Merchant Hotel: Ulster Bank sells loans attached to Belfast hotel

- Published

The firm that owns the Merchant has said it will be business as usual

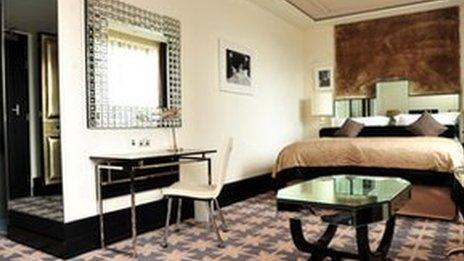

Ulster Bank is selling loans attached to Belfast's high profile Merchant Hotel, according to a report.

They are part of a portfolio known as Project Nadal which includes loans attached to pubs and hotels across Ireland.

The bank is selling a variety of loans in a move to reduce its involvement in property-related lending.

Beannchor, the firm which owns The Merchant, says it would be business as usual.

However, the firm will have a new lender.

The Belfast Telegraph has reported that loans on a number of pubs controlled by Beannchor are also for sale.

They include the loans on the Garrick and Whites Tavern in Belfast.

A spokesman for Beannchor said: "This process is part of a well-publicised strategy by Ulster Bank to reduce its debt book, north and south.

"For Beannchor, it means we will have a new funder, but other than that, it is very much business as usual for The Merchant and the pubs in this portfolio.

"Our focus on the successful running of these high-performing assets continues unabated."

The 2013 accounts for the company which owns the hotel, Merchant Hotel Ltd, showed a loss of £534,000 on a turnover of almost £11m.

Part of the reason for the overall loss was a provision of £1.2m for doubtful debts.

At that time, the company had borrowings of £21m with Ulster Bank and a note in the accounts stated that the directors were in discussion with the bank and "alternative funders" about refinancing that debt.

In 2012, the value of the hotel was written down from £34m to £22m.

A note in the accounts said that followed a review of land and buildings which was conducted "in response to the current economic climate".

Beannchor is owned by Bill Wolsey, who is one of the leading figures in Northern Ireland's hospitality business.

Not all the loans on his premises are for sale.

For example, a group of pubs he bought in 2011, and held in a company called North Down Leisure, are funded by borrowing from Santander.

Ulster Bank has been rapidly reducing its property-related lending over the last 18 months.

It is also selling a portfolio of loans called Project Achill which includes the borrowings related to office buildings in Belfast's Titanic Quarter.

- Published8 July 2013

- Published10 April 2013