Nama: Mick Wallace makes £45m 'fixers fees' allegation

- Published

Independent TD Mick Wallace claimed that amounts larger than £7m had been paid to fixers

The Irish parliament has heard a claim that £45m in "fixer fees" have been paid in relation to the Northern Ireland Nama property deal.

Independent TD Mick Wallace had previously claimed that £7m in fixers fees were to be paid from an Isle of Man bank account in the wake of the deal.

On Thursday, he told the Dáil that the £7m was "only for openers".

He said larger amounts have been paid to fixers as part of loan refinancings.

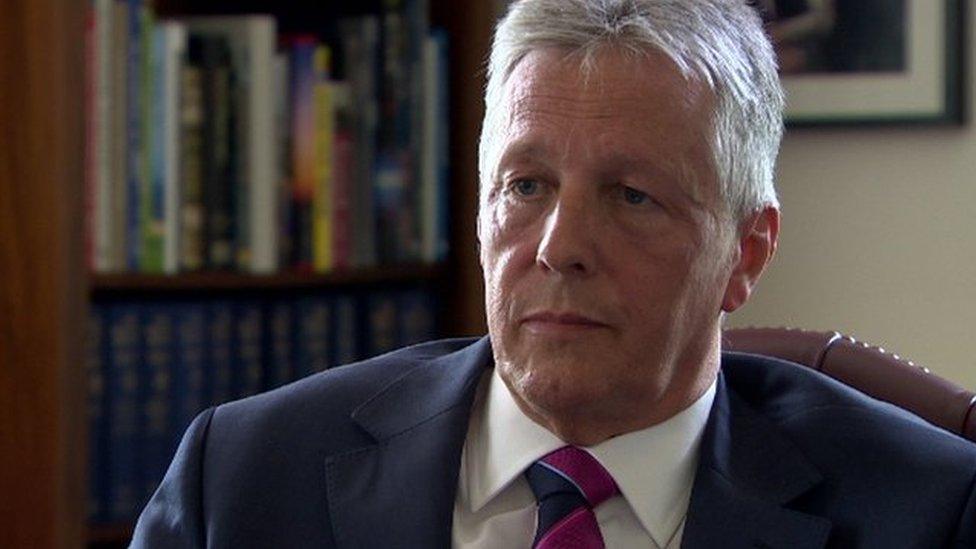

On Wednesday, Northern Ireland first minister Peter Robinson rejected as "scurrilous and unfounded" an allegation that he was to receive a payment upon completion of the deal.

The claims were made at Stormont's finance committee, which is examining the sale, by loyalist blogger Jamie Bryson.

Nama: The key figures and background you need to know

Timeline of Nama's NI property deal

The £1.2bn sale - Northern Ireland's largest ever property deal - was of property loans to US investment firm Cerberus by Nama, the Republic of Ireland's "bad bank".

Mr Wallace claimed in the Irish parliament on Thursday that after Cerberus bought the Nama loans at the equivalent of 27p in the pound, it had offered major developers the opportunity to refinance at 50p in the pound.

He added that these deals could only be done on payment of a fixers fee.

Analysis: John Campbell, BBC NI economics and business editor

Mick Wallace's latest claim is substantially different to his original allegation about the Nama deal in July, when he said £7m was "earmarked" for a politician as a result of the deal.

His latest allegation is about what happened after Cerberus bought the Nama loans.

He told the Irish parliament that developers were offered the chance to refinance loans if they paid a "fixer's fee".

However, loan refinancings often involve paying an arrangement fee - something which is uncontroversial.

So are fixers' fees and arrangement fees being conflated?

