What's happening to North East council taxes?

- Published

North East councils have been setting their budgets for 2022-23

Councils across the North East have been setting their budgets for the next financial year, meaning tax rises for most residents.

Most authorities are increasing council tax by about 3% from 1 April.

The rises have not gone through easily though with councillors expressing concern over the extra hit on households already struggling to cope with a "cost of living crisis".

See below to find out what your city, borough or county council is doing.

Northumberland County Council

Northumberland County Council is increasing council tax by 4.24%

The Conservative-led council is increasing tax by 4.24% from April, which is made up of a 1.99% base increase plus a further 2.25% earmarked for adult social care.

The adult social care levy was introduced by the government in 2016 to allow councils to raise funds to help pay for adults with certain needs to live independently in their own homes or in residential care.

Northumberland's overall rise equates to Band A households paying an extra £49.74 per year while those living in Band D properties would pay an additional £73.61 annually, the Local Democracy Reporting Service said.

Council leader Glen Sanderson said the budget would "support new and existing business" and do "the very best we can for all our residents" while helping "those residents who most need our help".

He said the rise would mean "no cuts to front-line services".

This increase was heavily criticised by Liberal Democrat Jeff Reid who said it "cannot be right" with residents also facing rises in fuel, energy prices and food costs.

The budget allocated:

£307m in capital funds for investment in affordable housing, leisure centre improvements and renewable energy schemes

£2.225m in U and C-classed roads and paths

£1.35m for a three-star programme to improve 54 public toilets across the county

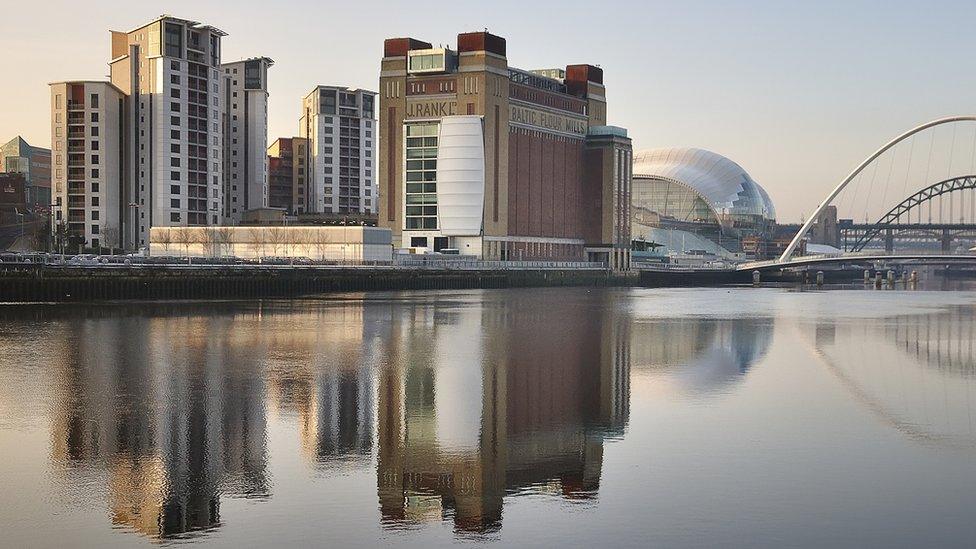

Newcastle City Council

Newcastle City Council is raising council tax by 2.949%

A council tax hike from April will see bills increase by 2.949%, which amounts to an extra £35.24 a year for a Band A property and £52.87 for a Band D.

The Labour-run authority's budget will also see a rise in parking charges and fees for services such as pest control and garden waste collections, while simultaneously making cuts of £12m.

The council, which has already slashed its spending by more than £300m since 2010, faces a shortfall of £41m over the next three years - and has yet to identify where it will make the majority of the savings required to balance its books between 2023 and 2025.

Leader Nick Forbes, who will step down in May, said the increasing financial burden on taxpayers to prop up essential services was "becoming unsustainable".

