Preston mastermind of one of UK's largest tax frauds convicted

- Published

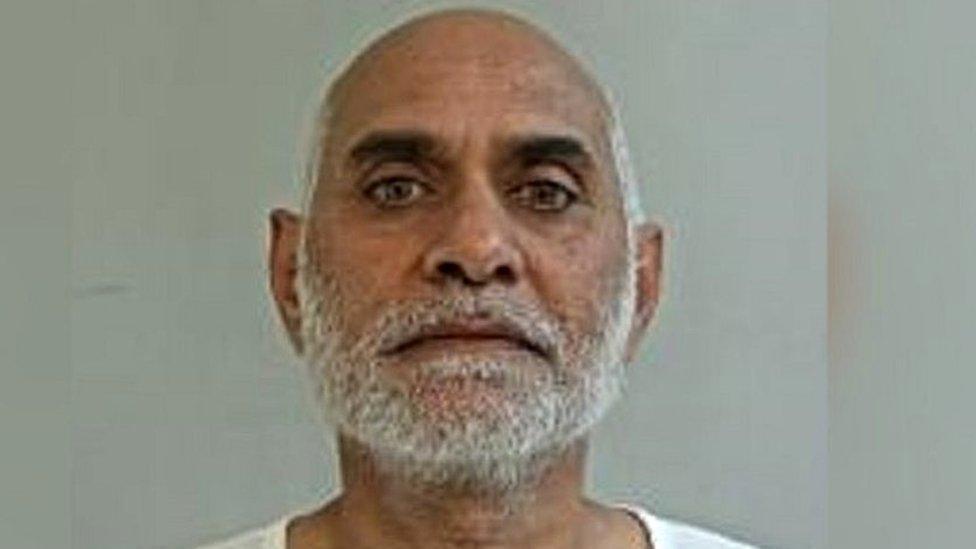

Arif Patel is thought to be in Dubai but has been convicted in his absence

The mastermind of a fake designer clothing scam has been convicted of one of the UK's biggest carousel tax frauds after an investigation spanning more than a decade.

Arif Patel and his gang tried to steal £97m through VAT repayment claims on false exports of textiles and phones.

The 55-year-old also sold counterfeit clothes that would have been worth £50m if genuine.

He was convicted by jury in his absence with a warrant out for his arrest.

Her Majesty's Revenue and Customs (HMRC) said Patel, of Preston in Lancashire, is believed to be at large in Dubai - where the gang also laundered huge amounts of money.

The fraud was uncovered after a joint investigation involving customs and Lancashire Police over more than 10 years.

The scam unravelled when dozens of containers full of fake designer clothing were stopped at UK ports including Liverpool, Southampton and Felixstowe.

Onward distribution to traders in the UK was confirmed when police intercepted a delivery to a Glasgow wholesaler.

Following a 14-week trial at Chester Crown Court, Patel was found guilty of a range of offences including false accounting, conspiracy to cheat the public revenue, conspiracy to sell bogus goods and money laundering.

Mohamed Jaffar Ali has also been convicted in his absence

The court heard he used the proceeds of the fraud to buy property across Preston and London through offshore bank accounts.

HMRC said Patel's Preston-based company, Faisaltex Ltd, was at the heart of his criminal dealings.

He turned to bulk imports of counterfeit clothing in 2004 as well as fraudulent VAT repayment claims on supposed high-value goods and yarns.

The scam saw a range of bogus goods intercepted by customs officials

Co-accused Mohamed Jaffar Ali, 58, of Dubai, was also found guilty of three counts of conspiracy to commit fraud by failing to disclose information under Fraud Act 2006.

As well as being a major player in the overall conspiracy, Ali also laundered the proceeds through bank accounts he set up in Dubai and offshore, HMRC said.

He was also convicted in his absence and is wanted by police.

HMRC said Patel frequently travelled to Dubai to meet Ali and also made trips to China and Turkey to set up deals with manufacturers of counterfeit clothing.

The pair are due to be sentenced at the same court on 25 May.

Richard Las, director of HMRC's fraud investigation service, said: "Arif Patel lived a lavish lifestyle at the expense of the law-abiding majority.

"Fraudsters like this pair steal the money that funds the NHS and other vital public services we all rely on.

"We have more than £78m of the gang's UK assets restrained and have begun the process to recover all those proceeds of crime."

HMRC said it has restrained more than £78m of the gang's UK assets

Sam Mackenzie, Lancashire Police's Assistant Chief Constable, said: "While presenting himself as a genuine and reputable businessman Arif Patel in fact used stolen taxpayers' cash to line his own pockets."

So-called carousel fraud is a term used for when goods are sold to genuine buyers but are in fact controlled by criminals who instigate a paper trail of alleged sales and exports in order to reclaim VAT.

Why not follow BBC North West on Facebook, external, Twitter, external and Instagram, external? You can also send story ideas to northwest.newsonline@bbc.co.uk

- Published27 November 2017

- Published11 November 2022