Labour plans could see steep rise in private school fees

- Published

There are about 2,500 private schools in England and Wales, including St Nicholas School in Harlow, which charges £15,000 a year for its older pupils

Parents of children at private schools could end up paying thousands of pounds more in fees due to Labour's tax plans, a headmaster has warned.

Labour is pledging to charge private schools 20% VAT, as well as ending business rate relief, to raise about £1.7bn, if it wins the next election.

The party said it aimed to plough that money into state schools.

Terence Ayres, head of St Nicholas School in Essex, said if could mean fees going up by £3,000 a year.

St Nicholas School headmaster Terence Ayres said the Labour VAT increases would hit the finances of parents paying for their children to be educated

Labour leader Sir Keir Starmer has said he wanted to change the rules so that independent schools pay more to the government in tax.

He said the extra money for the state sector would mean "mental health staff in every school, more expert teachers in the classroom, more creativity, speaking skills, confidence".

Labour has dropped plans to end charitable status for private schools, but said it would still remove other "unfair tax breaks" if it won the next general election, which is due by the end of January 2025 at the latest.

There are about 2,500 private schools in England and Wales and the government says half are registered as charities.

Having charitable status means schools cannot operate for a profit and are eligible to claim some tax exemptions, for example, on donations and business rates.

Since 2006, private schools have had to demonstrate they were creating "public benefit" to maintain their charitable status.

What is a private school?

There are about 2,500 private, fee-paying schools in England and Wales

Private schools have more say over how they run themselves. Unlike state schools they are not paid for by the government, but they charge fees instead which parents or guardians have to pay

About half are registered charities, and thus exempt from VAT

About 6.5% of pupils in England go to independent schools, according to government figures

Fees at St Nicholas, which is a non-boarding, day school for pupils from reception to Year 11, are about £15,450 a year for its Upper School.

Mr Ayres said the Labour VAT increases would hit parents.

"There's not much room for us to manoeuvre regarding fees. We ultimately would have to pass the VAT on to our parents which would have a real impact on them," he said.

Saint Nicholas School was founded in Churchgate Street, village on the outskirts of Harlow

Mr Ayres said many parents make "sacrifices to send their children" to the school.

Luke Sibieta, of the Institute of Fiscal Studies, which has written a report on Labour's VAT plans for private schools, said the measure would raise "about £1.3bn to £1.4bn, but that is just 2% of current school state spending".

"So it would add a little bit to the state sector, but is unlikely to be transformative - to really narrow the achievement gap between rich and poor," he added.

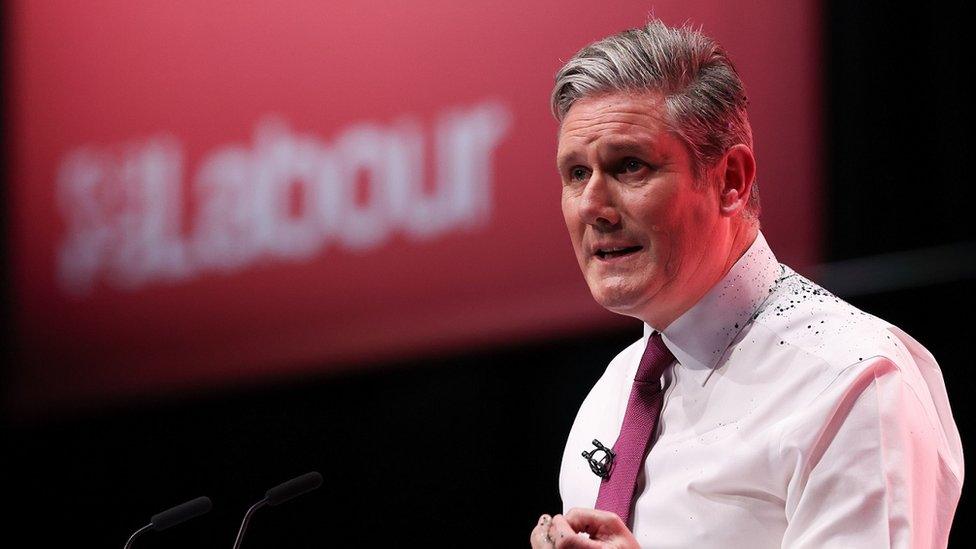

Keir Starmer gave a speech at the Labour party conference in Liverpool on Tuesday

Rudolf Eliott Lockhart, chief executive of the Independent Schools Association, said: "Independent schools play a vital role in providing specialist provision and diversity of settings, whether Special Educational Needs, bilingual provision, performing arts schools, or educating within different types of religious ethos.

"This diversity would be threatened by VAT on school fees, where it will be the smaller and less well-known schools that will be most vulnerable to closures."

However, Michael Pyke, a spokesman for the Campaign for a State Education, said the tax "exemptions derive from the fact that, in law, owing to a historical anomaly, most private schools have charitable status".

"They are not charities in any meaningful sense of the term," he said.

"The [existing] tax exemptions are in effect a subsidy from society as a whole to the children of the very rich (households within the top 10% of incomes provide 50% of all the pupils in private schools) and Labour is right to seek to remove them."

The Conservative Prime Minister Rishi Sunak has criticised Labour's plans to change the tax rules.

The prime minister has previously said the policy showed Labour "just don't understand the aspiration of families like my parents who were working really hard".

BBC Politics East will be broadcast on Sunday, 26 November at 10:00 GMT on BBC One and will be available after broadcast on the BBC iPlayer.

Follow East of England news on Facebook, external, Instagram, external and X, external. Got a story? Email eastofenglandnews@bbc.co.uk, external or WhatsApp us on 0800 169 1830

Related topics

- Published10 October 2023

- Published28 September 2023

- Published6 July 2023

- Published30 November 2022

- Published30 September 2019