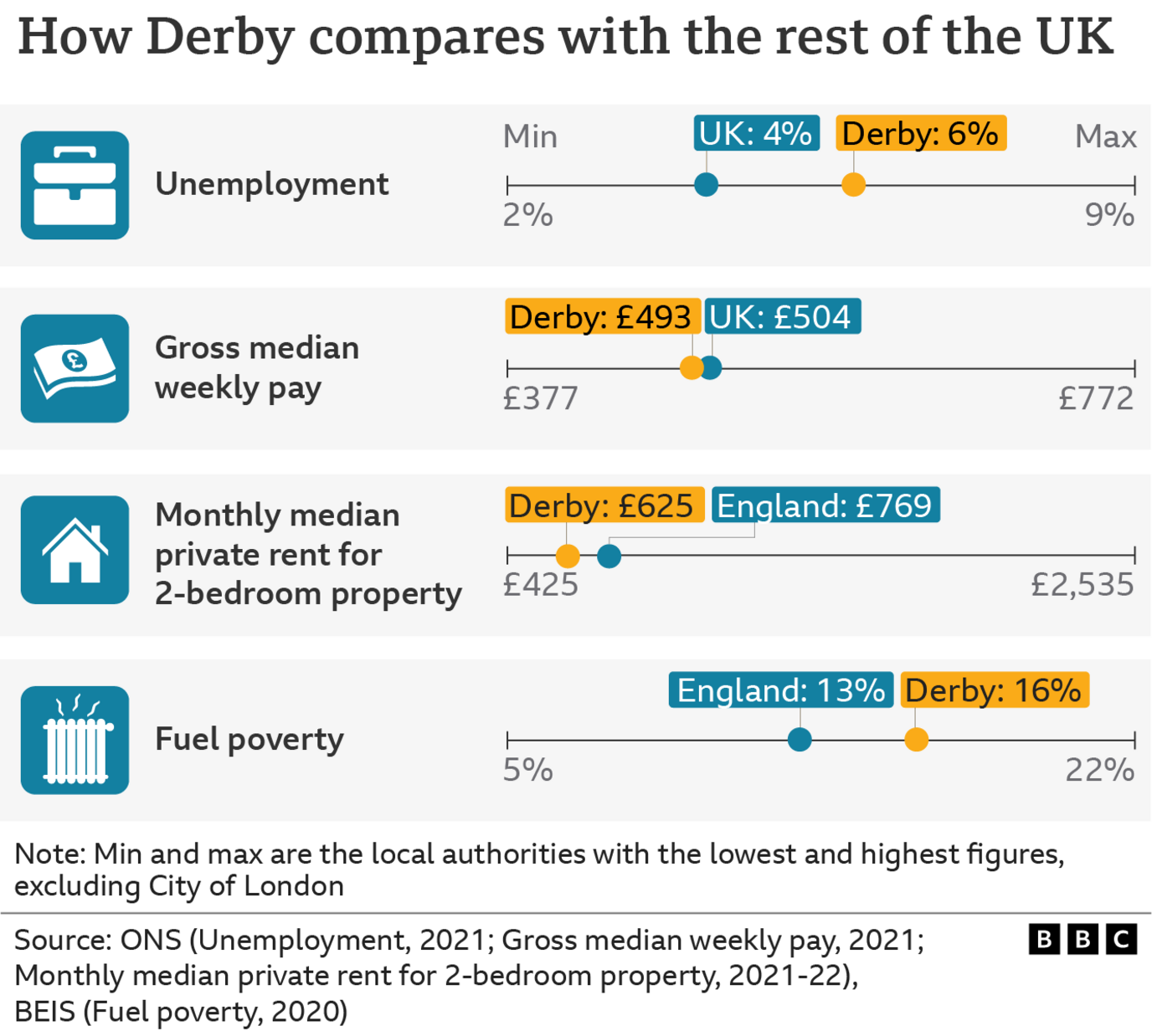

Prices of food, fuel and energy are continuing to rise at their fastest rate in 40 years, leaving many households across the country in crisis. As part of its Counting the Cost of Living series, BBC News will be asking people from towns and cities around the UK how they are coping - and revisiting them over the coming months.

