Pasty tax: Bakers take protest to Downing Street

- Published

Protesters said charging VAT on pies and pasties could lead to taxing all fresh food

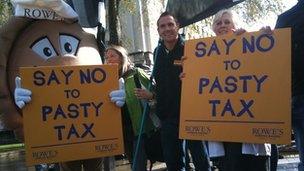

Hundreds of bakers have protested at Downing Street against plans to tax hot takeaway foods such as pasties.

Almost half a million people have signed petitions against the proposals, campaigners said.

The Treasury said VAT was already charged on most hot food and extending it to pies and pasties closes a "loophole".

But bakers say taxing fresh, hot food will be unmanageable, difficult to implement and is unfair on customers.

Proposals in the March Budget mean a tax of 20% will be charged on all hot food - with the exception of freshly baked bread. The plans have met with resistance from high street bakers Greggs as well as MPs on all sides.

Around 300 workers from bakeries across the country gathered opposite Downing Street to protest against the plans.

Martin Kibbler, a baker from Newcastle, said the tax would hit his customers' pockets.

"It'll be difficult for customers to understand and extremely difficult to implement. It's going to cost customers money and certainly cost businesses money," he said.

Greggs chief executive, Ken McMeikan, told the crowd the government was "out of touch with the poorest people in this country who need aspirations and hopes - not higher taxes".

Chris Beeney, who runs two small bakeries near Rochester, Kent said VAT was previously only charged for the service of providing food - not the food itself.

"I think George Osborne has been advised wrongly over this because he's changed the rules by putting VAT on a fresh food product. If we let this go through it could mean that you could put VAT on any fresh food product - lettuce, tomatoes, anything."

The chancellor has said it was the Treasury's intention in 1984 to charge VAT on all hot takeaway food but that legal wrangles had always prevented the tax being extended to foods like pies and pasties.

"I am seeking to just stick with the position that hot, takeaway food has VAT on it. If you buy your pasty in a fish and chip shop, it almost certainly has VAT on it. If the pasty is heated up in a microwave it has VAT on it," he told the Treasury Select Committee in March.

A cross-party attempt to reverse the tax was recently defeated by the government.

Mike Holling, chair of the National Association of Master Bakers, said the tax would be unworkable because it depends on the "relative hotness of the product in comparison to the ambient temperature in the baker's shop".

"We have until 4 May to make the government see how this price increase will effect ordinary people and how unmanageable the implementation of the tax will be", he added.

Cornish MP Stephen Gilbert, who joined the demonstration, said the tax could cost 400 local jobs and take £7.5 million out of the economy.

Urging the government to review the plans, the Liberal Democrat MP said: "It is simply wrong for the government to impose a tax on the humble Cornish pasty while luxurious caviar remains tax-free.

"My fight in Parliament will not stop until these plans are dropped and I urge everyone to continue to sign the <link> <caption>petition</caption> <url href="http://epetitions.direct.gov.uk/petitions/32044" platform="highweb"/> </link> ."

One baker, from Treforest in Wales, said customers were "absolutely livid".

"It's totally unfair. We've got a double-dip recession. Our customers don't need this. The business doesn't need it - it's grossly unfair and we'll fight until the bitter end until the government change their minds," Adam Yates said.

- Published26 April 2012

- Published19 April 2012

- Published29 March 2012