Southampton City Council ends £450m waterfront development deal

- Published

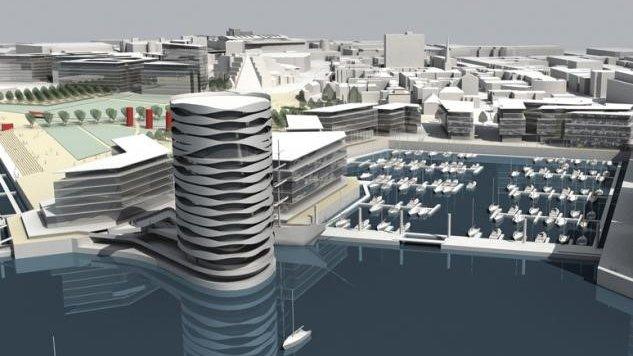

An artist's impression of the proposed Royal Pier Waterfront scheme

A £450m waterfront development deal has been terminated by a council after five years.

The proposed Royal Pier Waterfront scheme would include a hotel and a casino on land reclaimed from the River Test in Southampton.

Southampton City Council said it had ended an agreement signed in 2014 with developer RPW Southampton Ltd but did not explain why.

Councillor Daniel Fitzhenry said the scheme was back at "base point".

The development would be built at Royal Pier, Mayflower Park and land reclaimed from the River Test

A "gourmet market" and 730 flats are included in the scheme, to be built on the site of the derelict Royal Pier, Mayflower Park and the reclaimed land.

RPW submitted an outline planning application in 2015, saying building work would start the following year.

However, the application has not yet been approved.

The development would include a casino, a waterfront hotel and up to 730 apartments

In a statement, Southampton City Council said: "As one of the landowners of Royal Pier Waterfront, Southampton City Council terminated the conditional landowner development agreement with RPW (Southampton) Limited."

The authority said it "welcomes all expressions of interest from potential investors".

Conservative group leader Daniel Fitzhenry said he believed the deal had been cancelled due to insufficient progress.

"We are naturally disappointed that this major development and opportunity for our city has not worked out. We're at base point," he said.

Brexit uncertainty

KMG Capital Markets, which owns RPW, reported to shareholders in 2017 the development had "build-ability concerns".

A new "concrete basement structure" had been proposed to resolve issues with a deep layer of "contaminated silt", the report said.

It said increased costs, together with economic uncertainty caused by Brexit, had "caused significant impact on the value of this asset".

The council's Labour leader and KMG Capital Markets have been approached for comment.

- Published27 July 2017

- Published9 July 2015

- Published27 September 2013

- Published25 February 2011