Timeline: From billionaire to bust the downfall of Sean Quinn

- Published

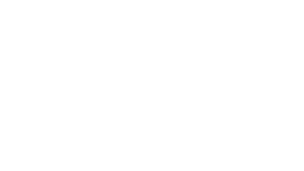

Sean Quinn was once Ireland's richest man

BBC News Online looks at the timeline of events surrounding the downfall of former billionaire Sean Quinn, whose bankruptcy is currently the subject of legal action at the High Court in Belfast.

1973

Sean Quinn started his business from the family farm in Derrylin, County Fermanagh. He borrowed £100 to extract gravel, then started up a cement business.

November 2005

The Quinn Group, which was then privately owned by the Quinn family, was estimated to be worth between €4 billion and €5 billion.

2008

He is reportedly the richest person in Ireland. He was reputedly worth 4.72bn euros (£3.7bn) at the height of his success.

His portfolio included hotels, healthcare and insurance and he created thousands of jobs in County Fermanagh.

April 2011

Mr Quinn, 63, was stripped of control of his manufacturing and insurance business empire.

The former Anglo Irish Bank, now called Irish Bank Resolution Corporation (IBRC), took possession of the Quinn businesses, sparking protests from his some of his employees.

4 November 2011

Anglo Irish Bankreportedly plans to enforce 2bn euros in loan guarantees given by Mr Quinn.

He had borrowed millions to buy shares in Anglo Irish Bank but lost it all when the shares became worthless.

The bank said the loans include one of 1.3bn euros, one of $820m and one of 200m yen all taken by Mr Quinn personally.

They also called in personal guarantees by Mr Quinn and his wife for a home improvement loan of 3.5m euros.

11 November 2011

Sean Quinn is declared bankrupt. He was granted a voluntary adjudication over the alleged 2.8bn euros (£2.4bn) debt owed to Anglo Irish Bank.

It is believed to be one of the biggest bankruptcy orders of its kind ever made in either the United Kingdom or Ireland.

10 January 2012

A judge rules Sean Quinn was not entitled to file for bankruptcy in Northern Ireland.

IBRC claim Mr Quinn's "centre of main interests" is the Republic of Ireland, thus rendering the Northern Ireland bankruptcy invalid.

A judge rules in favour of the bank, annulling the bankruptcy.

The bankruptcy regime in the Republic of Ireland is much more onerous than that in Northern Ireland.

In the Republic, the period of bankruptcy lasts at least five years while in Northern Ireland it can be just one year.