Yorkshire polyhalite mine: Investors may lose money

- Published

The project is set to be the world's largest polyhalite mine

Thousands of people who invested in a £4bn mining project may be left out of pocket as a result of a takeover bid.

Up to 85,000 small investors sank cash into the Sirius Mineral development near Whitby before it ran into financial difficulty last year.

Mining giant Anglo American has offered to buy the project for £405m, with investors set to receive 5.5p a share.

The company said it was "sensitive to the fact that the price is lower than what many people may have invested".

About 10,000 of the investors live near the mine, which would extract polyhalite from beneath North York Moors National Park before transporting it on an underground conveyor belt to a processing plant near the former Redcar steelworks.

Sirius failed to reach a fundraising target which would have unlocked a $2.5bn bank loan

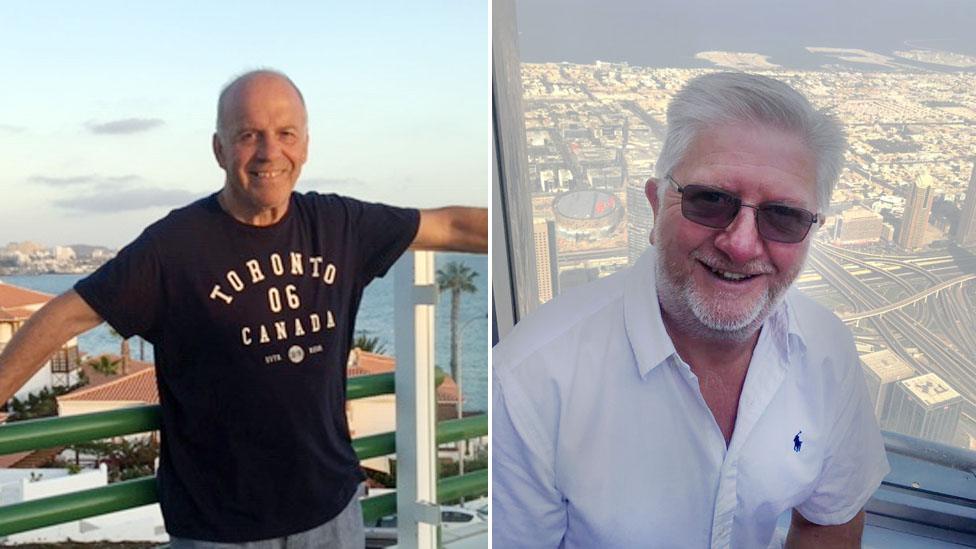

Scott Murphy, a "seasoned investor" from London, looks set to lose about £12,000, but said his thoughts were with investors in the local area.

"A lot of them have no real investment experience," he said. "They're 'Ordinary Joes' who have been sold the dream and that's what I find disgusting.

"I've got no excuse for losing my money and I accept it for what it is, but many of these people are not going to get an opportunity to get their money back."

Analysis

by Danny Savage, BBC North of England correspondent

The project plans to extract polyhalite from a mile below the North York Moors

The takeover of the Sirius Minerals project may secure jobs but there will be dismay and anger behind the front doors of plenty of houses in North Yorkshire and Teesside.

This scheme attracted a large number of small investors, individuals who saw an opportunity to buy into a local project.

It was the talk of the area, a huge project to mine a valuable resource. There was gold - well, polyhalite actually - in them there hills.

I remember going to a prospective investors meeting at Ravenscar several years ago where there were dozens of people in their forties, fifties and sixties, thinking of buying in to help their retirement.

It got under way and soon seemed too big to fail, but not, it seems, too big to be taken over.

Now, anyone who bought shares for more than 5.5p each will be taking a hit.

The other side of the coin is the old argument that shares can go down as well as up and perhaps you should not invest what you can't afford to lose.

But many investors had an altruistic take on getting involved; it was local, some of them can literally see the project from their homes.

That view could now be a painful outlook instead of a pleasant one.

Shares in Sirius Minerals hit a high of about 45p in August 2016 and were worth more than 22p a year ago.

But share prices dropped when Sirius Minerals slowed construction work at the end of 2019 due to funding problems.

Sirius chairman Russell Scrimshaw said the company had searched for a partner who would provide cash in return for a minority stake, but in the end the full acquisition by Anglo American was the only "viable proposal".

The deal is subject to shareholder approval but the firm, which has its head office in Scarborough, will recommend they accept Anglo American's offer.

Mr Scrimshaw said that if the offer was not approved then there was a high probability Sirius could be placed into administration or liquidation within weeks.

Mark Cutifani, the chief executive of Anglo American, said the company will look at opportunities to improve the project but stressed "this process is about preserving and creating jobs, not cutting them".

Follow BBC Yorkshire on Facebook, external, Twitter, external and Instagram, external. Send your story ideas to yorkslincs.news@bbc.co.uk, external.

- Published8 January 2020

- Published20 September 2019

- Published17 September 2019

- Published7 August 2019

- Published17 February 2019

- Published19 November 2012