Shared appreciation mortgages: The 1990s deals that became a nightmare

- Published

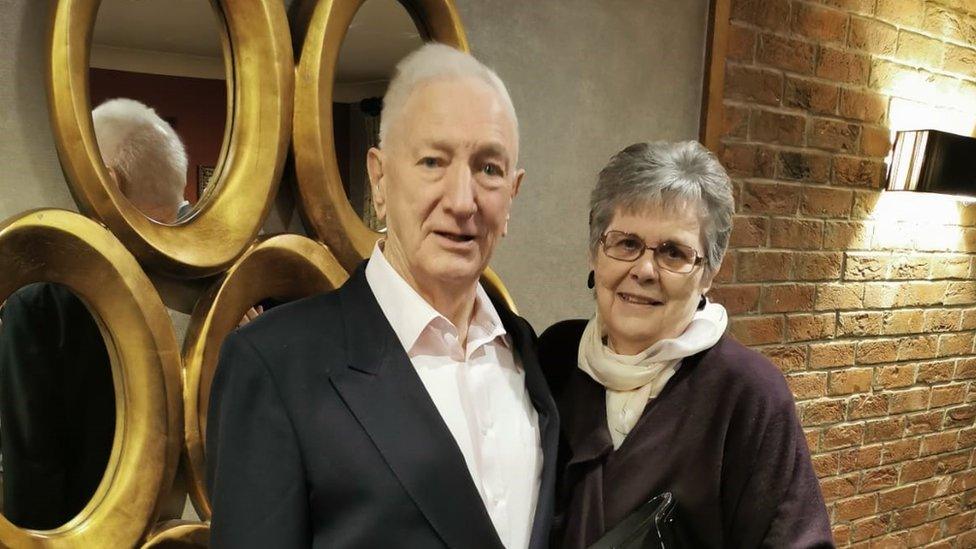

A shared appreciation mortgage (SAM) prevented John and Margaret Potterton from moving into a bungalow

Families have spoken of their shock after they discovered relatives agreed to shared appreciation mortgages (SAM) as a way of releasing some of the equity in their homes.

For some elderly people the mortgage, that was only available for a few years in the 1990s, has forced them to choose between staying in their home or facing financial hardship.

The deals offered customers the opportunity to release up to 25% of the value of their property which they had to pay back in full along with a share of the property's increase in value.

Steve Hutchinson, from Nottinghamshire, said a £16,250 SAM taken out by his father left his 88-year-old mother facing a £165,000 repayment, which could leave his family in debt if his 88-year-old mother needs to go into a care home.

He has since set up a petition and connected with some of the other 15,000 families across the UK who are in a similar situation.

"In a way I'm glad that there's other people coming out because it confirms in my mind that he was duped," Steve said.

Three more families whose relatives took out five-figure loans have now said they have also been left with six-figure repayments.

'A really sensible bloke'

John died in December 2022 a few weeks after suffering a stroke

Louise Potterton said her father-in-law was left filled with regret at taking out a SAM right up until he died last year.

Wilfred Potterton, who was known as John, agreed to a loan through Barclays in 1998 for £19,500.

"He'd paid his mortgage off by then and he just wanted some money out of the house," Louise said.

"He put a new kitchen in with it and new windows."

At the time their four-bedroom house in Grantham, Lincolnshire, was thought to be worth about £78,000.

Louise said he realised he had made a mistake quite early on and asked the bank if he could repay the loan in full, but he was told he could not.

"We didn't know what John had done," she said.

"He was a really sensible bloke, he was the top bloke in the police here in Grantham so he wasn't a stupid man.

"So I don't really know why he did it."

Louise said the SAM really worried John and prevented him and his wife Margaret from moving into a bungalow.

"They couldn't keep up with looking after the house, it was impossible, but he knew.

"He couldn't talk to Margaret about it.

"He wouldn't talk to any of us about it either because I think he was just so embarrassed it had happened."

Louise Potterton said her father-in-law was filled with regret over the SAM right up until he died

John was 93 when he died in December 2022, a few weeks after suffering a stroke.

Margaret, who has vascular dementia, had to move into a care home.

When the family sold the house in September, the bank took £208,000.

Louise said: "I understand if you borrow money you've got to pay a percentage back, I get that, but this is an astronomical amount.

"To me it's just not fair."

Now, the family does not know if they will have enough money left to continue paying for Margaret's care home place.

'I was absolutely horrified'

Ernie Lesueur took out a SAM following some health complications

Karen Bowey, 57, said her stepfather Ernie Lesueur took out a SAM on the house he shared with her mother Sylvia in about 1998.

The four-bedroom property in Spalding, Lincolnshire, was mortgage-free at the time and was valued at £85,000.

Karen said he borrowed £21,250 so they could go on some trips away.

"He'd had some complications with his health and I think he just wanted to treat them," she said.

"They weren't short of money, he'd got a good pension."

Ernie was 82 when he died from lung cancer in 2012 and Karen began helping her mother to manage her finances.

It was about five years later she realised Ernie had taken out a SAM with Barclays.

"She's [Sylvia] got a crumbling spine and other medical complications so she couldn't do the stairs, she couldn't cope with the amount of work in the house so we started looking into her moving," said Karen.

