No change as Northern Ireland paper £5 note stays in use

- Published

All four Northern Ireland banks print their own money, but only two of them produce £5 notes

The paper £5 note will live on in Northern Ireland.

Its 'old-fashioned' fivers are staying in use for now, despite the Bank of England's version being withdrawn at midnight on Friday night.

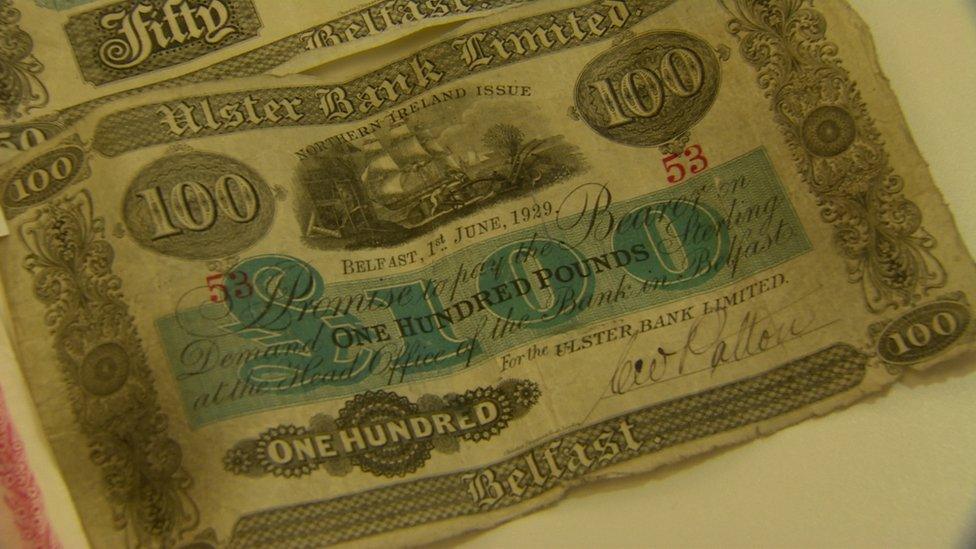

All four Northern Ireland banks print their own money - a tradition which stretches back to the early 19th Century.

But only two of them produce fivers - the Ulster Bank and the Bank of Ireland.

The Bank of England paper note is being pulled from circulation because there is a newer version, made of polymer.

The Bank of England introduced its first plastic banknote last year

Northern Ireland's banks could, eventually, follow suit, but for now their paper £5 notes remain in use.

Sean Murphy of Ulster Bank said: "In the long run, polymer notes will probably be more cost-effective and it is something we are actively looking at."

There is about £2.5bn worth of Northern Ireland banknotes in circulation.

Sean Murphy said Ulster Bank is considering the introduction of polymer banknotes

One of the most recent new designs was the George Best £5 note, a million of which were issued in 2006, external by Ulster Bank in tribute to the late footballer.

Danske Bank is currently doing a print run of £20 notes, with the signature of its chief executive, Kevin Kingston, being added for the first time.

'Prestige and branding'

There are rules covering the issuing of Northern Ireland banknotes.

Each of the banks must hold assets with the Bank of England equal to the value of the cash being printed, so that if they were to ever go bust their notes in circulation could be exchanged.

Northern Ireland banks' practice of printing their own money is a long-held tradition

The banks have said the main reason they print their own notes is for prestige and branding.

Incidentally, in Northern Ireland the paper £5 Bank of England note was never legal tender, which has a very narrow technical meaning.

Just like Northern Ireland banknotes being presented in Great Britain, acceptability as payment is essentially a matter for agreement between the parties involved.

Northern Ireland banks must hold assets with the Bank of England, equal to the value of the cash they print

- Published4 May 2017

- Published15 February 2017

- Published13 September 2016

- Published13 September 2016