Wrightbus: Invest NI loaned bus company £2.5m in June 2019

- Published

Invest NI will attempt to claw back their loan to Wrightbus

Invest NI has disclosed it loaned the Wrightbus group £2.5m in June 2019 in a bid to provide financial breathing space as the business sought a buyer.

The group was placed into administration last week, with the loss of 1,200 jobs, after it failed to find a new owner.

Invest NI will now attempt to "claw back" the loan.

The government agency has written to local politicians to explain what support it gave the business.

When the company went into administration last week, 1,200 employees were made redundant.

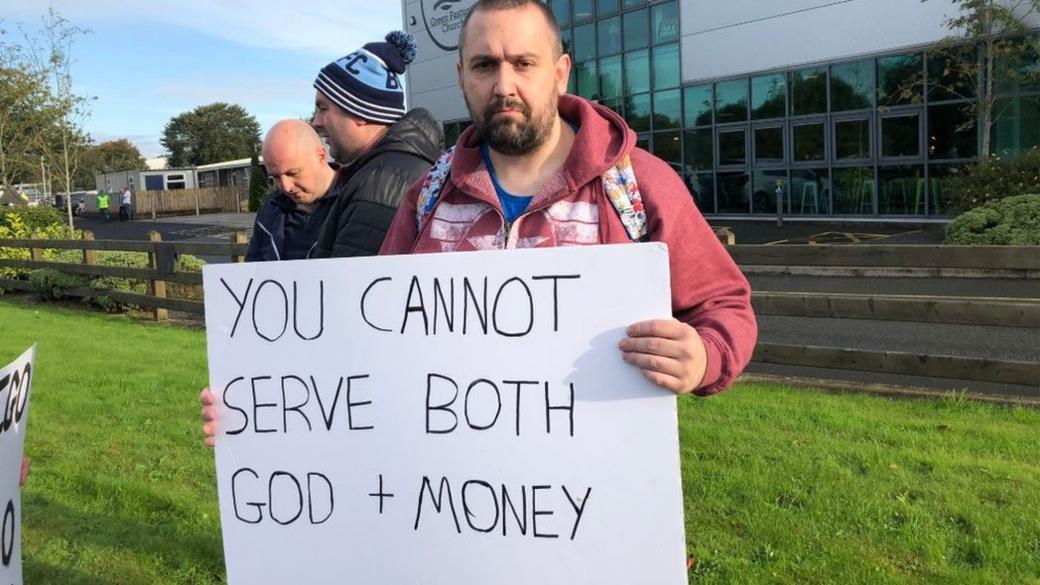

Wrightbus workers gathered on Wednesday to stage a rally

Wrightbus suffered from a major downturn in demand for buses in the UK, which was its major market.

The group's parent company, Cornerstone Group, also made donations of more than £15m to a related religious charity over a six-year period.

Some workers have expressed concern that weakened the business.

New bidders

News of the loan emerged as the Unite union revealed four bidders are now interested in buying the company.

One is from the UK, one from China, and two from the European Union.

The details were revealed during a meeting held by the union for redundant Wrightbus workers in Ballymena on Wednesday.

Attended by around 300 people, the meeting was held as a precursor to a rally through Ballymena on Friday.

Politicians have also asked why Invest NI was giving grants to Wrightbus at the same time its parent was making big donations.

Wrightbus protesters left their work shirts on a fence outside Green Pastures

Since 2012, companies in the Wrights Group have drawn down £4.2m against six offers of support from Invest NI to support Research & Development, skills, job creation and export growth.

These offers included a restriction on how much could be paid in dividends and a requirement to maintain a minimum net asset level.

Invest NI said any associated dividends taken from Wrights Group complied with its requirements.

The minimum net asset condition was met up until the recent financial difficulties.

The companies which Invest NI supported paid permissible dividends to Cornerstone Group which in turn made the charitable donations.

Invest NI said that once the dividends were paid to Cornerstone, it was "a matter for directors of Cornerstone as to how they are put to use.

"Invest NI neither currently, nor in the past, has had any support agreements with Cornerstone. Therefore the quantum or timing of any payments by Cornerstone are not a matter over which we have any control."

Cornerstone made a loss of £1.7m in 2017, a year in which it made a donation of more than £4m.

However Wrights Group made a profit before tax of £1.5m in that year.

Invest NI said: "We can confirm that there were no dividends paid from Wrights Group in any year it was loss making, over the duration of these Letters of Offer."

'Pursue claw back'

The agency said that in the past few months it became aware of the significant cashflow issues in the Wrights Group and became heavily involved with the company directors and its advisors to try to find a resolution that would save the companies.

"To that end we provided a loan of £2.5m to Wrights Group, approved in June 2019, to allow time for the advisors and directors to conclude negotiations with prospective bidders.

"Despite this additional time, which was sufficient to allow final bids to be delivered, the directors and their advisors were unable to reach a successful conclusion.

"As the business has now been placed in administration we will pursue claw back, as is our standard practice."

- Published29 September 2019

- Published1 October 2019

- Published25 September 2019

- Published25 September 2019