Nama deal: Peter Robinson agrees to appear before Stormont inquiry

- Published

Peter Robinson has said he will appear before the Stormont inquiry into the Nama deal

First Minister Peter Robinson has said he will give evidence to a parliamentary inquiry into Northern Ireland's biggest ever property deal.

The Republic of Ireland's National Asset Management Agency (Nama) sold its portfolio of Northern Ireland loans to a US investment firm last year.

Stormont's finance committee is probing the circumstances of the £1.241bn sale.

It heard claims last week that Mr Robinson was set to benefit from a "success fee" linked to the deal.

The loyalist blogger Jamie Bryson made the allegation that £7m lodged in an Isle of Man bank account was earmarked for Mr Robinson, the leader of the Democratic Unionist Party (DUP), and four other men.

Happily

Mr Robinson said the claims were "scurrilous and unfounded" and were made "without one iota of evidence".

Sinn Féin MLA Daithí McKay, the committee's chairman, then wrote to Mr Robinson asking him to give evidence to the inquiry.

Daithí McKay had written to Mr Robinson inviting him to give evidence to the inquiry

On Thursday, Mr Robinson responded to the letter, saying: "I will happily make myself available to attend the committee on the earliest of the dates you offered me of Wednesday 14 October."

Máirtín Ó Muilleoir, another Sinn Féin MLA who sits on the finance committee, said Northern Ireland's former Finance Minister Simon Hamilton should also appear before the inquiry.

He said Mr Hamilton, a DUP member, had a responsibility "to fully co-operate" with the investigation and "would have more credibility" if he did.

Prompted

Nama, a state-owned so-called 'bad bank', was set up in the Republic of Ireland to take control of property loans made by the country's banks before the financial crash in 2008.

It sold all of its Northern Ireland property loans to Cerberus in April 2014.

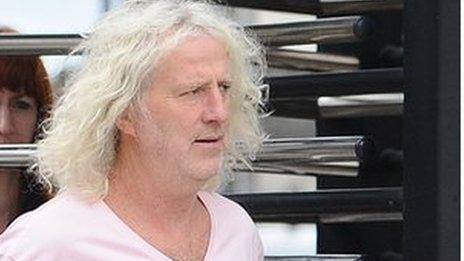

Independent politician Mick Wallace first made claims about fixers' fees connected to the deal in the Irish parliament in July.

His allegations prompted the Northern Ireland Assembly and the Irish parliament to begin investigations into the deal.

The National Crime Agency, the UK's equivalent of the FBI, is carrying out a criminal investigation into the sale.

- Published1 October 2015

- Published1 October 2015

- Published30 September 2015

- Published24 September 2015

- Published24 September 2015

- Published23 September 2015

- Published23 September 2015

- Published14 September 2016

- Published9 July 2015

- Published2 July 2015

- Published4 April 2014