Identity theft: Belfast man speaks of stress after scam

- Published

A Belfast man has spoken of his stress after scammers took out mobile phone contracts in his name, running up bills of almost £3,000.

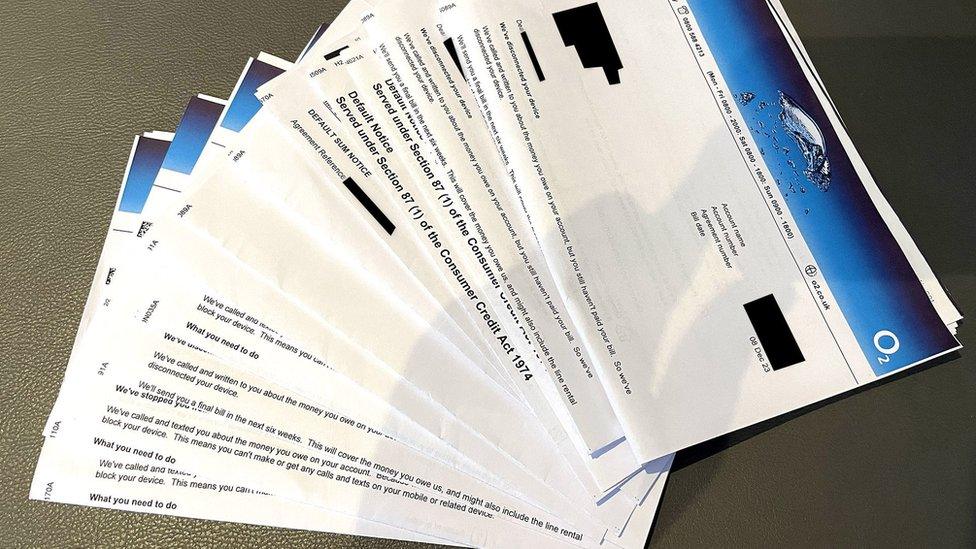

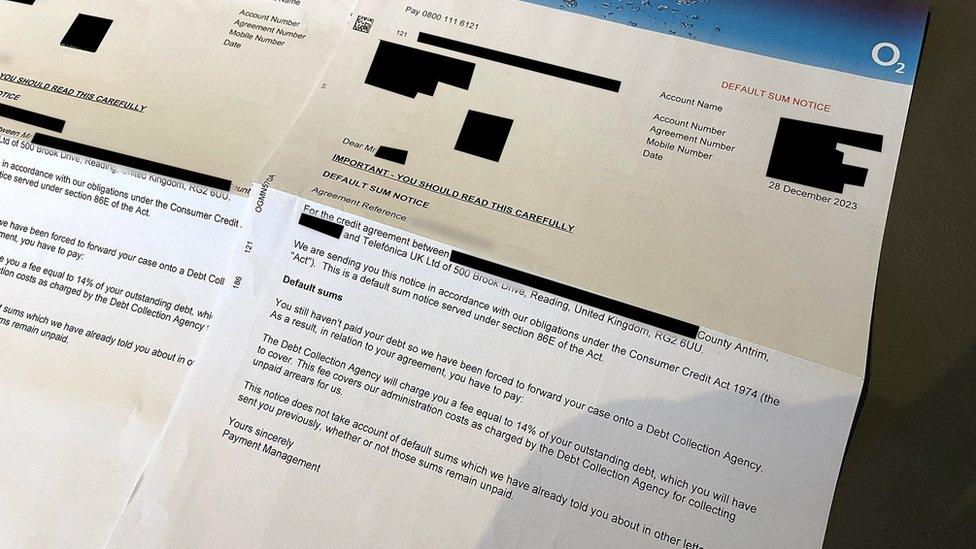

The 38-year-old received enforcement letters from 02 for several months after his identity was stolen.

"It's very stressful - my credit rating is dropping every month," he said, adding that it took "too long for O2 to investigate and resolve".

Since BBC News NI contacted O2, the company has apologised.

It said it has closed down a "fraudulently opened account", updated the man's credit file and recalled the debt.

"We always aim to take swift action whenever fraud is reported to us and we apologise that in this case it took longer than it should have done," a spokesperson said.

According to the latest figures from the Police Service of Northern Ireland (PSNI) there were 5,412 reports of fraud made from December 2022 until 15 January 2024, with reported total losses of approximately £23m.

The man, who wishes to remain anonymous, told BBC News NI he found out in early December that he had been a victim of fraud, after arrears letters arrived at his parents' house, an address he had not used for a decade.

The fraudulent accounts were set-up using his parents' address, his own date of birth and first name but just one part of his surname - which is double barrelled.

