Spending review: £400m could be cut from Stormont budget

- Published

The Chancellor's spending review could mean a £400m cut from the Stormont's budget by 2019/20

The Chancellor is to lay out tough plans for the next four years in a comprehensive spending review.

The review will determine the amount of money Stormont gets from Westminster - known as the block grant.

Some UK government departments can expect cuts of more than 20%.

The Resolution Foundation think-tank has used official figures to calculate that it will likely mean around a 4% drop in the amount of money coming to Stormont.

In cash terms, that will mean Stormont's departmental spending budget could be cut by about £400m in real terms by 2019/20.

Funding allocation

The way in which funding is allocated to the devolved institutions, under the Barnett formula, means they receive a degree of protection from cuts.

It is understood that Stormont officials believe the block grant could actually rise slightly in cash terms next year as a result of increased NHS spending announced by Chancellor George Osborne on Tuesday.

However, in the following three years the amount of cash received is expected to fall.

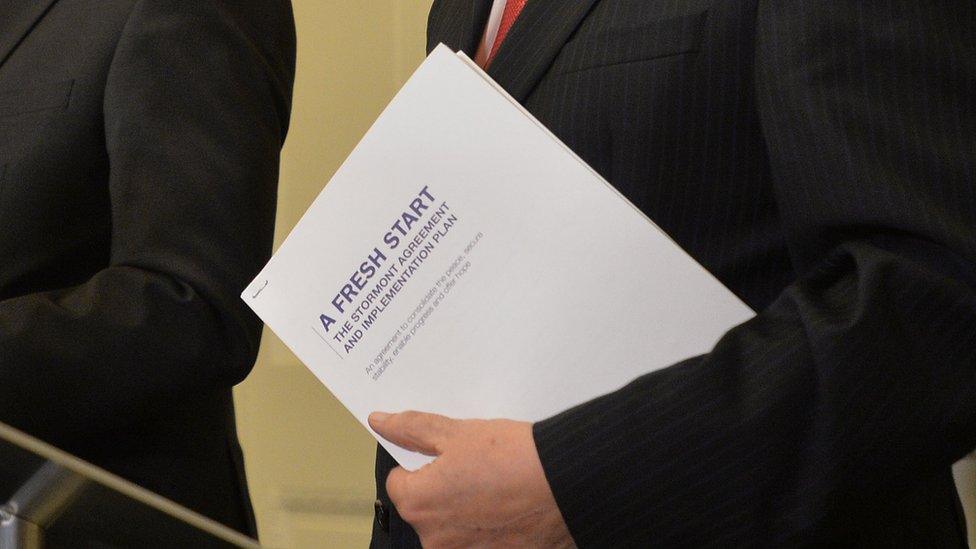

Last week, the Stormont Executive received an additional funding package from the UK government as part of the Fresh Start, external deal.

It is worth as much as £565m over the next five years.

However, the executive has also committed to spending £585m on welfare mitigation measures and an amount yet to be confirmed on devolving corporation tax.

The Health Minister, Simon Hamilton, has also said the DUP wants to increase health spending by "at least £1 bn by the end of the next assembly term."

Tax Credits

Meanwhile, the Chancellor will also return to the issue of tax credits.

His plan to save more than £4bn by cutting tax credits was effectively blocked by the House of Lords.

Under that plan more than 120,000 households in Northern Ireland would have had their tax credit payments cut.

An official analysis by the Department for Social Development (DSD) suggested the average loss per household would have been £918 per year.

There has been speculation that Mr Osborne will reduce the cuts to tax credits by imposing new cuts to housing benefit.

Tax credits are effectively a means-tested benefit paid to people on lower incomes.

They are paid to two main groups: unemployed people with children and low paid working people who may or may not have children.

- Published23 November 2015

- Published17 November 2015

- Published17 November 2015