Bank closures: 'We are losing our little towns'

- Published

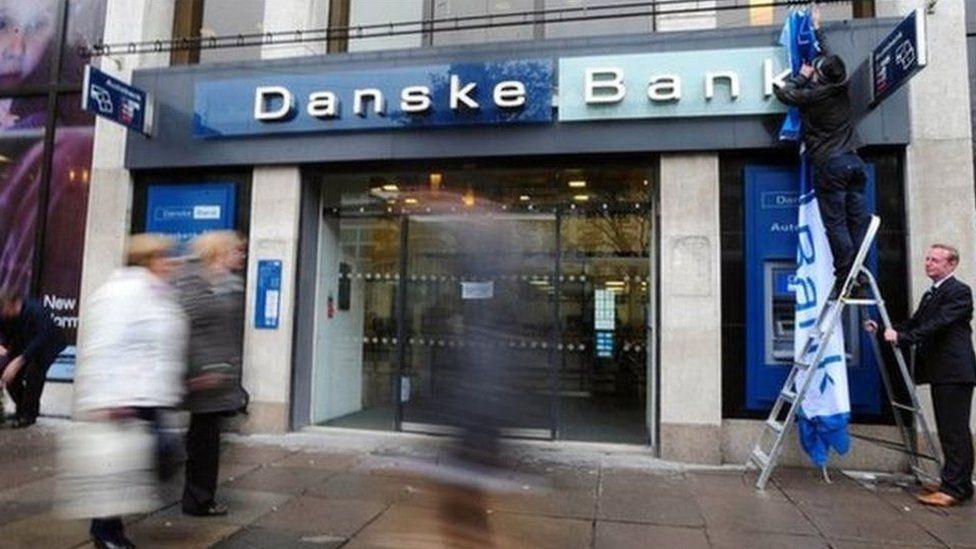

The Danske Bank announcement will see Fivemiletown left without a bank

"We are losing our little towns and a lot of us need our little towns."

That's the view of one shopper after an announcement of further bank closures in Northern Ireland, amid a rise in online and cashless transactions.

Danske Bank is closing four branches within months, and Ulster Bank is shutting nine branches.

The move will see some places, including Fivemiletown, left without a physical bank presence - something that worries businesses and consumers alike.

Finola Murphy, president of the local Chamber of Commerce, says she will be fighting to keep the County Tyrone village's cash machine, which is also to be removed.

According to Ms Murphy, who owns a salon on Main Street, people from the surrounding areas of Ballygawley, Rosslea, Fintona and Lisnaskea travel to the bank in the village.

Ms Murphy has concerns for the elderly in the community, who are not tech savvy

She believes that some businesses which rely on passing trade will be hit hard by the bank loss, but that is not her only concern.

"You have the likes of the Valley Hotel and the butchers. There is not going to be a night safe, so what are they going to do with their takings?," she asks.

"They are talking about taking the cash machine away as well, which is really going to affect people in the town."

Danske Bank says the move is due to customers using "alternative ways of banking".

'Paper in their hand'

It says the business has to make "difficult decisions to close certain branches that are being used less and are no longer sustainable".

But there are many concerns in Fivemiletown, as the nearest Danske bank branch is in Enniskillen, some 16 miles away.

The local Post Office can deal with cash transactions but Ms Murphy feels it won't be able to keep up with demand.

She also has worries for people in the community who are not as savvy with modern technology, such as the elderly.

"They were pushed towards opening an account with the bank for their pension and their benefits, but now they are expected to go to Enniskillen, how do they get there?

"I am all for going online but you have to take into account that some older clients prefer to have paper in their hand."

George Graham, who has lived in the town most of his life, says the news left everyone in shock

George Graham, who has lived in the town most of his life, says everybody was in "shock" at the announcement.

"I would say it was a hard decision, but I suppose it is all online banking and that now", he says.

"As you can see it is a busy bank and brings a lot of business in, so it going will definitely have an impact."

For Yvonne Johnson, it will be the second time she will have to move banks after her previous branch in Lisnaskea closed in 2014.

"One of the main reasons I would go into the bank would be for queries and you get to know people in the bank. I wouldn't want to be going to strangers", she says.

Ms Johnson also says that getting to Enniskillen to bank will prove particularly hard for her sister who is blind.

Fivemiletown will be left without a physical bank presence within a few months

Hollie Parsons is a regular user of the bank as her husband is a farmer and deals mostly with cash.

"With the online banking, the app constantly crashes and it is hard enough to get someone to speak to on the phone. I think it is going to take away a lot from local people."

Others believe little can be done to stop the closure.

"We are losing our little towns," adds Linda Cowan.

"It does have a knock-on effect. People stopping in to use the bank might stop in this shop or that, but you really are potentially ruining a town.

"But is is very hard to change this, it really is set in stone."

'Final nail in the coffin'

However, the situation in Fivemiletown is not unique - many towns and villages across Northern Ireland have been left without the physical presence of a bank.

AIB and Bank of Ireland have also closed a significant number of branches across Northern Ireland in recent years.

Dungiven in County Londonderry has been facing the same issue after the closure of its Ulster Bank branch four years ago.

Dungiven's Main Street Ulster Bank branch closed in 2018

Karen Groogan, who owns a business on Main Street, says she noticed a decrease in footfall following the bank closure.

"We used to have a Mace, that business was there for years. The owner said that the final nail in the coffin was the banks leaving, her footfall fell that much," Ms Groogan says.

"All of our essential services are leaving the town, which is leaving less and less reasons for people to come to Dungiven, and the businesses are suffering as a result."

Ms Groogan says works on a bypass of Dungivan have been an "absolute disaster"

Ms Groogan also describes work on the A6 bypass of Dungiven as an "absolute disaster".

She says that having traditionally enjoyed passing trade, the detour has put many people off, choosing to travel to Londonderry instead.

At Rosmar Coffee Bistro, Kathleen Kealey says the town is much quieter than in previous years.

"I have been here for seven years, people are getting used to using cards. But it is just terrible for older people who prefer to use cash and now they have to go to Limavady."

But Claire McGill, owner of Inner Beauty, says road closures to facilitate the bypass project could be a "bigger problem" than the bank closure.

Ms McGill says: "I am lucky because I would have appointments throughout the week, but other businesses will have struggled more.

"I have been here 17 years, it is sad because I have put in a lot of effort and it is sad to see the town closed off. "

Related topics

- Published19 May 2022

- Published13 May 2022

- Published1 March 2021