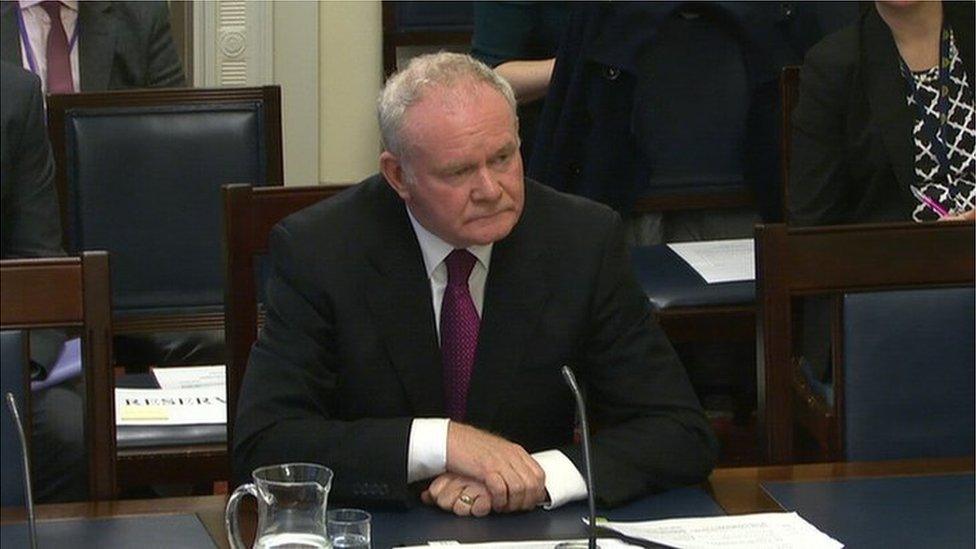

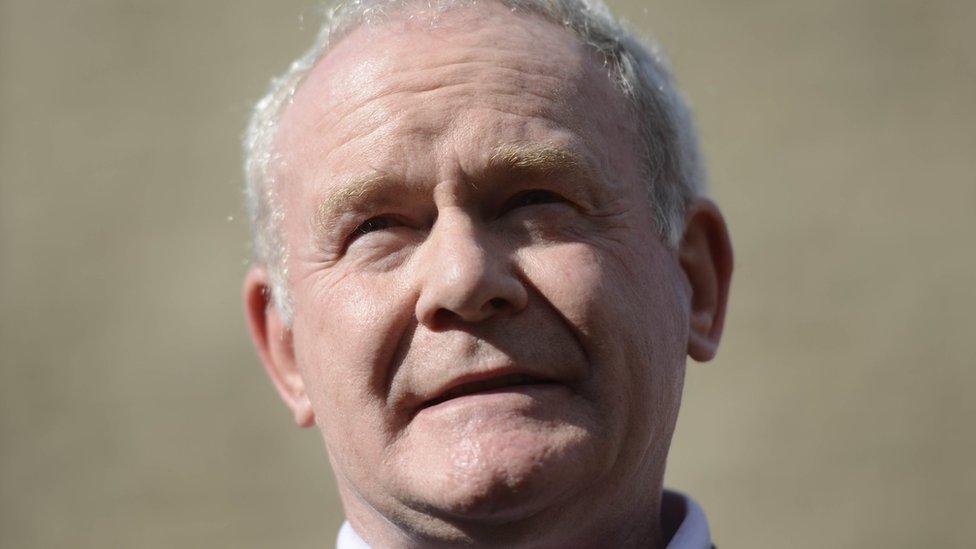

Frank Cushnahan served on the Nama NI advisory committee from 2010 until 2013

Mr Wallace also said it was "nonsense" for Nama to claim that its former advisor Frank Cushnahan did not have confidential information on the Northern Ireland loan sale.

Mr Cushnahan served on the Nama NI advisory committee from 2010 until 2013.

He then began advising Pimco, a US investment fund that was interested in buying the portfolio.

Pimco was required to withdraw from the sale when Nama learned of Mr Cushnahan's involvement.

However, Nama has always maintained that Mr Cushnahan did not have access to commercially sensitive information in his role.

Cerberus, which bought the loans from Nama, has denied that any improper or illegal payments were made on its behalf.

Nama says the sales process was "robust, competitive and secured the best outcome for the Irish taxpayer".

- Published23 September 2015

- Published23 September 2015

- Published24 September 2015

- Published14 September 2016

- Published18 September 2015

- Published16 September 2015

- Published6 September 2015

- Published10 July 2015