NI's paper £5 and £10 notes withdrawn from circulation

- Published

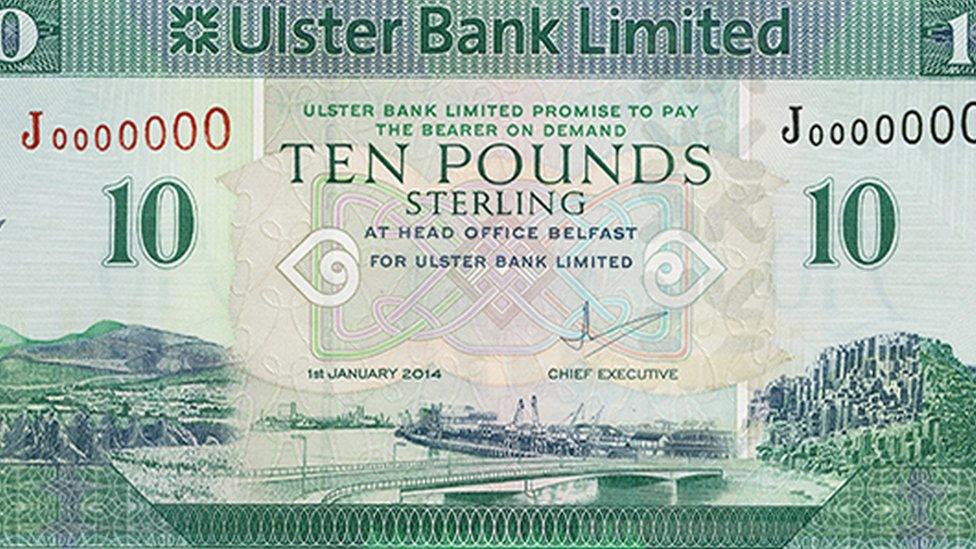

Polymer notes were introduced in February

Northern Ireland £5 and £10 paper notes are to be withdrawn from circulation on Monday.

In February, Bank of Ireland, Danske Bank and Ulster Bank began circulating notes made from polymer - a thin plastic material.

From Monday, retailers can refuse to accept the older paper notes at their own discretion.

However, banks will continue to accept all NI notes from their own customers as deposits or exchange for new notes.

The Post Office will also continue to accept paper notes for customers who use branches to pay in to their account.

Bank of Ireland, Danske Bank and Ulster Bank have agreed they will exchange their own paper £5 and £10 notes from non-customers up to the value of £250.

The Association of Commercial Banknote Issuers (ACBI) has been encouraging the public to spend or exchange any paper notes in advance of the 30 September deadline.

All is not lost - banks will continue to accept all NI notes from their own customers as deposits or an exchange

It said polymer delivers "significant benefits over paper, particularly when combined with state of the art security features which make the notes much harder to counterfeit".

As polymer is stronger than paper, notes will last longer, remain in better condition and deliver environmental benefits, it said.

An ACBI spokesperson said: "We have set a deadline for using paper £5 and £10 notes as 30 September.

"The Northern Ireland note issuing banks will continue to accept old paper-based notes and there are currently no plans to change this."

First Trust Bank announced in February that it would end its tradition of printing its own bank notes by June 2022.

As Northern Ireland banknotes promise to pay the bearer on demand, customers will always receive value for genuine notes from the issuing bank.

- Published24 July 2017

- Published6 November 2018

- Published13 February 2019