Portsmouth City Council agrees New Theatre Royal rescue plan

- Published

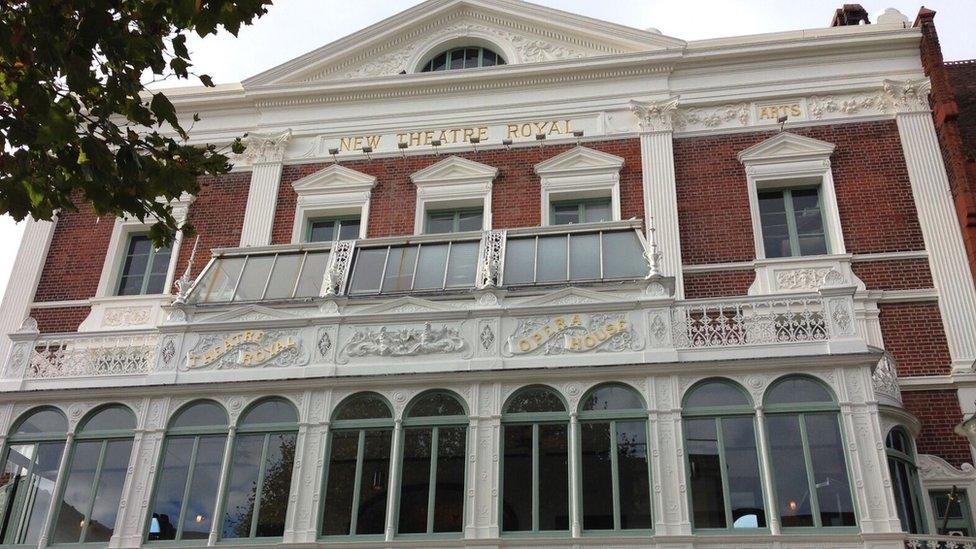

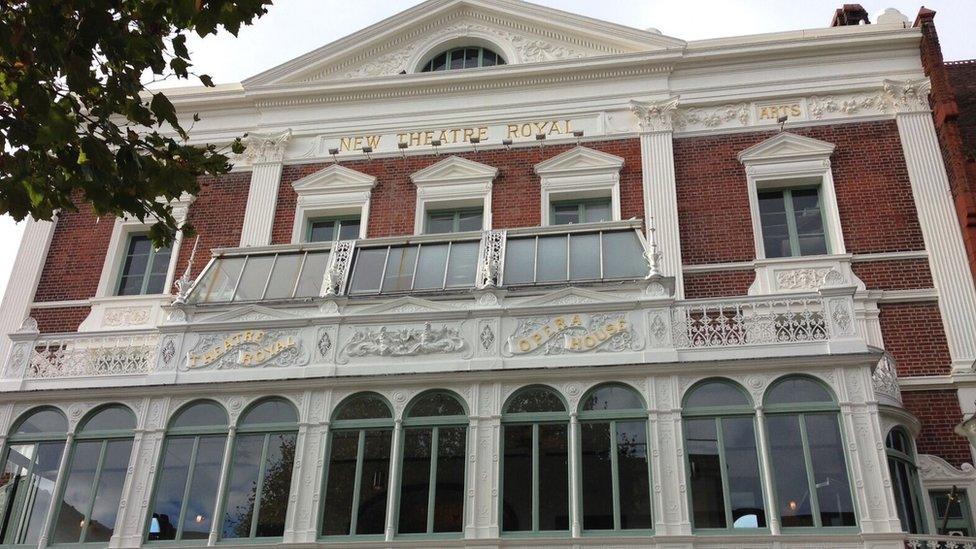

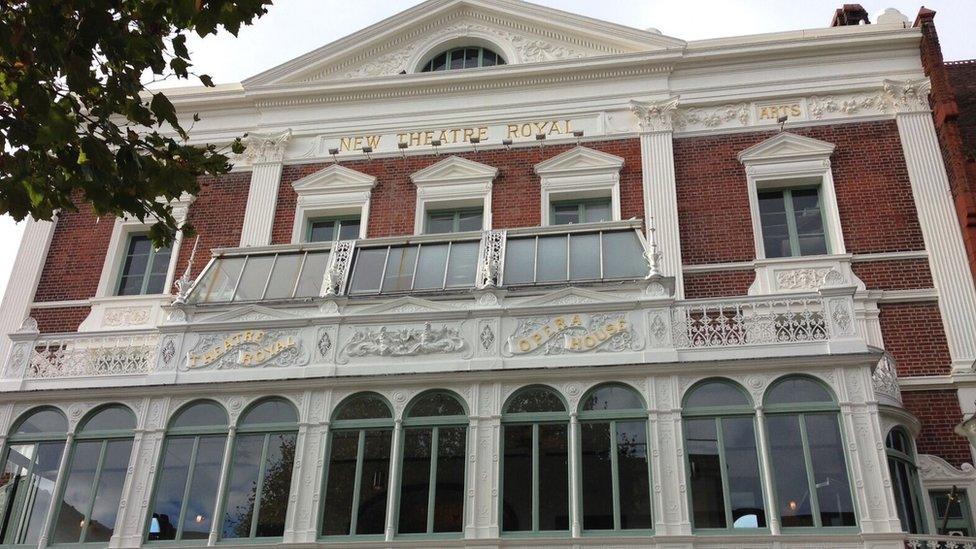

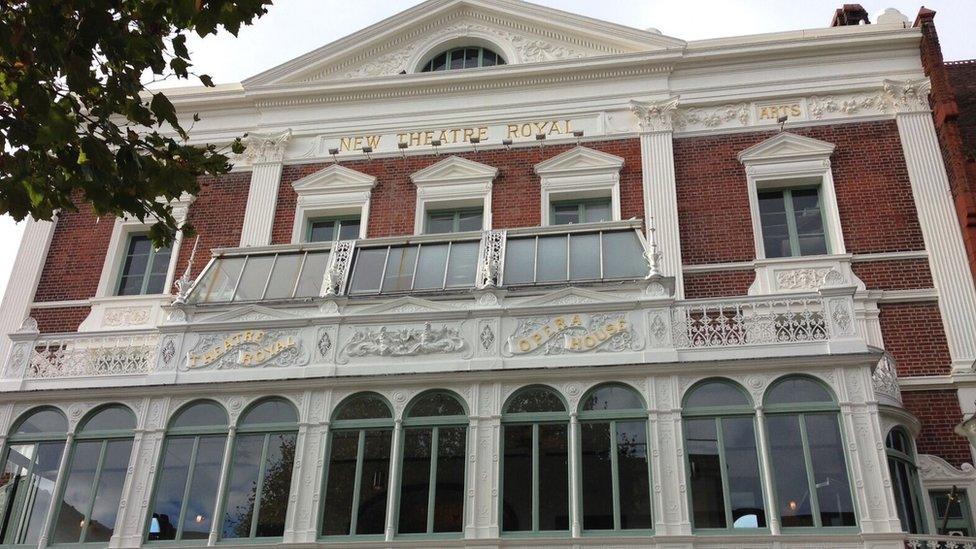

Portsmouth's New Theatre Royal has been closed since the start of the first lockdown

A rescue plan for a struggling theatre has been agreed by Portsmouth City Council, despite concerns raised by the city's university.

Portsmouth City Council's cabinet accepted a plan to buy New Theatre Royal and lease it back to its management trust.

The University of Portsmouth has claimed it was owed more than £600,000 from its backing of the venue.

The trust said it would continue discussions over the debt.

The 165-year-old theatre has faced financial difficulties having been forced to cancel shows during the pandemic.

The 650-seat theatre re-opened in 2015 after a £4.5m revamp, which saw a new stage, backstage area and additional performing spaces created.

At a meeting on Tuesday, the council's cabinet agreed to proceed with a plan to purchase the theatre.

Steve Pitt, cabinet member for culture, leisure and economic development, said it was of "paramount importance that this asset is maintained for the city".

He said talks with the university and trust would continue "to meet any concerns in the spirit of partnership".

A university spokesman said it was "happy to support the sale" of the freehold to the council, but insisted "amendments to the lease and management agreement must be dealt with in advance of any sale of the building".

"The changes would ensure that the theatre can continue as an arts and performance space, or as a venue consistent with the ethos and values of the university, should the ownership of the building change again in the future," he added.

The university previously said it was instructing lawyers to recover the debt it was owed, following a major refurbishment of the theatre, and had offered to write-off 30% of the theatre's debt.

Theatre trustee Will Purvis said: "The university is an important partner to the theatre so we will continue to work with them to find the best way forward."

Follow BBC South on Facebook, external, Twitter, external, or Instagram, external. Send your story ideas to south.newsonline@bbc.co.uk, external.

- Published1 February 2021

- Published25 January 2021

- Published15 October 2015

- Published11 December 2020

- Published16 September 2020

- Published4 October 2020