"I can't fathom why they thought I was suddenly buying two phones and opening a new account whilst misspelling my name," he said.

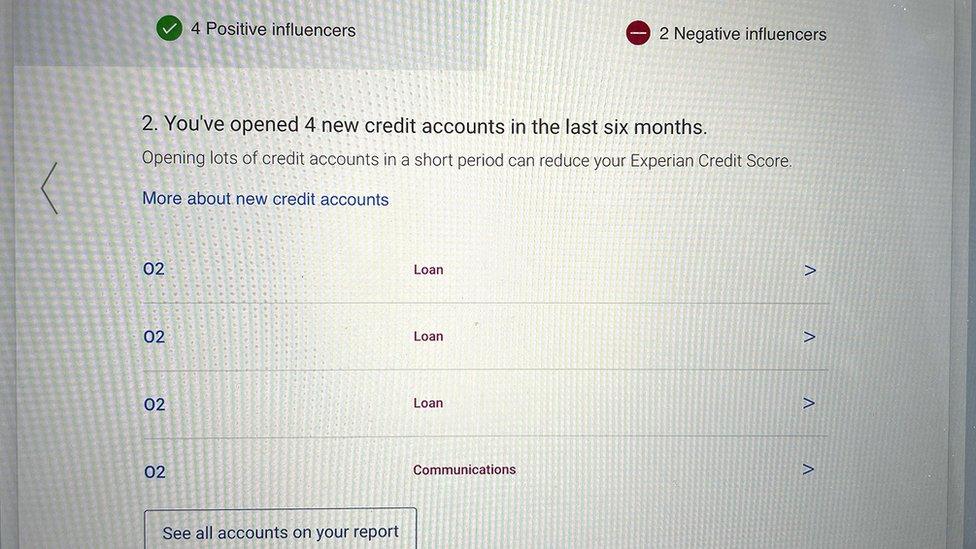

Nonetheless, the information was sufficient for the accounts to be linked back to him and details appeared on his credit report.

What is identity theft?

Fraud prevention group Cifas said identity fraud happens when a someone else uses your personal details to buy a product or take out a loan in your name.

Cifas told BBC News NI that identity fraud in the UK rose by 23% in 2022 compared to 2021.

"You probably won't realise anything has happened until a bill arrives for something you didn't buy, or you experience problems with your credit rating," the organisation said.

The man said he has been receiving numerous weekly letters demanding payment (stock image)

The man said he had an account with 02 for 15 years but was alarmed by the volume of letters he received after repeatedly reporting the fraud to them and the police.

Prior to the BBC contacting O2, he said he had "made countless calls and explained the situation to a new person every time".

"They have been sending multiple letters every week for each device and contract bought as they are all overdue - I am getting letters saying my details have been sent to debt collectors and that they have added 14%," he outlined.

'Emotionally distressing'

However, the situation got worse when the man approached a credit reference company.

Scammers had taken out credit in his name with a buy-now-pay-later company and tried to do the same with retailer Next - but were blocked.

"The buy-now-pay-later company took one day to investigate, agreed it was fraud and removed it from my credit report," he said.

"Next called to check the details, but told me they had rejected the credit application so there was no further action necessary," he said.

Referring to fraud statistics in Northern Ireland, external, Chair of ScamwiseNI Partnership, Police Service of Northern Ireland Ch Supt Gerard Pollock, said that "behind each of these reports, is a person or a business owner who have been cheated by criminals and had their money stolen".

"Not only can there be a significant financial hit, but this type of crime can also be really traumatic and emotionally distressing," he added.

The man told the BBC he had reported it to Action Fraud, since registered with a fraud prevention group and locked his credit report with Experian but the "damage had been done".

He said he had been lucky that he had not been applying for a mortgage or any other financial product over the past few months.

"As a self-employed person it was difficult to get a mortgage - I can't imagine what it would have been like with this on my credit report," he said.

What to do if you've been a victim of identity fraud

Contact the organisation concerned - whether it be a bank, credit card company or something else and let them know what's happened

Report it to Action Fraud - individuals or businesses who have fallen victim to identity fraud should report it to Action Fraud on 0300 123 2040 or on their website.

Get victim support - if you have been a victim of fraud, you can contact Victim Support for free, confidential advice and support

Report fraudsters If you have information about those committing identity crime please tell independent charity Crimestoppers anonymously on 0800 555 111 or at their website.

Query suspicious mail - Be suspicious of any unsolicited emails, even if it appears to be from a company you know of.

For more tips see the Cifas victim of impersonation advice section on their website., external