Cost of living: How can people cope with price increases?

- Published

Millions of households face rising prices in what is being called a cost of living crisis

Fuel prices, energy costs and food are all on the rise prompting what is being called a cost-of-living crisis. What is happening and how can people cope?

Doreen Hindmarsh was in tears as she said goodbye to her colleagues and clients.

"I can't afford the driving," the care worker sobbed. "It's costing me money to go to work."

She is just one victim of the surge in fuel prices, unable to cover the cost of filling the car she needs for visiting the vulnerable people she cares for around Redcar and Cleveland.

"It's expensive," she said simply, before leaving the office for good.

Doreen Hindmarsh said she had no choice but to leave her job due to the rising price of fuel

Her boss at Caremark in Redcar, Michelle Jackson, said Doreen's situation is becoming a familiar story.

"We rely heavily on carers with cars who cover the whole of Redcar and Cleveland," she said. "With the rising fuel prices our carers are leaving to go elsewhere where they don't have to use their car and have those extra costs.

"It is hitting us massively."

A lack of carers would also affect those who need care, Ms Jackson said: "I want to be able to keep people in their homes but if I've not got staff, people can't have care at home so they have to stay in care homes or go into hospital.

"It's not good enough."

Another carer, Sadie Dowson, said each tank of fuel was now costing her an extra £6, and on a busy week she could "easily fill up once or twice a week".

Care boss Michelle Jackson said high fuel prices are causing many of her staff to leave

Most of Carework's work is done on behalf of Redcar and Cleveland Council which has just upped the mileage it pays from 35p to 45p a mile.

But the average cost of fuel has risen steeply, with diesel rising by 13p a litre over the week to an average £1.70 and petrol by 8p to £1.61.

"Drivers will be wondering whether these record rises are ever going to stop," RAC spokesman Simon Williams said.

"While prices may well continue to go up in the coming days, oil and wholesale fuel prices dropped for the second day in a row on Thursday, which should hopefully slow, or even halt, the cycle of escalating pump prices in the next week or so as retailers buy new stock at lower prices.

"There is, however, a concern they will be reluctant to lower their prices for fear of catching a cold if wholesale costs were to jump back up again."

Fuel prices at a station near Newcastle reached £175.9 a litre for petrol and £1.93.9 for diesel on Wednesday

The Russian invasion of Ukraine and the "uncertainty" which it has created has caused oil prices to rise according to Rebecca McDonald, a senior economist for the Joseph Rowntree Foundation, although she says much of the recent increase is due to the coronavirus pandemic and a resulting surge in inflation.

"After lockdowns and the effective freezing of the economy for a year, demand for goods and services picked up massively but supply was still restricted due to Covid restrictions and the capacity that was lost during the pandemic," she said.

The Bank of England aims to keep inflation at about a "stable" 2%, but there are predictions it could climb as high as 8% in April, Ms McDonald said.

"Prices are going up across the board faster than they normally would. That includes essentials like food, clothing and of course petrol.

"A few things are combining together to create the living standard squeeze."

A rise in the energy price cap, due in April, is going to cause a "very significant increase in energy bills", Ms McDonald said, with an even "bigger jump" likely again in October.

Energy bills are rising hugely from next month

Although the figures vary depending on the household specifics, the average low-income family will see a £566 rise in April with energy prices set to account for 16% of their costs after rent or mortgage repayments, according to the foundation.

Ms McDonald said the government could not control all the factors causing the price rises but can help households cope with them.

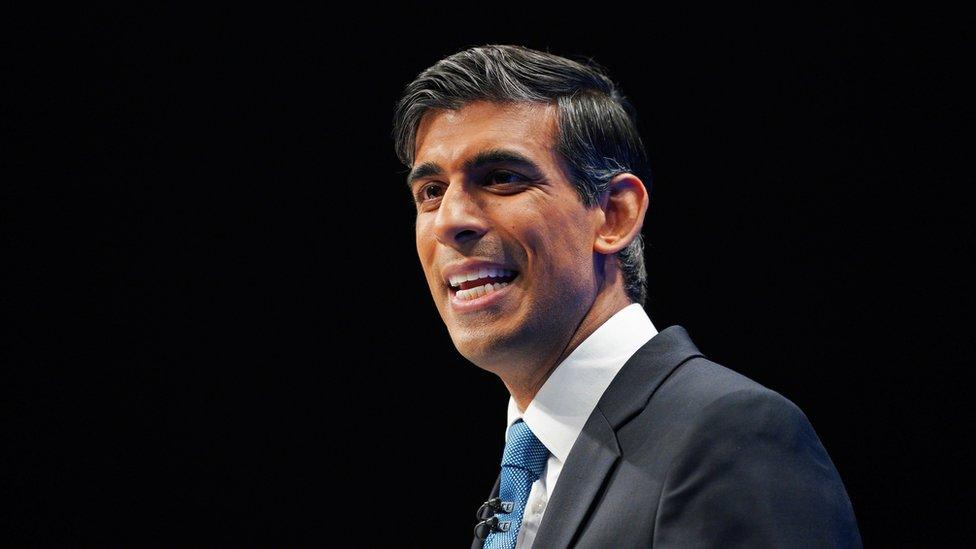

Chancellor Rishi Sunak outlined a series of measures, including a £150 council tax rebate for most homes and a repayable £200 discount on bills.

Rebecca McDonald said households face huge financial pressures

Ms McDonald said the measures were aimed at helping as many people as possible rather than focussing on those who are struggling the most, but they should "mitigate" about 60% of the rise for low income households, although only 33% for low income families with children.

She said the situation was not unprecedented with high inflations rises causing price spikes after previous economic crashes.

But this time there are more factors at play, not least the benefits rate being at a "30-year low".

Chancellor Rishi Sunak has outlined several schemes aimed at helping households cope

"The aim is for the social security system to be robust enough to act as a safety net so when things like this happen it's not a disaster for families," she said.

Ms McDonald said the "most important thing" the government could do was ensure a rise in benefits, expected to be about 3% in April, is matched to inflation.

In terms of what people can do for themselves, Ms McDonald said seeking help and advice is the first step with the Citizen's Advice Bureau, external a good first port of call.

"There are many charities and organisations who offer help and advice on how to reduce bills and get income support," she said, while adding local authorities offer hardship funds which people should find out about.

People should also be aware of the government measures, she said, adding: "Most are automatic but people should be aware of what they are entitled to and make sure they get it," she said.

"It's a very difficult time," Ms McDonald added.

Follow BBC North East & Cumbria on Twitter, external, Facebook, external and Instagram, external. Send your story ideas to northeastandcumbria@bbc.co.uk, external.

Related topics

- Published9 March 2022

- Published8 March 2022

- Published4 March 2022