Nama deal: Stormont inquiry may not finish before assembly term ends

- Published

Stormont's finance committee has been investigating Nama's Northern Ireland property loans sale

A parliamentary inquiry into Northern Ireland's biggest ever property deal may not end before the current assembly term finishes, its chairman has said.

The Republic of Ireland's National Asset Management Agency (Nama) sold its Northern Ireland loans portfolio to a US investment firm for £1.2bn in 2014.

The Northern Ireland Assembly's finance committee is investigating the sale.

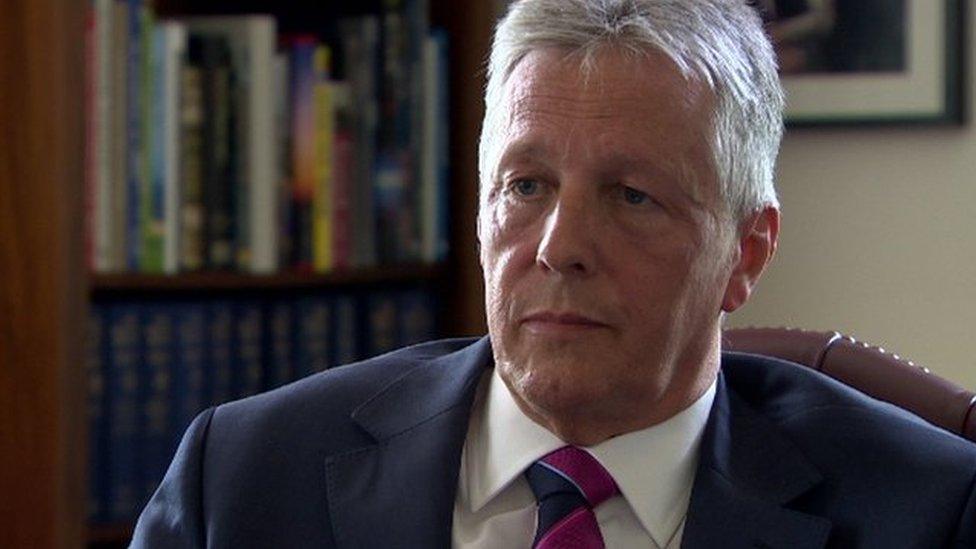

It has been alleged that former first minister Peter Robinson was to benefit from a "success fee" after to the deal.

Mr Robinson, a former leader of the Democratic Unionist Party (DUP), has denied that claim.

Gaps

During the committee's meeting on Wednesday, its chair, Sinn Féin MLA Daithí McKay, said more time may be needed for the inquiry to be completed.

The assembly is due to break up in March to allow for the start of an election campaign, with voters going to the polls in May.

Mr McKay said the committee would have to decide whether it presents the evidence it has already gathered or gives a series of recommendations.

Daithí McKay said the inquiry may not be completed before the end of March

He also suggested that members may conclude the committee "can't reach conclusive recommendations... given there are gaps" in the evidence received.

Mr McKay said he would want to see the new assembly and committee take up the matter due to the "lack of co-operation from certain witnesses".

Questions

But the DUP's Gordon Lyons questioned "starting again in the new mandate", and said he would prefer the inquiry was brought to "some sort of conclusion".

Committee members also said they would seek advice as to whether a former adviser to Nama in Northern Ireland could be compelled to give evidence.

Mr McKay said it was "unfortunate" that Frank Cushnahan "has chosen not to communicate with the committee".

"He could have answered the many, many questions we have put to him in writing," Mr McKay said.

In September, Mr Cushnahan wrote to the committee to reject critical comments made about him at an inquiry hearing.

Allegations

The Irish state-owned Nama was set up to take control of property loans made by the country's banks before the financial crash in 2008.

It sold all of its Northern Ireland property loans to Cerberus in April 2014.

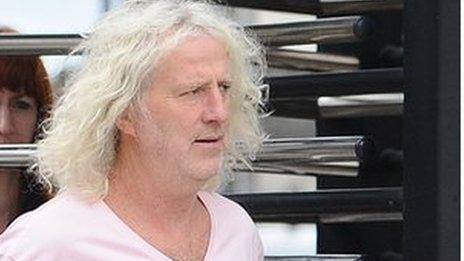

Independent politician Mick Wallace first made claims about success fees connected to the sale in the Irish parliament in July.

His allegations prompted the Northern Ireland Assembly and the Irish parliament to begin investigations into the deal.

The National Crime Agency, the UK's equivalent of the FBI, is carrying out a criminal investigation into the sale.

- Published23 September 2015

- Published2 July 2015

- Published4 April 2014