Apostle Accounting clients told to repay thousands of pounds over tax error

- Published

Apostle Accounting is owned by Zoe Goodchild, who set it up in 2012

Dozens of accountancy firm clients have been told to repay thousands of pounds after incorrectly claiming tax refunds.

Workers who used Suffolk-based Apostle Accounting to apply to HM Revenue and Customs (HMRC) were told they were not entitled to the money, a BBC investigation found.

MP Dan Poulter described it as "an unprecedented situation".

HMRC said it could not comment. Apostle Accounting denied any errors and said HMRC had not applied its own guidance.

According to the HMRC website, people may be able to get a tax refund or rebate, external for paying too much tax for areas such as pay from a job or work-related expenses.

Apostle Accounting, based in Stowmarket, offered clients a service to obtain tax refunds based on work expenses and took a 20 per cent fee before forwarding the money on to its clients.

The company, set up in 2012 by Zoe Goodchild, confirmed 1,400 people had used this particular service between 2016 and December 2021.

The BBC has been in contact with dozens of people who said HMRC had put them on notice that their claims were wrong and they would have to repay the amounts.

Some allege Apostle Accounting did not provide them with a detailed breakdown of the expenses being claimed for when it asked them to sign off on their applications.

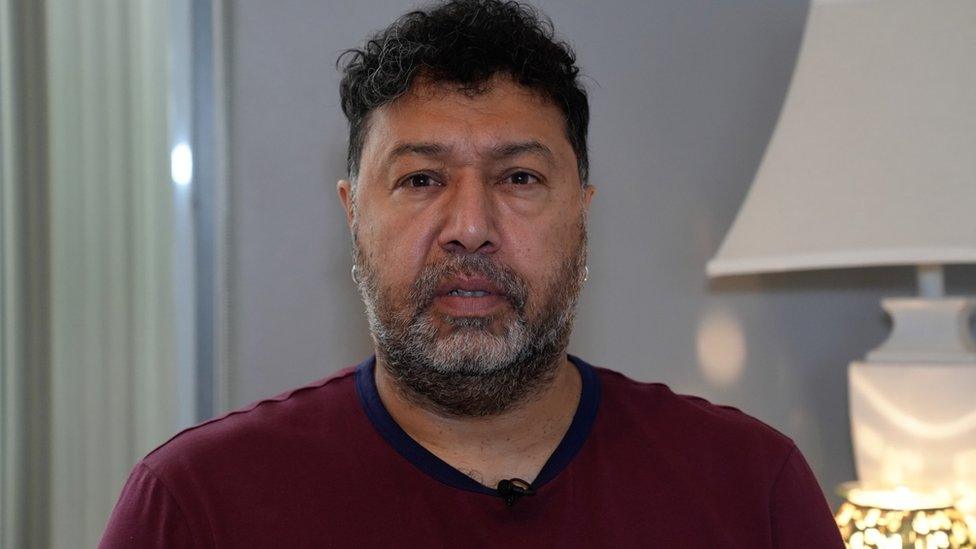

Lucky Singh says he faces more than a decade's worth of monthly repayments to cover the amount he owes HMRC

Lucky Singh, a labourer from Ipswich, received a tax refund of £5,500 but now has to give it back.

He has agreed a repayment plan with HMRC, which will see him making a £50 monthly payment until 2035.

"There's a lot of people going to find it really hard and they've got to pay this money back," he said. "I'm not happy at all."

He said a colleague at work had mentioned the company to him and that he could claim for washing personal protective equipment (PPE).

"I have been told by HMRC, who have been in contact with me, that they [Apostle] set me up as an independent company," he said.

"They've been putting the claims in for mileage, food and everything else - loads of things which obviously I'm not entitled to and that I wasn't aware of."

Another client, Ian Goadsby, a delivery driver from Coventry, said: "I'm going to have to find £6,000 very, very quickly."

Trevor Burroughs says he is worried about how much he might have to pay back

Delivery driver Trevor Burroughs, from Thetford in Norfolk, said he approached Apostle Accounting to sort out a problem with his tax code.

"They sent me this piece of paper with my name, details, National Insurance number and basically all my information to fill in and sign, also with a copy of my current P60 [an annual tax statement], which I did," he said.

"I then received a text message from them asking for my bank details as they had received the payment for me and consequently, in January 2019, I received £2,783.59."

He said HMRC had since notified him that he would have to pay a sum back.

Mr Burroughs said two former colleagues had also applied for refunds through the company.

"The worry I've got is how much are they [HMRC] going to want?"

A Facebook group, set up at the beginning of March by people stating they are aggrieved clients of the accountancy firm, now has more than 850 members.

Apostle Accounting said not all those in the group were its clients.

The Conservative MP for Central Suffolk and North Ipswich, Dan Poulter, said he had been meeting with affected clients of Apostle Accounting

The matter has been taken up by a number of MPs, including Mr Poulter, the Conservative MP for Central Suffolk and North Ipswich, who said at least 15 people had approached him.

"I am very concerned by this and there are a number of issues to address," he said.

"The first is to help ensure that HMRC does not take action against these individuals who have acted in good faith and sought professional advice from this firm, and I am meeting with a number of individuals who have contacted me to offer my support.

"There are also wider concerns here and where appropriate, I will be asking the financial authorities and regulators to look into the conduct of this firm.

"This is quite an unprecedented situation."

The BBC has seen correspondence from other Conservative MPs in Norfolk and Suffolk, including Tom Hunt, George Freeman, Liz Truss, Jo Churchill and Therese Coffey, who say they have also contacted HMRC.

'Unfounded allegations'

HMRC said it could not comment on specific firms or individual cases.

A spokesman said: "You should treat promises of easy money with real caution - if it sounds too good to be true, it probably is.

"Handing over sensitive personal information could leave you having to pay back the full value of any invalid claim made on your behalf.

"Employees can quickly and easily claim work-related expenses direct with HMRC, meaning they keep all of the money they are entitled to."

In a statement released through its lawyers, Apostle Accounting said HMRC had not followed its own guidance in relation to its clients claiming tax refunds and had incorrectly informed them that it had registered them as self-employed.

It said it had "no reason to believe that rebate claims were submitted when a client was not entitled to such expenses claims".

It also rebutted claims some clients did not know what was being claimed for.

"The allegations, if any, that individuals were not provided breakdowns as to the expenses is unfounded - Apostle has breakdowns for each of its former clients, with the individuals fully aware of how such sums were calculated," it said.

It also said that clients were informed that it was their responsibility to provide all the necessary information and ensure the same was "complete and accurate".

It stated that it was "disappointed and deplores the comments by some MPs and former clients which include inaccurate statements about it".

The company said it was concerned about the number of people who had been affected and that it was "taking the matter extremely seriously, completing its own investigation and engaging with its external compliance team and HMRC".

Find BBC News: East of England on Facebook, external, Instagram, external and Twitter, external. If you have a story suggestion email eastofenglandnews@bbc.co.uk