Bank shareholders must get stronger grip, Cable says

- Published

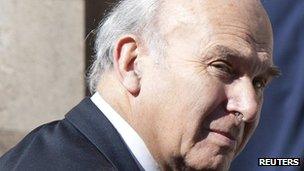

Vince Cable said "greed" had been endemic in British banking

Shareholders "must get a stronger grip" to prevent corruption in banks, Business Secretary Vince Cable says.

<link> <caption>Writing in the Observer</caption> <url href="http://www.guardian.co.uk/commentisfree/2012/jun/30/vince-cable-banking-scandal-coalition" platform="highweb"/> </link> after Barclays was fined for trying to rig the Libor inter-bank lending rate, he condemns the "incompetence, corruption and greed... endemic in British banking".

He plans to consider criminal sanctions for directors of failed banks.

Ministers have announced an independent review of the Libor workings but Labour want a full public inquiry on banking.

Barclays boss Bob Diamond has been summoned to appear before the Treasury Select Committee on Wednesday and chairman, Marcus Agius, will also be questioned about the Libor scandal.

'A joke'

The bank was fined £290m ($450m) but Mr Cable said: "The public cannot understand how a corporate fine - which will be passed on to customers and shareholders - begins to address the problem.

He suggests four steps for sorting out the banking "mess":

Making banks safe so there is no further risk of collapse and rewarding "sensible banking" rather than "hoarding" and "speculative trading"

Carrying out the <link> <caption>Vickers reforms</caption> <url href="http://bankingcommission.s3.amazonaws.com/wp-content/uploads/2010/07/ICB-Final-Report.pdf" platform="highweb"/> </link> , which are designed to segregate retail and business banking

Shareholders taking more responsibility

Changing the culture of the sector and encouraging the introduction of new business models

On the role of shareholders, he added: "No-one at the top of Barclays will take responsibility for systemic abuse.

"Shareholders, the owners, have a major responsibility here. I am bringing in legislation to strengthen their control over pay and bonuses, through binding votes, but shareholders have to get a stronger grip on weak boards and out-of-control executives."

Shadow business secretary Chuka Umunna questioned the independence of the the body that represents the banks.

"We've got the absurd situation where the current chair of the British Bankers' Association (BBA), Marcus Agius, is also chair of Barclays," he told the BBC.

"He was chair of Barclays at the time that Barclays was providing erroneous information and lying to the BBA. And yet he is still in place as chair of the BBA. Now to most people this begins to make the BBA like a joke."

Meanwhile, more than three-quarters of people (78%), who responded to a survey by consumer group Which?, think individuals should be personally prosecuted when banks break the law.

'Sticking plaster solutions'

It also showed two-thirds (66%) were not confident the government would act in their best interests when introducing banking reforms.

Which? has urged ministers to ensure prosecutions can be brought - up to boardroom level - against people found to have been involved in corrupt practices.

Libor - the London Inter Bank Offered Rate rate at which banks in London lend money to each other for the short-term in a particular currency.

A new Libor rate is calculated every morning by financial data firm Thomson Reuters based on interest rates provided by members of the BBA.

On Friday, the Financial Services Authority revealed separately that Barclays, HSBC, Royal Bank of Scotland and Lloyds Banking Group had agreed to pay compensation to customers who were mis-sold interest-rate hedging products.

FSA chairman, Adair Turner: "The public are justifiably angry"

Mr Cable said that: "Incompetence, corruption and greed have been endemic in British banking."

He cited the example of last month's RBS/NatWest computer failure which left many customers unable to access their accounts for several days as an example of incompetence, the Libor scandal as an example of "corrupt practices", and the mis-selling of "complex financial derivatives" as an example of greed.

The TUC and some Tory backbenchers and the Labour party have called for a probe into banking similar to the Leveson Inquiry, which is looking into the practices and ethics of the press, but the Treasury and the Bank of England have rejected the idea.

Mr Cable also dismissed a "costly Leveson-style inquiry" and said the independent review would enable the coalition government to make changes to bills affecting banks currently going through parliament.

He added the government would launch a consultation on criminal sanctions for the directors of failed banks later this week.

But during a speech to left-leaning think tank the Fabian Society, Labour leader Ed Miliband said the government needed to do more.

"The British people will not tolerate anything less than a full, open and independent inquiry, they will not tolerate the establishment closing ranks and saying we don't need an inquiry.

"They want a light shone into every part of the banking industry - including its dark corners. They want a banking system that works for them."

The independent review, which will examine the future operation of Libor will be established next week and report by the end of summer.

- Published30 June 2012

- Published30 June 2012

- Published29 June 2012

- Published29 June 2012

- Published29 June 2012