Mortgage rates causing concern and anxiety in Northern Ireland

- Published

Craig Mullan and his fiancee Danielle are facing an uncertain time

Uncertainty around the future of interest rates has forced many homeowners across Northern Ireland into making tough decisions.

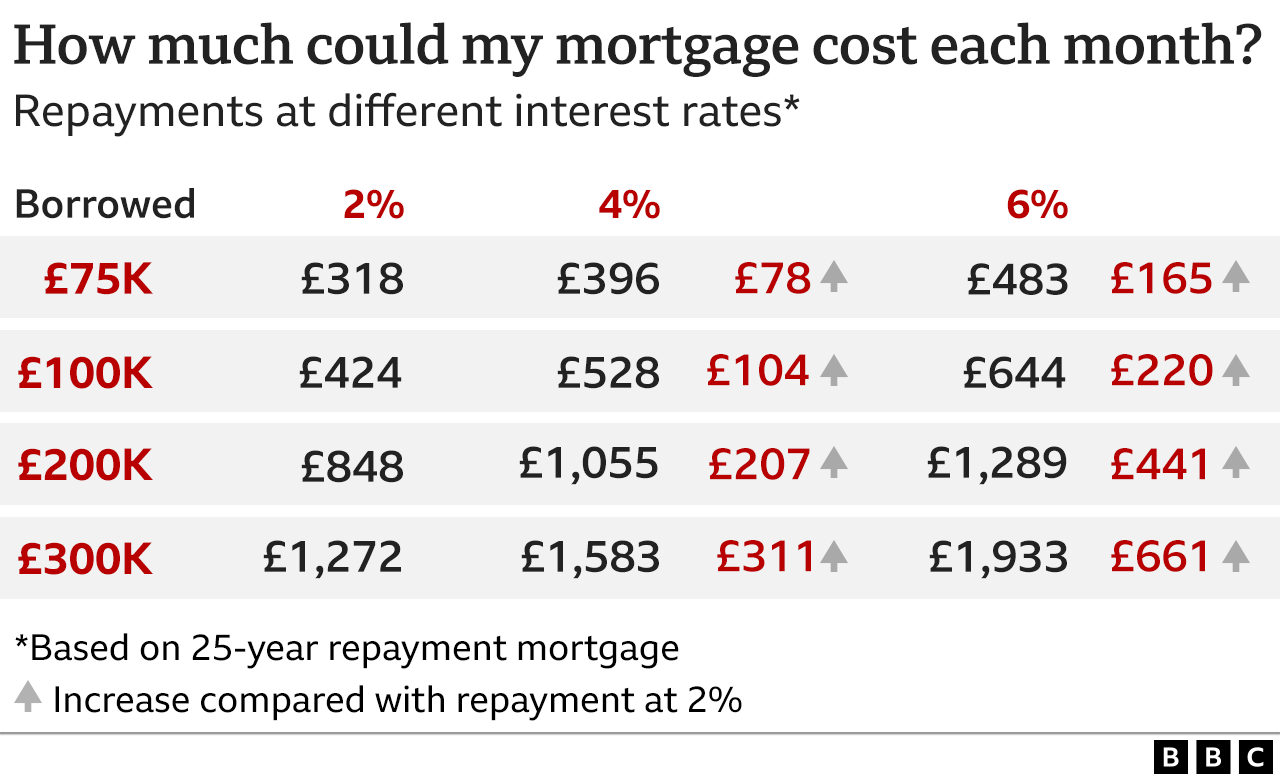

Some economists have predicted the Bank of England will raise its base interest rate from the current 2.25% to 5.8% by next spring, which would cause mortgage repayments to jump significantly.

The unpredictability has caused Craig Mullan and his family a lot of anxiety.

"We're in a fixed deal at the minute, which actually doesn't end until December 2023," he said.

"We spoke to our broker and even though we're in that deal, we've decided to re-mortgage.

"The new rate we've been offered is 1.5% higher than what we have now."

Craig lives in Newtownards, County Down, with his fiancee Danielle and their three children.

The family's mortgage payment will go up by £200 a month under the new deal and they will have to pay an exit fee on their current mortgage.

But Craig feels the move will give them a "bit of security" in the longer-term.

"If we left it to later it could be a rate 4% higher than we're paying now," he said.

'Don't like credit cards'

Craig said the changes mean they will have to divert savings into household expenditure.

"I work in the public service. My wages haven't gone up. We don't like putting things on credit cards. But Christmas is coming up and we're getting married in May 2024," he said.

"It is very worrying."

Claire Harper, from Coleraine in County Londonderry, faced a similar dilemma.

She has just re-mortgaged her family home and has seen the cost jump by £140 a month.

"We bought in January 2021 so our two-year fixed (rate) was coming to an end at the end of the year," she said.

"We decided to try and get a deal early and I feel lucky now.

"If we'd left it until this week it could have been another £100-£150 a month."

'Get a good broker'

The mother-of-two said she would have to cut back on some luxuries in light of the extra mortgage cost.

"Thankfully, we're both working full-time. We do have childcare to pay and that is a big concern. But we were fortunate that we could re-mortgage in advance of this," she said.

"There's nothing you can do now, but hope for change."

Sally Mitchell, a mortgage adviser and broker known as the Mortgage Mum, told the BBC about 300,000 people in the UK come to the end of their fixed-rate mortgage every three months, but there was a "lot of help out there" for those looking at costs increasing.

"It's really important to remember that everyone has an individual set of circumstances, and what works for you might not work for your neighbour or your co-worker," she said.

"Try to find a good broker and get some advice on what might work for you."

If you are reading this page on the BBC News app, you will need to visit the mobile version of the BBC website to submit your question on this topic.

Related topics

- Published27 September 2022

- Published27 September 2022