Nama property sale: Questions raised over integrity of portfolio deal process

- Published

Nama sold its Northern Ireland property portfolio to US investment firm Cerberus last year

Questions have been raised about the integrity of the sales process that resulted in the biggest ever property deal in Northern Ireland's history.

It comes after the BBC found that about £7m in an Isle of Man bank account was intended to facilitate payments to non-lawyers or deal fixers.

The money was in an account controlled by Ian Coulter, a former managing partner at Belfast law firm Tughans.

He left the company in January after it found out and retrieved the cash.

It had been received from a US law firm for work Tughans did on behalf of New York investment firm Cerberus, who bought an 850-property loan portfolio from Nama for more than £1bn last April.

Earmarked

Alliance MLA Chris Lyttle told BBC Northern Ireland's Sunday Politics programme: "We need to get to the bottom of this because it has cast serious doubt over a significant financial transaction."

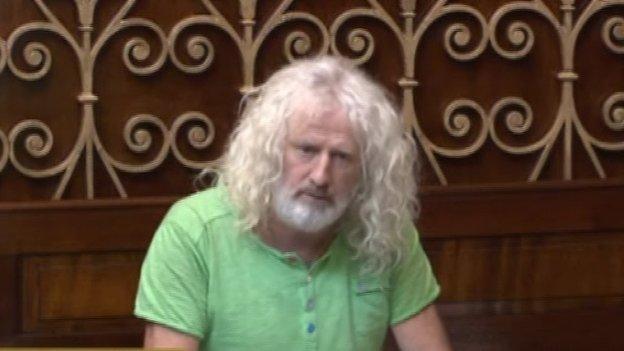

Stormont's finance committee intends to hold urgent sessions, prompted largely by last week's allegation in the Irish parliament by independent politician Mick Wallace that money was "reportedly earmarked for a Northern Ireland politician".

Cerberus has said "no improper or illegal fees were paid by us or on our behalf".

The Law Society of Northern Ireland has been unable to establish what work was carried out by Tughans to earn millions of pounds in fees, sources have told the BBC

BBC Northern Ireland's Spotlight programme has been investigating the circumstances around the deal.

It understands that Mr Coulter and Frank Cushnahan, a Nama Northern Ireland advisor until November 2013, had been involved in trying to set up the sale of the property portfolio to another US investment firm, Pimco.

The firm has confirmed "an unsolicited approach" was made, but it did not progress a deal and said it raised concerns with Nama.

Nama said it asked Pimco in March 2014 to withdraw from the sales process over the discovery of proposed fee arrangements between Tughans and its former advisor, Mr Cushnahan.

It said it had "serious concerns... in particular" the proposed payment to a former advisor.

Competitive

A Nama spokesman added on Sunday that Mr Cushnahan "never had access to confidential information but the Nama board determined this arrangement could undermine the integrity of the sale".

Ian Coulter left Tughans after the firm discovered he had diverted cash into an account in his name

His lawyers told Spotlight he is satisfied that at all times he complied with his fiduciary and statutory obligations as a member of Nama's Northern Ireland advisory committee.

Mr Coulter said he was unable to respond to Spotlight's requests for a response, nor has he returned other calls from the BBC.

Nama has insisted that the sale to Cerberus "delivered the best possible return" and that any issues are "internal" to Tughans and have "no relevance to Nama's open, competitive sales process".

Sources told Spotlight that the Law Society of Northern Ireland has been unable to establish what work was carried out by Tughans to earn millions of pounds in fees.

A Law Society investigation is ongoing.

- Published4 July 2015

- Published4 July 2015

- Published3 July 2015

- Published2 July 2015

- Published20 June 2014

- Published4 April 2014