Business review 2023: Continued rise in cost of living

- Published

2023 has seen a continued rise in the cost of living

The cost of living continued to put pressure on homes and businesses here throughout 2023, but are households worse off now than this time last year?

BBC News NI reflects on a year of fluctuating costs and high interest rates.

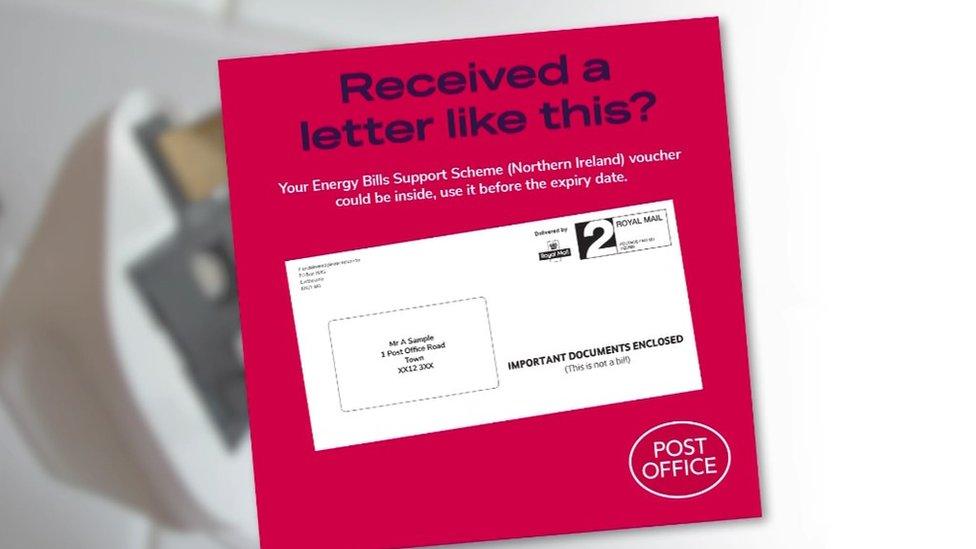

Back in January, households across Northern Ireland were receiving their £600 payments towards their energy bills, either by post or directly into their bank account.

At that time, inflation, which is the rate at which prices are rising, was at 10.1%. While interest rates - the main lever to try and tackle inflation set by the Bank of England - stood at 3.5%.

£600 energy support vouchers were posted to about 500,000 households in Northern Ireland

Throughout the course of the year, interest rates were hiked up to 5.25% and then stayed there - at a 15-year high.

Meanwhile, inflation had fallen to 3.9% by November, the lowest level in more than two years.

Prime Minister Rishi Sunak had pledged to half the rate of inflation by the end of the year.

While this did happen, economists argue that it was largely due to global factors, as opposed to any actions taken by the government.

It's widely believed that interest rates have now peaked, with markets expecting rates could be cut sooner than expected next year.

We've taken a closer look at some household bills, like food and energy, to try and compare this winter to last year.

Food

Food prices on the shelves were among the biggest increases this year, with food price growth peaking at almost 20% back in April.

At that time, Ulster Bank's chief economist Richard Ramsey said: "The rises that we've seen with our food bills over the last 12 months are the same as the increases that we have seen over the last 12 years."

Ulster Bank's chief economist Richard Ramsey

Food wholesaler Harry Crawford told us some produce was reaching prices he had never seen before.

"Exchange rate, transport, weather, availability, input costs of the packaging as well, all those sorts of things. It's never coming back down to where it was."

Food wholesaler Harry Crawford said many factors were involved in the prices of food

Energy

This year saw the first price decreases from some energy companies since 2021.

But lower levels of government support this winter mean many households won't feel the benefit of these price cuts.

Despite gas and electricity prices being lower than last year, most households will actually pay more for energy this winter than in 2022 because government support is no longer in place.

Peter McClenaghan said despite the drop in energy prices, things are still really tough

Peter McClenaghan, from the Consumer Council, said: "Energy prices are still a lot higher than they were before the pandemic."

"People are going to find things tough this winter so while it's good news that prices have starting to come down, we aren't out of the woods yet," he added.

Electricity

Power NI is our largest and only regulated electricity supplier in Northern Ireland.

A typical household bill last year included government support through the Energy Price Guarantee and cost £846.72, whereas this year it has risen to £1,015.04 That's an increase of £168.32 or about 20%.

Oil

The majority of homes in Northern Ireland - about two thirds - use home heating oil.

Figures from the Utility Regulator show NI household gas prices are among the cheapest in Europe

The latest information from the Consumer Council, external shows 500 litres cost £433.81 last December and would now cost £376.90 this December - that's 15% lower or a saving of £65.91.

Gas

This time last year, a typical household bill, including EPG, with SSE Airtricity, which supplies homes in Greater Belfast, was £985.80. It has now risen to £1,399.42. That's a jump of £413.62 or 41%.

For Firmus gas customers in the Ten Towns area, a typical household annual bill, including EPG, was £1,743.32 last year and has now fallen to £1,363.32 this year. That's £380 lower or a reduction of 21%.

Fuel

Petrol and diesel prices hit record levels in 2022.

After Russia's invasion of Ukraine, oil prices surged.

But pump prices have fallen back and are now at their lowest level for more than two years.

Petrol was 152.4p per litre last December and is 139.6p per litre this year - that's almost 13p per litre cheaper.

Diesel was 172.5p per litre last December and is 147.6p per litre now - that's a reduction of almost 25p per litre.

What about pay?

It depends whether you work in the public or private sector.

A typical full-time public sector worker in Northern Ireland saw their real pay fall by more than 7% over the last year.

Real pay is the value of pay adjusted for inflation and is a guide to how living standards are changing.

Most public sector pay decisions are devolved to Stormont

There is ongoing industrial action across public services in Northern Ireland in protest of below inflation pay settlements.

Official figures suggest that private sector workers fared much better over the last year with typical full-time pay increasing by 1.4% in real terms.

HMRC data suggests the sharp rise in cash wages that have been seen in Northern Ireland over the last two years, related to inflation, have now levelled off.

Typical monthly pay in Northern Ireland was £2,064 in November - that's an increase of 2.3% over the year and a month on month fall of 1.8%.

By contrast, typical wages in the UK as a whole showed a 1.2% month-on-month increase in November.

That meant Northern Ireland earnings were 11% below UK earnings, the largest difference on record.

All things considered

While inflation is well down from its peak in 2022, it is still almost double the Bank of England's 2% target.

As 2023 draws to a close, many households will not feel better off compared to last year as food bills, energy bills and borrowing costs remain high.

Related topics

- Published5 April 2023

- Published21 September 2023