Borough Market trader calls for terror attack support

- Published

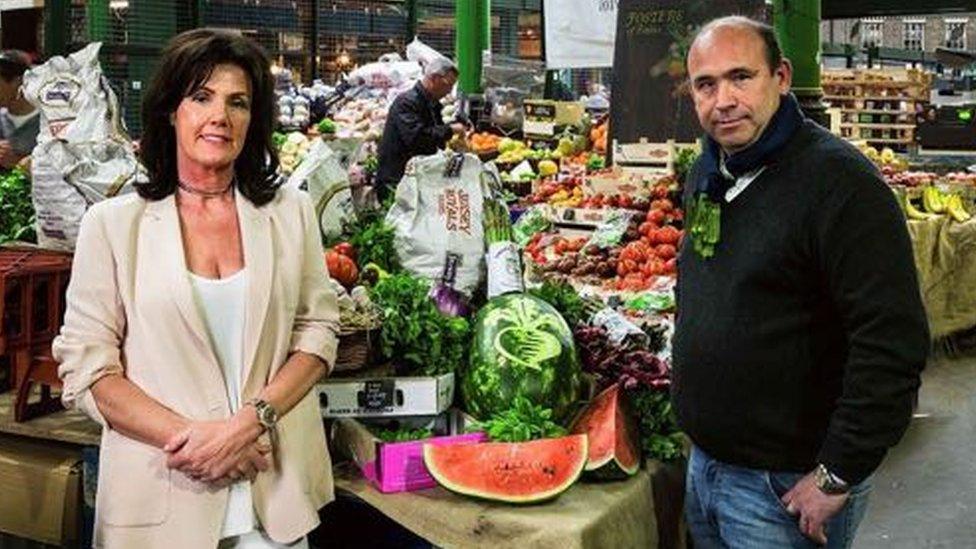

Marie and Fred Foster lost £100,000 after the attack in June

A trader says he has been "left in the gutter" by insurers and the government after the London Bridge terror attack.

Fred Foster, a fruit and vegetable wholesaler at Borough Market, lost almost £100,000 in business when police cordoned off the market for 10 days.

His insurers Aviva said it had paid out £150,000 to customers but Mr Foster did not have the relevant cover.

Ministers have conceded the current insurance model was outdated and should be revised to help businesses.

Mr Foster's claim for lost trade was turned down by Aviva because he had insurance cover for business interruption and not terror-related events.

But the owner of family business Turnips Distributing said terror cover offered by insurers "isn't enough" and called for the government to ensure businesses are helped in the aftermath of terror attacks.

Mr Foster, 54, said: "This is people's trade, and their living, and for 10 days they weren't allowed to come into this market and had no income.

"We feel we are being attacked again - not by the terrorists, but by the insurers and the MPs."

Mr Foster said he and his employees all know people who died in the attack

Mr Foster said he and his 25 employees all knew people who died in the attack on 3 June.

"As much as our clients were sympathetic - and we have some major clients, such as in The Shard at the Shangri-La Hotel - they had to go elsewhere," he added.

"We should really drop some staff but we are defiant. We are here to fight."

In a House of Commons debate on Wednesday, Mr Foster's MP, Neil Coyle, urged the government to take action to ensure terror attacks did not "put British jobs at risk or force companies under".

Ministers said the current insurance model for paying out after terror attacks was outdated and would be reformed "in the new year".

An Aviva spokeswoman said: "Aviva has worked with a number of its commercial customers who did have relevant cover to help them get back on their feet.

"We look to treat customers fairly and pay whenever we can, but we cannot pay out for terrorism losses where customers have chosen not to buy that cover."

- Published3 May 2019

- Published8 June 2017