Danske Bank makes £71m profit in Northern Ireland

- Published

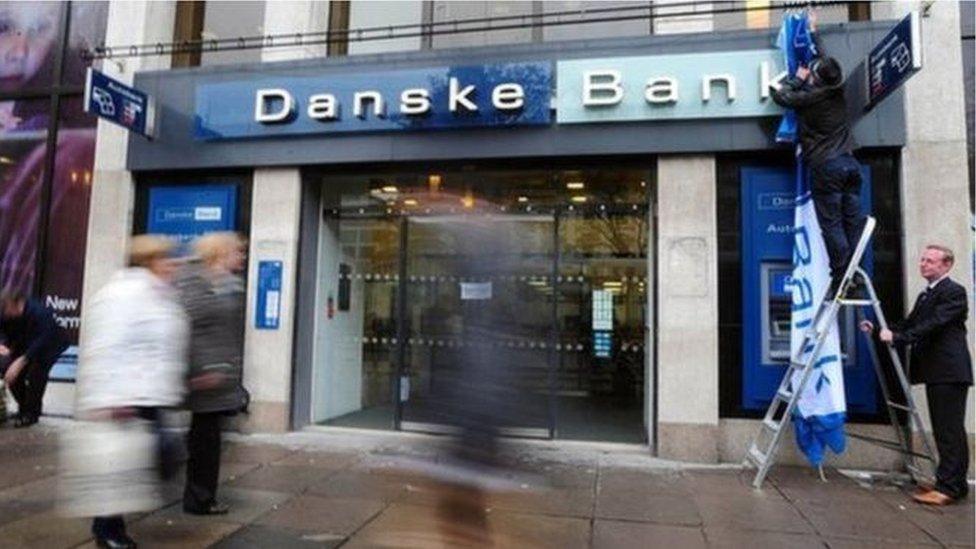

Danske Bank is one of the largest of the so-called 'big four' banks in Northern Ireland

Danske Bank in Northern Ireland made a pre-tax profit of £71m in the first nine months of 2019.

That is up by 6% on the £67m profit achieved during the same period in 2018.

Turnover in the nine months was £176m, up marginally on 2018.

Danske is one of the largest of Northern Ireland's 'big four' local banks. It has 40 branches and employs about 1,500 staff.

Chief executive Kevin Kingston said Brexit uncertainty meant that businesses' demand for new borrowing continued to be "subdued."

"Current demand levels are below what we would expect in a more normalised trading environment," he said.

"In the short-term, the business community awaits much-needed clarity on what the Brexit journey will look like."

Restoring trust

The bank's Danish parent company made a net profit of $450m in the third quarter.

The parent company is trying is trying to restore trust among regulators and consumers after its involvement in one of the world's biggest money-laundering scandals via its Estonia branch.

It emerged that between 2007 and 2015 200bn euros (£177bn) of suspicious transactions flowed through the bank's Estonian operation.

Danske was warned by the Russian central bank that the Estonian operation was being used for tax evasion or money laundering.

Later, in 2014, a whistleblower in the Estonian branch raised further concerns.

The bank said operating expenses rose by 2% in the first nine months of 2019 due to higher compliance costs and anti-money laundering activities.

- Published19 February 2019

- Published1 November 2018