Danske Bank reprimanded again over Covid Bounce Back loans

- Published

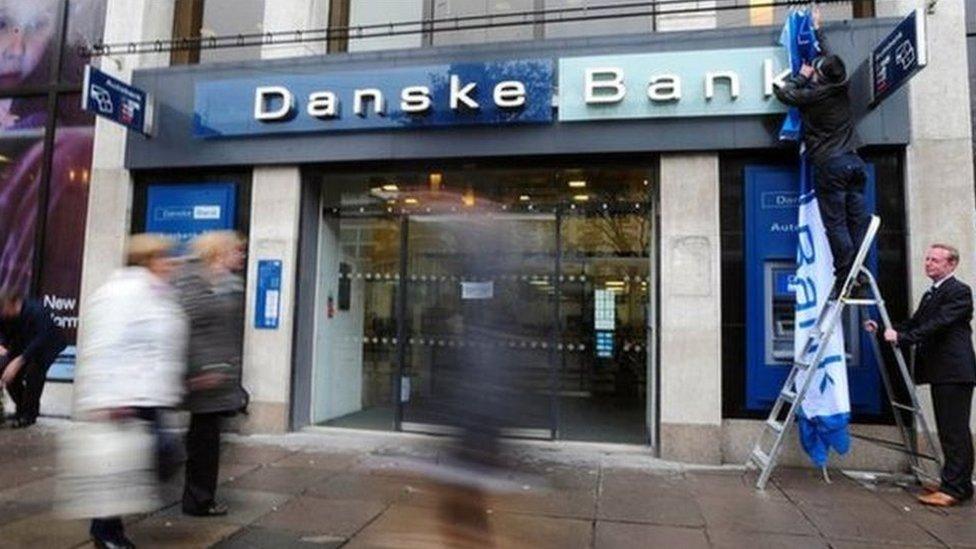

Danske Bank is one of the largest banks in Northern Ireland

Danske Bank has been reprimanded for a second time over the treatment of some small businesses applying for Covid-19 Bounce Back loans.

Danske wrongly required up to 205 firms to open business accounts to access a loan.

This only came to light after publicity concerning another group of 305 firms which had been treated in this way.

The Competition and Markets Authority (CMA) said this meant the businesses faced new fees.

The CMA said it was concerned that Danske "did not investigate the first breach in sufficient detail" so as to identify all affected customers.

It added: "This breach notified on 30 April might not have come to light had Danske customers not seen the CMA's 30 March 2021 announcement of the first breach and subsequently contacted the bank.

"While a lack of knowledge among relationship managers of the undertakings may be part of the cause, it is at least in part due to Danske's failures in investigating the first breach."

The CMA investigation focused on what is known as "bundling" - when a bank requires a customer to open a specified type of account in order to get a loan.

The CMA says this restricts customer choice and, therefore, competition in the market.

In 2002, Danske, along with other banks, gave an undertaking not to engage in bundling.

The bank said it had required small companies to open a business account as the best way to promptly meet the demand from these firms, while also meeting fraud checking requirements of the Bounce Back scheme.

However, the CMA did not accept this explanation saying that other banks had been able to provide Bounce Bank loans without breaching their undertakings on bundling.

Danske has now remedied the breach and refunded around £26,000 to affected customers.

The CMA said that it would take no further action given "the challenging circumstances of responding to the Covid-19 pandemic, in combination with the constructive approach taken by Danske to ending the breach".

A Danske spokesperson said that when the bank launched the Bounce Back loan scheme it asked customers using personal current accounts for their business needs to open a business current account.

"Our driving purpose for doing this at the beginning of the scheme was to ensure that we balanced the risks of non-standard applications from personal current account holders against the need to give customers quick access to the funds and avoid unnecessary delays at what was a critical time for them.

"With hindsight we now accept that the correct course of action would have been to offer customers alternatives, including a fee-free business servicing account option."

"We have worked closely with the CMA to agree an action plan that includes us contacting all customers who were not given this choice during the initial period of the loan scheme. We apologise to customers that were impacted."

- Published6 April 2021

- Published29 October 2021

- Published9 July 2021