Tour De Yorkshire firm's £500k loan a 'bailout' says peer

- Published

Welcome to Yorkshire runs the UK's biggest domestic cycling race, the Tour De Yorkshire

A loan made to the tourism company Welcome to Yorkshire (WtY) has been described as a taxpayers' "bailout" by a Liberal Democrat peer.

North Yorkshire County Council (NYCC) has given WtY the £500,000 loan.

The leader of the council, Carl Les, said it was needed to help WtY manage a "cashflow issue".

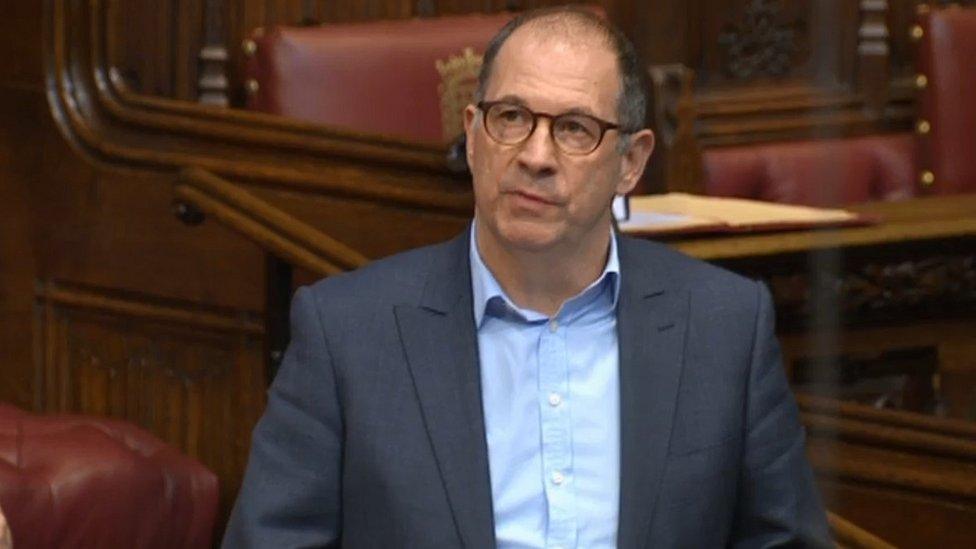

Lord Scriven, former leader of Sheffield City Council, said taxpayers were "bailing out a non-viable company".

He has raised concerns about WtY in the House of Lords, after an investigation in July revealed there was little oversight of how public money given to the company was being was spent.

Documents filed at Companies House, external show the loan will see the company pay an initial interest rate of 2.75% per year to NYCC.

Council leader Carl Les said: "The commercial loan is a good investment for North Yorkshire taxpayers as the interest rate is better than what we get from our own bank.

"The loan will also help WtY whilst long-term decisions are made about how much money it will receive in future from councils across Yorkshire."

The tourism organisation is a private company but receives more than £1m in public funding each year from councils across the region.

Lord Scriven (Paul Scriven) has called on the whole board of WtY to resign over the running of the company

Lord Scriven said: "It's staggering that the poor taxpayers of North Yorkshire are bailing out a company which is clearly non-viable.

"It is beyond the pale that a company that has been investigated over misusing public money now gets more money from the public purse."

WtY said it was not the case that the loan was a sign that company was in financial trouble.

Keith Stewart, the interim chairman of Welcome to Yorkshire, said "It's no secret the challenges that Welcome to Yorkshire, which is a not-for-profit organisation, has faced over recent months.

"The loan enables the business to offset the one-off costs the organisation has faced, and allows the company to rapidly progress..."

- Published17 July 2019

- Published25 March 2019

- Published24 July 2019