Other measures in the budget include:

Leasing out another floor of the civic centre to outside organisations

Cutting the number of pool cars available to staff and councillors

Reducing the number of children in the council's care and the number of childcare placements outside the city that the local authority pays for

Cutting adult social care spending by nearly £4.5m by remodelling the council's services, including by trying to prevent or delay people going into long-term care and delivering new supported housing that "promotes independence in communities" for people with learning disabilities

North Tyneside Council

North Tyneside Council is raising tax by 2.99%

The Labour-controlled authority plans to increase council tax bills by 2.99%, which includes a 1% precept for adult social care services, which will put an extra £3m into the council's coffers.

This means households in Band A properties will pay a total of £1,336.23 per year while those in Band D will have to pay £2,004.35.

Council house tenants are facing a rent increase of 4.1% next year with service charges and garage rents increasing by 3.1%.

The council faces a budget shortfall of £7.9m over the next financial year - a figure which rises to £27.6m over the next four years.

Council bosses say the budget does not include any substantial impact to front line services or closures of any facilities.

Martin Rankin, cabinet member for finance and resources, said: "We have an ambitious plan to maximise support for those who need it most while investing in all areas of the borough and continuing our recovery from the pandemic."

Gateshead Borough Council

Gateshead Council is raising tax by 2.99%

Gateshead residents face a 2.99% rise which includes a 1% precept for adult social care services.

Households in Band A properties, which form the majority of the borough, will pay an extra 73p a week while those in Band D properties pay £1.10 more.

The Labour-led authority will continue with the £24m council tax support scheme which means around 12,000 of Gateshead's poorest residents pay no more than 8.5% of their liability.

In the next financial year the council needs to save £5.8m which it will cover using temporary funding from the "budget sustainability reserve", while also having to face savings of £45m over the next five years.

Council leader Martin Gannon said: "We are conscious and aware of the great stress in Gateshead financially at the present time."

He said the "model of local government finance", which has seen massive cuts since 2010, is "effectively permanently broken".

"It is impossible to deliver the range of statutory services expected of a local authority with the level of support we're getting from central government," he said.

Jonathan Wallace, leader of the Liberal Democrat opposition, opposed the rise, citing a "cost of living crisis".

The borough plans to spend:

£5.9m on adult social care and £2.9m on children's social care to meet increased demand

£1m to continue social work in schools

£400,000 in parks and open spaces

£600,000 to fund a social worker academy to tackle increased workloads and recruit staff

£200,000 will be spent on extending "early help" posts which support families at an earlier stage to stop them needing social services

Sunderland City Council

Sunderland Council is raising tax by 2.99%

Sunderland residents face a 2.99% rise comprising a 1.99% in core tax and a 1% adult social care levy.

This would mean an increase of 59p per week for a Band A property, into which the majority of households in Sunderland fall, or 89p per week for the average Band D property.

As part of the budget, the council needs to make savings of around £5.8m and also plans to use £5.430m of reserves to help balance the books.

Graeme Miller, leader of the Labour-run council, said: "Raising council tax is not a decision we take lightly, especially in these unprecedented times.

"But if we don't raise council tax now, we will need to identify service reductions and not continue with the investment in the development of our city."

The budget will provide extra funding to support children's and adult social care as well as investment in waste collection and recycling through reviewing the arrangements for replacement bins and bulky waste.

It also allows for the continuation of free pest control services for eligible city residents into next year as well as £295m to support the City Plan, external.

The plan will see new various projects including developing a business case for a multi-million pound arena at the former Crowtree Leisure Centre site, the ongoing regeneration of the Sunniside district, improvements to city parks, and investment into leisure facilities and libraries.

South Tyneside Council

South Tyneside Council is increasing tax by 2.95%

Council tax in South Tyneside will rise by 2.95%, made up of a 1.95% increase in core tax and a 1% adult social care services levy.

Residents living in the lowest value Band A properties, which make up the majority of homes in the borough, will pay an extra 79p per week, or an extra £41.10 per year.

For an average Band D home, the council tax rise and precepts would also represent a weekly increase of £1.19 and annual increase of £61.66.

About 11,000 working-age households on low income will be given a £100 reduction in their bill, with the discount automatically applied to their council tax demand.

There will also be a support scheme to help about 18,400 households a year as well as the government's £150 energy rebate, which was announced in February.

Joanne Bell, cabinet member for resources and innovation, said: "In order to maintain our incredibly successful record of investment in the borough, and as council tax now makes up more than 50% of our revenue income due to significant historic falls in government grant, an increase in council tax is proposed."

