Sheffield clean air zone: How much is it, how do I pay and other questions

- Published

The clean air zone was introduced on Monday 27 February 2023 and does not affect private cars or motorbikes

Sheffield's new clean air zone (CAZ) has gone live, meaning drivers of the most polluting taxis, vans and lorries will have to pay a charge to drive on some roads.

The council said this will rid the city of dirty commercial vehicles, but many businesses have opposed the changes.

There are worries roads in other parts of the city will be busy as drivers try to beat the zone and the impact it will have on small firms.

But what else do drivers need to know?

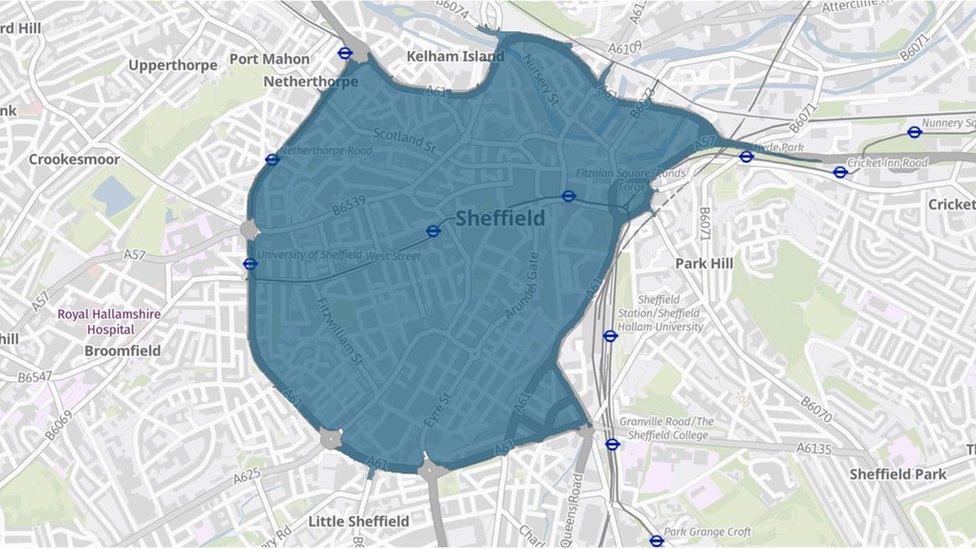

Where is the CAZ?

The clean air zone boundary will cover Sheffield city centre

The zone covers much of the city centre, controversially including the ring road and parts of the Sheffield Parkway, A57.

This means offending drivers who want to skirt around the edge of the city will be subject to charges.

The roundabouts at major junctions are not included, meaning drivers who want to avoid the charge heading towards the city centre can turn around.

Signs have been places across Sheffield warning drivers about the zone, with some making it clear where zones start and end.

Why has the CAZ been introduced?

Air quality in Sheffield has historically been poor with some areas exceeding legal limits of nitrogen dioxide, the council had previously said.

This led to the government requiring the council to introduce the scheme to lower levels as quickly as possible.

Sheffield public health boss Greg Fell said air pollution "killed people" and led to people having strokes and heart attacks.

"Living alongside a busy road carries the same risk as passively smoking 10 cigarettes a day," Sheffield City Council said.

Sheffield is not the only city to have brought in a CAZ, with Bath, Birmingham and Portsmouth already having schemes in place.

Who has to pay and how much?

The scheme will run 24 hours a day, 365 days a year

Private car drivers or motorbike riders will not be charged to drive in the CAZ.

The Class C zone charges apply to specific types of vehicles that do not meet these standards:

taxis, including both Hackney Carriages and private hire vehicles, which are below Euro 6 diesel or Euro 4 petrol

light goods vehicles (LGVs) such as vans, campervans and pick-up trucks and minibuses which are below Euro 6 diesel or Euro 4 petrol

buses and coaches which are below Euro 6 diesel

heavy goods vehicles (HGVs) which are below Euro 6 diesel

Many of these are older vehicles, usually registered before September 2015.

A government vehicle checker can tell you if you should expect to pay by clicking here, external.

Vans, LGVs and taxis will be charged at a rate of £10 per day, whereas coaches, buses and HGVs will be charged at £50 per day.

When does the charge apply?

Signs will tell drivers when they are entering or leaving a chargeable clean air zone

The scheme went live on Monday 27 February 2023.

It runs 24 hours a day, seven days a week, but only once in a 24-hour period, meaning non-compliant vehicles can make multiple journeys in a day.

Some drivers can apply for a local exemption from the council,, external delaying charges until 5 June 2023.

I can't afford to change vehicles, what do I do?

The council has said financial support to upgrade has been offered to those with non-compliant commercial vehicles.

However, some business owners have said the authority's support schemes have been "impossible" to access.

Mazher Iqbal, co-chairman of the council's transport committee, said: "The package we secured from government includes financial support to upgrade or replace vehicles to meet the Class C charging zone restrictions and the opportunity to apply for an exemption, if eligible."

How do I pay?

Cameras are dotted across the city centre recording the number plates of vehicles

Automatic Number Plate Recognition (ANPR) cameras will record registration plates and check them against a database of vehicles.

Drivers can then log on to the government website to pay what they owe, external.

Payments can be made six days before, on the day of travel or by 23:59 on the sixth day after driving in the zone, the council said.

Money brought in from the zone can only be spent on the costs to run the CAZ and projects to reducing air pollution in Sheffield.

Follow BBC Yorkshire on Facebook, external, Twitter, external and Instagram, external. Send your story ideas to yorkslincs.news@bbc.co.uk, external.

Related topics

- Published27 February 2023

- Published14 February 2023

- Published6 February 2023