UK economy: What now, Darling?

- Published

- comments

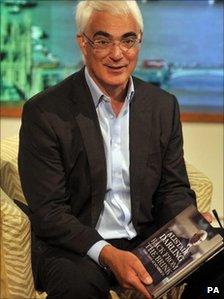

Mr Darling claims that Gordon Brown 'ignored' the problem of the deficit

There could be queues outside bookshops when Alistair Darling's memoirs go on sale later this week.

Queues, that is, of workers from Tory HQ who will want to buy a copy for every voter, wrapped in a new cover with the title We Told You So.

After all, the former chancellor says that Labour didn't have a credible economic strategy at the last election, should have focused on cutting spending to bring down the deficit and should have put up VAT rather than national insurance which Darling, like his successor George Osborne, regards as a tax on jobs.

Not so fast, though. The Tories may be winning the political argument about the past but they are in danger of losing it about the future.

Today a man who George Osborne is fond of quoting calls on him to consider "fine-tuning" and "re-routing" his deficit reduction plan in "a mid-course correction" and "mild re-adjustment".

The man in question is Bill Gross, the managing director of the Pacific Investment Management Company (PIMCO) who tells the Times, external:

"The economy in the UK is worse off than it was when the plan was developed, so there should be at a minimum fine-tuning and perhaps re-routing of the plan… the problem becomes if it is too quick and swift and leads to an economic contraction, which it appears close to doing in the UK.

"Bond investors obviously want not just low inflation but some type of positive growth. An economy that doesn't grow, like Japan, ultimately can't resolve its debt crisis, either…

"The UK is actually in the best position of all to make a mid-course correction… a mild re-adjustment that might keep the economy out of recession would be viewed very favourably".

Mr Gross, you may recall, was briefly the pin-up boy of Tory HQ when he declared before the last election that British bonds were resting on a "bed of nitroglycerine" and that investors should avoid them.

In June the chancellor quoted PIMCO's praise of his policy, external:

"We think the UK is implementing what is probably the best combination of fiscal and monetary policies' in the western world."

What we don't know is what policies Mr Gross would consider to meet his requirement of "fine-tuning" and "re-routing".

The chancellor's aides will, no doubt, point out that there has always been more flexibility in George Osborne's deficit reduction plan than his rhetoric suggests.

He was due to meet his borrowing targets a year early and could now simply accept that that will be impossible.

History lessons

They may be hoping that the Bank of England will agree to print more money - so-called quantitative easing - when it meets later this week.

Yesterday in the Mail on Sunday the prime minister argued, external that since interest rates could not be cut any lower and spending could not be increased ministers needed to focus on other pro growth policies such as the battle with the National Trust and other green groups to build more houses.

What, though, if none of that is enough?

The importance of history is to learn from it.

What Alistair Darling's memoirs highlight is how the last government fell apart when their tax and spending policies went off course.

The prime minister wanted more investment to support growth while the chancellor wanted spending cuts to tackle borrowing. The cabinet never discussed this choice because, in Mr Darling's memorable phrase, New Labour was "almost a dictatorship".

There is no such division at the top of this government.

It is far too early to say that its economic policies are off course.

However, this looks likely to be the year when we see how David Cameron and George Osborne cope when the economy behaves in a way that they didn't plan for.