Kellingley Colliery employee buyout 'shelved'

- Published

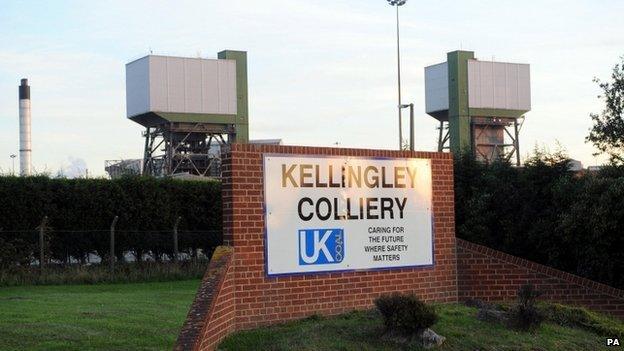

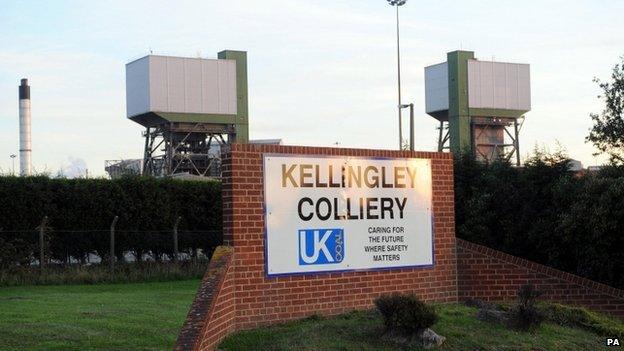

Kellingley is one of three remaining deep mines in the UK

An employee buyout to save one of England's last remaining deep coal mines has been shelved, the National Union of Mineworkers (NUM) has said.

UK Coal announced plans in April to close Kellingley Colliery in North Yorkshire with the loss of 700 jobs.

The government said it would loan the firm £10m for an 18-month "managed closure" of Kellingley and Thoresby Colliery in Nottinghamshire.

Now the NUM has revealed its five-year plan to save the pit is on hold.

'Out of control'

Chris Kitchen, from the union, said a buyout would involve employees taking on the whole of the company's £45m debts.

He said: "As it stands, the employee buyout has been shelved, not totally ditched. The main problem is the costs have spiralled out of control.

"The lads at the pit were thinking of taking on Kellingley's debts, which was doable. But when you're talking about them shouldering the whole of the company, it wasn't realistic."

UK Coal has strongly denied that it is 'blocking' an employee buyout of the pit.

Andrew Mackintosh, from the firm, said union officials had "buried their heads in the sand" and ignored the company's advice about the true cost of coal and securing funding.

'Dishonest and naive'

He said: "UK Coal is bitterly disappointed with the false accusations and inaccuracies announced by trade union branch officials today.

"The company has spent a huge amount of time explaining what would be needed to make the employee buy out scheme viable.

"At a meeting this week it was found that the steering committee had failed to pursue any of the recommendations made weeks earlier.

"The proposed plan was totally unviable and concerns were raised by directors that the buy out deal was not accurately presented to Kellingley employees as it did not include millions of pounds of liabilities that would have to be paid.

"To accuse the company of blocking this buy out proposal is both dishonest and naive."

Unions announced in May they were considering an employee buyout of the pit, which is on the border between North and West Yorkshire.

The plan would have seen workers invest £2,000 each and take a ten per cent pay cut to keep the pit open until 2020.

Pit fire

UK Coal said it would close the pit near Knottingley by the end of 2015 in a bid to avoid insolvency.

It blamed its financial problems on the global market with falling coal prices, on top of a fire which destroyed and subsequently closed its Daw Mill Colliery in Warwickshire.

If Kellingley and Thoresby close it will see the total loss of 1,300 jobs and will leave employee-owned Hatfield colliery in South Yorkshire as Britain's last remaining deep mine.

Yvette Cooper, MP for nearby Pontefract, said: "The workforce have come up with a good plan to keep Kellingley open beyond 2015.

"The government and UK Coal management need to work urgently with the workforce to make this work, instead of just focusing on the closure plan."

- Published11 June 2014

- Published22 May 2014

- Published22 April 2014

- Published10 April 2014