Coronavirus: Is the furlough scheme ending too soon?

- Published

Bloc Blinds adapted to manufacturing PPE early in the pandemic

Not many Northern Ireland businesses can say they have thrived during the pandemic.

Obvious exceptions are manufacturers, like Bloc Blinds, which quickly reorientated its factories to produce vital personal protection equipment (PPE).

The IT firm Kainos has also been able to keep growing.

In an unscheduled market update this week, it said trading had been strong.

Annual profits were on course to be "substantially" ahead of previous forecasts, said the firm.

The stock market liked this story and the company's valuation surged to well above £1bn.

Dividend-furlough debate

Kainos said things had gone so well that it was withdrawing from the government's furlough scheme and handing back all the money it had received.

This amounted to about £400,000 for 131 employees who had been furloughed for two months at the start of lockdown.

The company was under no legal obligation to return this money.

However, the directors appear to have concluded that it was the morally and reputationally right thing to do, particularly as they are also paying a shareholder dividend.

This may set the bar for other companies: If there is sufficient cash to pay a dividend then should you also repay the furlough money?

The hospitality industry has furloughed large numbers of workers during the Covid-19 crisis

Not many firms in Northern Ireland are likely to find themselves in that position.

Analysis published this week by the Department for the Economy suggests that at the end of June, more than 240,000 employees were furloughed.

That represents about 30% of total employee jobs, though in some sectors it was much higher - 61% in arts and entertainment, 70% in construction and 78% in hospitality.

Surge in unemployment

These numbers will have come down as the economy has reopened, but they show how important the furlough has been for staving off mass redundancies in some parts of the economy.

Which of course raises the question: What will happen as the furlough tapers off, and then ends in October?

"A surge in unemployment," was the answer from a respected think tank this week.

In its forecast for the UK as a whole, the National Institute of Economic and Social Research (NIESR) suggested the unemployment rate would touch 10% this year, higher than if the furlough was extended.

NIESR described the October cut-off point as "a mistake".

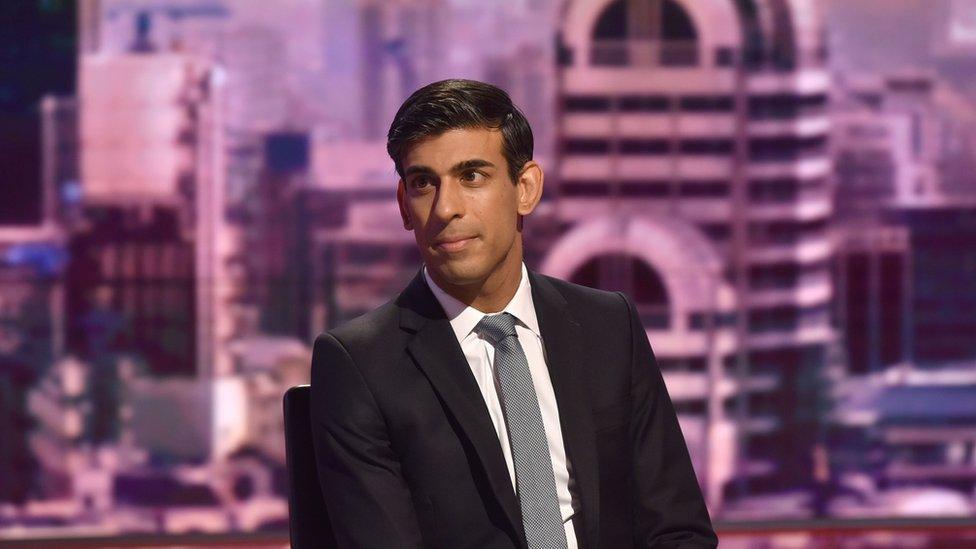

Chancellor Rishi Sunak introduced the furlough scheme

"The scheme was intended by the chancellor to be a bridge through the crisis and there is a risk that it is coming to an end prematurely," said Garry Young, NIESR deputy director.

"It has been an undeniable success in terms of keeping furloughed employees attached to their jobs."

The Treasury is adamant the timing is right.

"It is in no-one's long-term interests for the scheme to continue forever and right that state support is slowly reduced as we focus on getting furloughed employees back to work," it said.

The coming wave of unemployment will not be evenly distributed.

Workers at firms like Kainos should be alright.

Analysis from the Department for the Economy, which has looked at online job vacancies, found that while all sectors have experienced a sharp decline in job postings since March, "IT and finance are still recruiting in relatively good numbers".

- Published22 March 2016

- Published27 July 2020