Like many, Niamh Toner is finding it difficult to make ends meet. She lives with her partner, Melu Sibanda, and their 14-month-old son, Luan, in Derby. Here, the 23-year-old tells BBC News how she is trying to manage the soaring costs.

It's not easy. Our household income is £20,000.

We decided it's better if I have a phone contract that's a bit higher with the mobile data coverage to hotspot instead of using wi-fi, then it works out cheaper. It makes it tricky with the baby monitor - but we couldn't afford the £25-a-month bill for broadband.

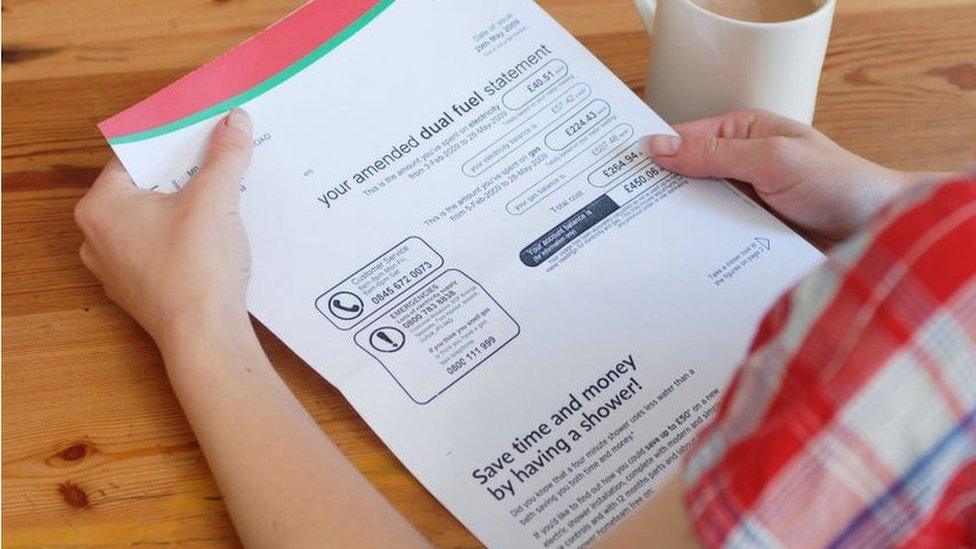

We don't have the boiler on most days. We only turn it on when we need hot water and if we do really need it, because the gas bills and electric bills are just crazy at the moment. We pay £270 a month, which is about the same as our rent. My partner's brother lives with us as well, so we can all afford living costs right now, so our rent is £300 instead of £600.

After bills, Melu's fuel for work and other debt, we're left with £250 for food and nappies for the month.

It is alarming to hear [prices] could be rising - I'm not sure what we'll do. We'll really struggle to make ends meet. It doesn't seem feasible for us at the moment to actually be able to support ourselves and our child.

Niamh's partner, Melu Sibanda, goes food shopping in the evening to buy reduced items

We're really cutting back. We used to enjoy a bottle of cider here and there - but that's too expensive now. And I can't even buy my little boy his snacks - it's £3 for a box and £2 for a pouch.

My partner goes to the shops late at night and gets all the reduced stuff and then we freeze it - he's really obsessed with that and getting quite into my budgeting schemes.

I haven't been to see my family in Ireland since before the pandemic. My little one has never been over, neither has my partner. We had to pick between do we make sure rent is easier this month or pay for a passport for my little one or the flights?

Our savings have over halved over this past year and a half. My partner tried to go back to uni to finish his degree, so that he could get a higher-paid job - and halfway through, he found out he was not eligible for his student loan, so we've had to pay off the half year. That was £5,000 - and then the gas bill from before had ran over a bit, so we had a bit of debt from that too.

So we've been paying off a few debts and that has eaten into the savings - but then it's just the cost of living on top of that as well, so we've got to build it back up. At the moment, it's all going on bills and food.

In terms of going back to work full time, I have to make sure that I go into a job that's a really good salary because otherwise the childcare is £12,000 a year, maybe more, so I've got to make sure that after tax I am still bringing in a good income to actually make a difference. Otherwise, there is almost no point in working.

As told to Navtej Johal and Katie Thompson

Related topics

- Published14 July 2022

- Published13 July 2022

- Published13 July 2022

- Published8 July 2022

- Published6 July 2022