The council pledged to invest in new accommodation schemes for vulnerable residents and build council homes for the first time in more than 10 years.

The budget includes £110.6m for capital projects including the housing programme and £2m for road resurfacing.

Hartlepool Borough Council

Council tax in Hartlepool is rising by 4.9%

A year after a council tax freeze to help people cope with the coronavirus pandemic, households in Hartlepool now face a 4.9% rise.

This is made up of a 1.9% core increase and 3% rise in the adult social care precept with the precepts for Cleveland Police and Cleveland Fire Brigade also rising (see the bottom of the article for more information).

Council finance chiefs said this means Band A properties will see a £64.89 increase in their annual council tax bill, from £1,398.04 to £1,462.93, equating to a £1.25 weekly rise.

Properties covered by a parish council in Hartlepool will also have a parish precept payment on their council tax bills.

Council leader Shane Moore, of the Hartlepool Independent Union party, said 40% of the council's budget is raised through council tax with the remaining 60% coming from a government grant.

Middlesbrough Council

Middlesbrough's council tax will rise by 2.99%

The council's 2.99% rise is made up entirely of the adult social care levy, which the government allows councils to charge to fund care.

Mayor Andy Preston, who is an independent, said it was needed to ensure vulnerable adults and children were protected and so that the council could plan for the future.

He said there were "no cuts" to staffing or services in the budget which, in "recent years", was "unusual".

The authority's Labour councillors put forward an amendment to ring-fence £160,000 for a tree maintenance squad to deal with a backlog of issues accounting for 70% of tree-related complaints, £90,000 for a subsided pest control service and £150,000 for more services to young people, all of which was approved by the council.

Labour councillor Chris Cooke, who presented the motion, said: "This amendment is what is needed by the people of Middlesbrough.

"In short, less rats, helping trees thrive, engagement with young people. What's not to love?"

Councillors also voted unanimously to introduce a new council tax support scheme which should make it easier for people to claim for a reduction.

It also means that the lowest earners will now be eligible for up to 90% off their bill, which is an increase from the current level of 85%.

Stockton Borough Council

Council tax in Stockton is rising by 2.9%

Councillors approved a 2.9% rise, 2% of which is made up of the government's adult social care precept.

Labour council leaders had originally planned a 3.9% increase pointing to costs for youngsters in care, inflation, and soaring energy prices, but the lower figure was ultimately agreed.

The increase will see a band A household pay £1,414.66 for 2022-23, up from £1,374.02 at the moment.

Meanwhile, a band D home is set to pay £2,122.30, up from £2,061.04.

Labour and independent councillors voted for the increase while Conservative members opposed the budget.

Yarm independent Andrew Sherris was the sole abstention.

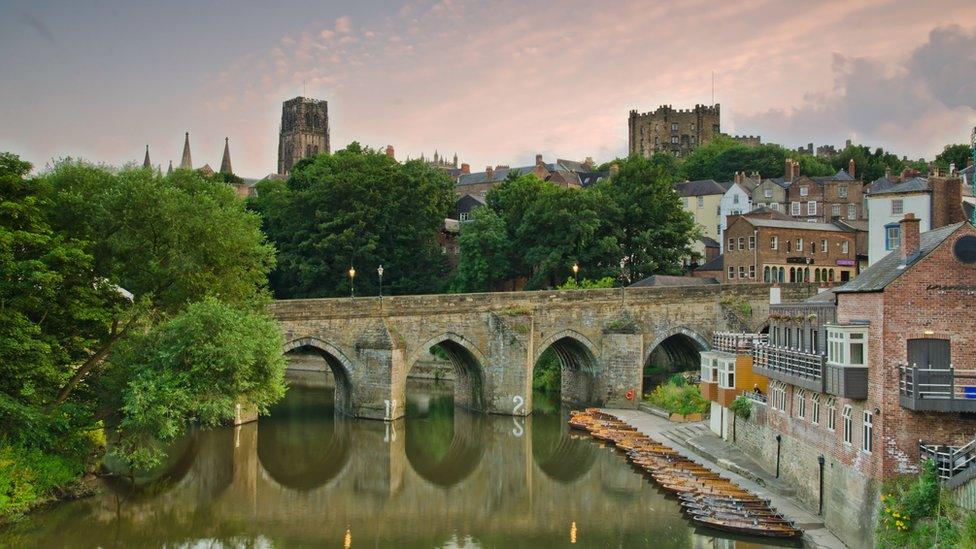

Durham County Council

Durham County Council is raising council tax 3%

Residents of County Durham face a 3% rise - all made up of the adult social care precept.

