York fire victim, 76, loses insurance payout over form error

- Published

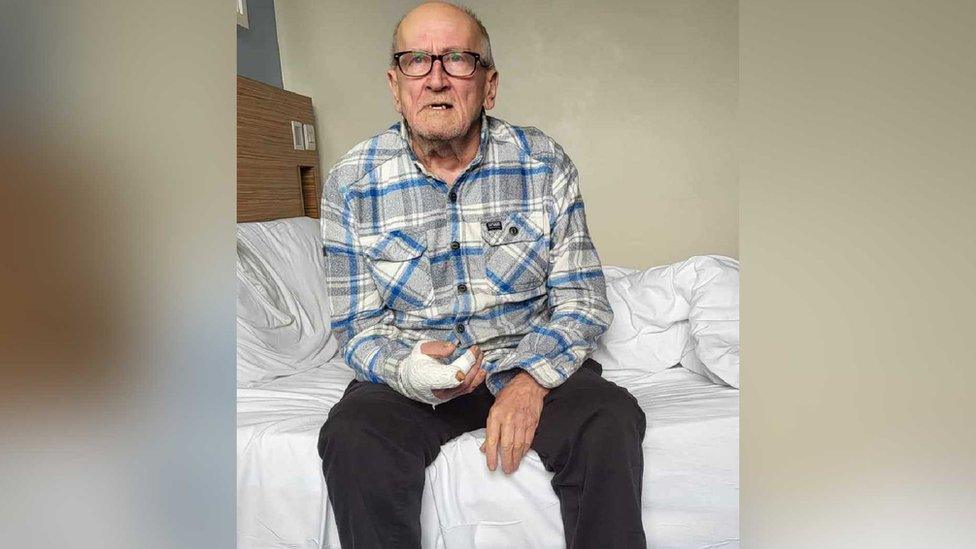

Retired council worker Barry Tordoff who lost his home in a devastating fire in York

A 76-year-old disabled man who lost everything in a house fire has been refused an insurance payout due to a paperwork error, his family claims.

York father-of-two Barry Tordoff ended up homeless following the blaze which was caused by an unattended chip pan.

According to his family, he will not receive any insurance money as he had missed ticking a box on a form.

Insurance company Liverpool Victoria said it had to treat customers "fairly" and did not decline claims "lightly".

North Yorkshire Fire and Rescue Service said crews were called to the semi-detached bungalow in Huntington on 12 April.

According to Mr Tordoff's daughter, Karen McKinley, her father, a retired council worker, had fallen asleep and left a chip pan unattended.

She told the BBC: "There was a big explosion that woke him.

"Luckily the neighbours heard it and they ran in and dragged my dad out."

She added: "If it hadn't been for them, I don't think he'd be with us today."

The fire service said 75% of the home had been destroyed with smoke damage throughout the property

Mr Tordoff, who is unable to stand for long periods of time due to a past hiking accident, suffered burns to his arm and hand.

Following the blaze, he received a letter from his insurance company Liverpool Victoria (LV) which stated it would not pay as he had failed to declare a previous flooding claim.

Ms McKinley said it had been a "genuine error" when her father "did not tick the box" when filling out the form in December.

She said LV should have spotted the mistake earlier as previous claims would have been registered on the firm's system.

She added: "Things change over the years and the policies change and it's your responsibility to check, but at 76 how easy is that to do?

"Yes, it was his fault legally but morally it's wrong."

The roof and kitchen will have to be replaced completely, according to the family

A spokesperson for LV said the firm did not decline claims "lightly" and had to treat all customers "fairly".

LV said it would not have been able to offer insurance cover if the flood claim had been disclosed.

The spokesperson added: "The premiums of our many customers pay for the claims of the few each year, and we have a duty of care to all of our customers to ensure we're only paying claims in line with the policy terms and conditions to keep the cost of insurance down."

The company initially paid for a hotel room but Ms McKinley said when it became evident her father's insurance was void, he had to move out.

Mr Tordoff then applied for emergency shelter via City of York Council but left the accommodation to use the money paid for rent towards house repairs instead.

The local authority said every applicant was charged for rent with some eligible to pay it through welfare benefits.

Due to the size of Ms McKinley's home in Bradford, which she shares with her children, she said she was not able to offer her father a place to stay.

She said her father, who is a hoarder, was currently living in a caravan and struggling to come to terms with losing his belongings.

She said: "He's not eating, he's losing weight.

"He's really sad and just wants to move back into his house."

She has now set up a fundraiser and raffles to try and raise enough money for roof and kitchen repairs which she was told would cost around £30,000.

Ms McKinley said: "We don't know what to do, we are struggling."

She added: "We really hope that my dad can move back in before Christmas."

Follow BBC Yorkshire on Facebook, external, X (formerly Twitter), external and Instagram, external. Send your story ideas to yorkslincs.news@bbc.co.uk, external.

- Published21 June 2023

- Published23 July 2023