"We had the house valued, put it up for sale, got a buyer and went back and said we need the redemption figure and it came back at £147,510.

"I was absolutely horrified. I'd never heard anything like it."

Karen Bowey said she was worried about how she would pay for her mother's care in the future

The house was sold in 2017 and the bank took the money from Sylvia's sale.

She used the Barclays SAM hardship scheme, external to borrow £81,000 back from the bank so she could afford to buy a bungalow to live in.

Karen said the name of the scheme was insulting when it was the bank's mortgage that had caused the hardship.

"This has been forced on my mother by what I call a corrupt interest rate loan," she said.

Sylvia, 87, has until 2032 to repay the bank but Karen is worried about how she will afford any additional care her mother might need in the future.

'We can't move'

Kevin and Jo Garvey feel like they have to remain at their house because of the SAM

Veronica Denman, 57, said her parents Kevin and Jo Garvey bought their three-bedroom semi-detached home in Grays, Essex, when they got married in 1959.

After they paid off the mortgage, Kevin took out a SAM in 1998 to borrow £19,000.

He used the money to help his son with a deposit for a house.

The house was worth £76,000 at the time but is now thought to be worth about £450,000.

Veronica said the bank would take about three quarters of this when the house is sold.

She only found out about the SAM a few years ago.

"My dad's got dementia and mums got mobility issues and I was trying to persuade them to move into sheltered accommodation," she said.

"They said 'we can't because we can't move from this house'."

Veronica only found out about the SAM a few years ago

Veronica said when the house sold, they would only be left with about 25% of its value.

She said her parents, aged 87 and 89, had accepted their situation but it made life difficult for her mother.

"Although it's not a big house, every house needs maintaining and it means all of the things she needs doing, she's having to deal with it all on her own," she said.

"It isn't easy for her by any means."

A few years ago, the family contacted Barclays to see if they could also use the hardship scheme.

Veronica said they offered to help with the cost of moving her parents into assisted living but it was still not affordable.

The bank also offered to pay for alterations to be made to the house that would make it easier for them to stay, something Veronica said her mother did not feel comfortable with.

Veronica said: "I try not to feel anything about it because if I do, it's all very negative.

"I just put it out of my mind and think it's not a decision I made about my life but one that my dad made."

What is a shared appreciation mortgage?

About 15,000 shared appreciation mortgages (SAM) are thought to have been sold by Barclays and the Bank of Scotland in the mid-late 1990s.

Customers were only eligible if they were aged 60 or over.

The agreement offered customers the opportunity to release up to 25% of the value of their property.

But when they died or sold their property, they had to pay back the total amount borrowed plus a share of the appreciated value in the property since the loan was taken out.

Typically, this was about 75% of the growth in the value of a home.

Source: Teacher Stern

Joe Green, an independent financial expert from Nottinghamshire, said many SAM customers would have been attracted by the low interest rate at the time.

"For many people getting hold of a mortgage or borrowing was very difficult, and the interest rate might have been too high," he said.

"What appreciation mortgages did was offer a much lower initial interest rate - sometimes it was even as low as 0%."

Mr Green's advice to anyone discovering their relative took out a SAM was to get professional help.

"The best thing you can do is, first of all read the terms and conditions," he said.

"You then need to pass them on to someone who's qualified to have a look at them and work out what those terms were.

"If you try and just deal with it all over the phone as soon as you find out you're going to struggle because it is very complicated."

'Information asymmetry'

When agreeing to a SAM, customers were told by the banks to seek independent financial advice.

Sarah Emerson, a partner at the solicitors firm Teacher Stern, told the BBC Radio 4 programme You and Yours banks still had a significant information advantage.

"They had access to much wider ranging information than the borrowers - they also had particular expertise in this field," she said.

"Borrowers simply would not have had access to historical house prices and economic price modelling or forecasting.

"We say this gave rise to an acute information asymmetry, which was wholly unfair."

Some customers who took out a SAM with Barclays reached a settlement with the lender in 2021.

Teacher Stern is now working with 160 claimants that took out SAMs with the Bank of Scotland, and a trial is due to take place in January 2024.

Ms Emerson has recommended other people affected by SAMs pay attention to the outcome of this trial.

'Unregulated products'

The Financial Ombudsman Service told the BBC sales of SAMs took place before it existed - so there is very little it can do about the situation most families face.

It said: "Shared appreciation mortgages are unregulated products, so we can only look into complaints if the firms are regulated.

"Most firms who sold these products were unregulated therefore we can't investigate these complaints."

A spokesperson from Barclays previously said: "Before a shared appreciation mortgage was completed and the funds were released, customers were required to seek independent legal advice and confirmation was obtained from the customers' solicitors that the terms of the legal charge and mortgage conditions had been fully explained to them.

"This was done to ensure customers fully understood the nature of their borrowing. The product literature also encouraged anyone interested in a shared appreciation mortgage to discuss their intended borrowing with their family."

Follow BBC East Midlands on Facebook, external, on X, external, or on Instagram, external. Send your story ideas to eastmidsnews@bbc.co.uk, external.

- Published8 October 2023

- Published6 April 2021

- Published8 September 2014