The Conservative-Lib Dem-Independent coalition, who won control of the council from Labour in May 2021, said their first budget was affordable, prudent and ambitious with millions of pounds going into frontline services "from rat control to roads", school building and levelling-up projects.

Labour opposition councillors condemned the rise as "completely unacceptable" and said the authority should give residents "a helping hand when they need it most".

Council leader Amanda Hopgood accused Labour of lacking "ideas, ambition and amendments".

Deputy council leader and cabinet member for finance Richard Bell said: "We've avoided the temptation to increase council tax by the maximum 5% permissible, as the government expects us to do.

"We know that people are feeling the squeeze from their incomes.

"Our local council tax reduction scheme - probably the most generous in the country - means that 21,000 pensioners pay nothing, as do 27,500 working age claimants."

Independent councillor Paul Sexton said: "Social care needs funding. We're not in a crisis but we're borderline right across the country. The 3% allows us to plan ahead in the next year."

Darlington Borough Council

Council tax in Darlington is rising by 2.99%

Darlington's council tax is due to rise 2.99% from 1 April.

Conservative council leader Heather Scott said the authority's medium term financial plan meant more than £100m revenue investment per year in the next four years and £160m capital investment in roads, housing and community assets.

Labour opposition group leader Stephen Harker had put forward an alternative rise of 1% to "give our residents a break this year", but he was accused of "playing politics" and being "irresponsible" by the controlling Conservatives.

Ms Scott said: "If we don't raise the council tax this year, we will be in a position next year that we're going to have to raise it by twice the amount."

Redcar and Cleveland Borough Council

Residents of Redcar will see bills rise 2%

Redcar and Cleveland Council has frozen council tax, although residents will still face a 2% increase on their bills through the adult social care levy.

Mary Lanigan, the independent leader of the council, said: "We have tried to do the very best we could by not putting up council tax."

The council leader cited increasing inflation and expected rises in household utility bills this year and said she had opened a bill at her own home in the morning to find it was going up by £460 a year.

The council said freezing tax in 2022-23 combined with the £150 non-repayable council tax energy rebate which had been announced by the government would reduce bills paid by a householder in a Band A-rated property by 12.7% and in a Band D property by 9%.

The total band D equivalent bill, taking into account all major precept charging authorities, will nonetheless rise from £2,051 to £2,097.

In terms of precepts, none of the five town or parish councils in Redcar and Cleveland chose to impose an increase in their precept amount.

The council's agreed budget proposals include providing more electric charging points for vehicles across the borough, along with a major tree planting programme.

As well as council tax, households pay precepts to parish and town councils (where applicable), fire services and police forces.

There will be rises in the following precepts:

Northumbria Police: An extra £10 a year, external for Band D homes

Tyne and Wear Fire and Rescue Service: Rising just under 2% meaning an extra £1.71 for a Band D property for the year

Cleveland Fire Brigade: 1.9% increase, external equating to an extra £1.02 a year for Band A properties or £1.53 for Band D households.

Cleveland Police: Rising £10 a year to £275.73, external for Band D properties

Durham Police: £10 a year increase for Band D homes

Durham Fire and Rescue Service: TBC.

Follow BBC North East & Cumbria on Twitter, external, Facebook, external and Instagram, external. Send your story ideas to northeastandcumbria@bbc.co.uk, external.

Related topics

- Gateshead

- Newcastle City Council

- Tyne and Wear Fire and Rescue Service

- Northumbria Police

- Gateshead Council

- North Tyneside Council

- Sunderland

- Northumberland County Council

- Council tax

- Stockton-on-Tees

- South Shields

- Darlington

- Hartlepool

- South Tyneside Council

- Newcastle upon Tyne

- Hartlepool Borough Council

- Redcar

- Durham

- Published3 February 2022