The tax return evidence that 'shocked' George Osborne

- Published

- comments

The Treasury has released a copy of the illustrative examples which left George Osborne "shocked" about wealthy tax avoidance and led him to introduce his since-abandoned plans to cap tax relief on charitable donations.

In April the chancellor told the Daily Telegraph, external that he was "shocked to see that some of the very wealthiest people in the country have organised their tax affairs... so that they were regularly paying virtually no income tax."

He explained that he was talking about people with multi-million pound annual incomes and added: "I'm not allowed to be shown the names of the individuals but I've sat with the most senior people at the Inland Revenue, the people who run some of the high net worth units there. They have given me examples, anonymised examples, and so we are taking action."

Mr Osborne was justifying his controversial plan in the Budget in March to limit all tax reliefs, including for charitable donations, to an annual maximum of £50,000 or 25% of an individual's income, whichever was greater.

Following a freedom of information request from the BBC for a copy of the "anonymised examples" shown to the chancellor, the Treasury has now disclosed one sheet, external setting out three "illustrative" cases provided to him.

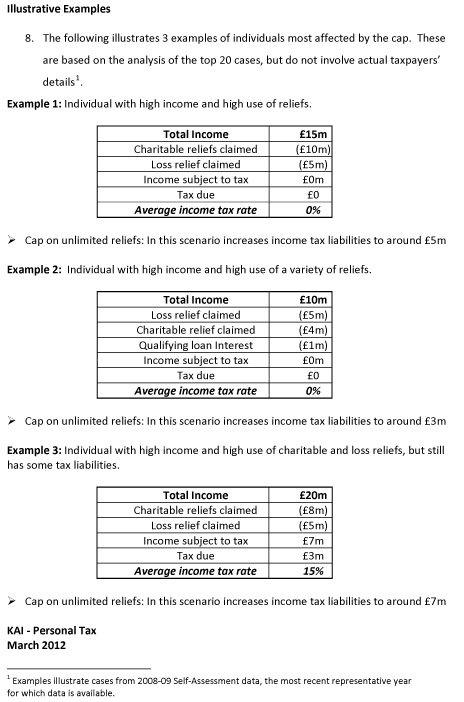

This shows:

an individual with an annual income of £15m paying nothing at all in income tax, largely due to charitable donations of £10m

an individual with an income of £10m also paying no income tax, due to a mix of reliefs including £4m given to charity

an individual with an income of £20m paying an average income tax rate of only 15%, largely due to charitable donations of £8m

It is not completely clear on what basis these cases were derived. The Treasury describes them as "stylised examples based on an analysis of the tax records of those individuals most affected by the change" and "not actual taxpayers' details". HM Revenue and Customs is legally prohibited from revealing the tax details of an identifiable individual.

Of course Mr Osborne may have been given further evidence in meetings of the tax avoidance problem he was seeking to tackle, but this is the only written documentation that the Treasury was able to provide.

The proposed limit provoked outrage from many charities, and two weeks ago the chancellor announced he was dropping plans to cap tax relief for gifts to charity, although he plans to press ahead with the restriction on other tax reliefs next year.

However, what is clear from this disclosure is that it is indeed charitable donations rather than other allowable reliefs which was the focus of the Treasury's concern to extract more tax from some of the country's richest individuals.

- Published7 June 2012

- Published11 May 2012

- Published16 April 2012

- Published15 April 2012