Cost of living: Rise in 'priority' debts warns Newham group

- Published

Newham residents increasingly need help with "priority debts"

The amount of debt taken on by households is at record levels as people struggle with the cost of living, according to new data.

Figures from PwC suggest that total household debt in the UK now exceeds £2tn for the first time.

In London, more than half of those surveyed said that their financial situation was worse since the pandemic.

"People are at risk of becoming homeless, said Jerry During, of Newham-based social enterprise Money A&E.

In the past year, unsecured debt has grown by almost £900 to £14,300 per UK household, PwC said.

Money A&E, in Newham, east London, reported that the number of people it supported with debt advice rose by more than a third from 2021 to 2022.

Priority debt help

People increasingly need help with "priority debts" including rent, mortgage and utility bill arrears, it found.

Greg Ashby, co- founder of the organisation, said: "People have modest incomes and they're just not making enough money to cover those expenses.

"Often they don't have enough at the end of the month to cover them."

He said that his small team helps people in one of the poorest parts of the country with grants, but is struggling to meet the current level of the demand.

"On average, we've been giving out £200 to £250 of these small grants to individuals who are severely in debt and need immediate emergency help," he said.

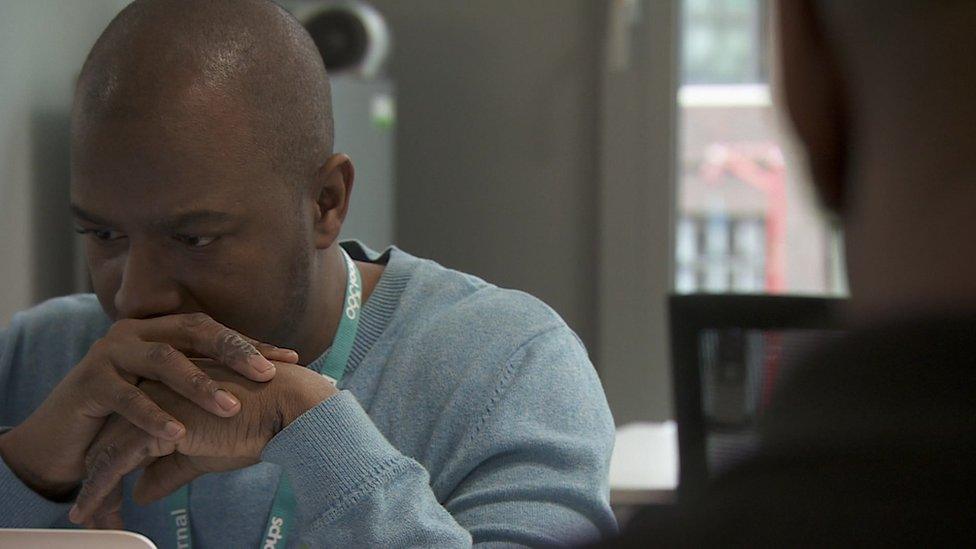

Jerry During, CEO of Money A&E, said that the amount by which people are in debt has increased significantly

"But the demands have been really high and we're running out of funds to keep giving these grants out."

CEO of Money A&E, Mr During added that the amount by which people are in debt has increased significantly.

'Risk of becoming homeless'

"People are choosing whether they need to heat or eat. It's becoming more serious.

"People are at risk of becoming homeless and demand is too much. There aren't enough debt advisors to support them."

And the financial burdens are increasingly harming people's mental health, debt advisers noted.

Mr During is concerned about price rises in the new tax year tomorrow.

"Low-income families will be hardest hit by the price hike on bills due to the poverty premium," he said.

These are the extra costs that people in poverty pay "through living hand-to-mouth, such as higher rates of credit and increased energy costs," he said.

Follow BBC London on Facebook, external, Twitter , externaland Instagram, external. Send your story ideas to hellobbclondon@bbc.co.uk, external

Related topics

- Published9 January 2024

- Published17 July 2024

- Published25 March 2023