Autumn Statement: At-a-glance summary of key points

- Published

Chancellor George Osborne has updated MPs on the state of the economy and the government's future plans in his Autumn Statement. Here are the key points:

FUEL

The 3p-a-litre increase in fuel duty, planned for next January, is cancelled

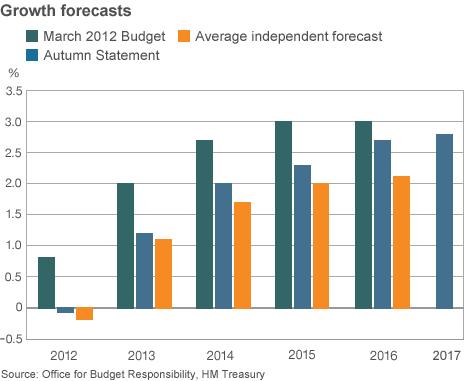

ECONOMIC GROWTH

Predicted to be -0.1% in 2012, down from 0.8% predicted in the Budget

Forecasts for next few years are: 1.2% in 2013, 2% in 2014, 2.3% 2015, 2.7% in 2016 and 2.8% in 2017

BENEFITS AND PENSIONS

Most working-age benefits to rise by 1% for each of next three years

From 2014-15 lifetime pension relief allowance to fall from £1.5m to £1.25m - annual allowance cut from £50,000 to £40,000

Basic state pension to rise by 2.5% next year to £110.15 a week

Child benefit to rise by 1% for two years from April 2014

Local housing allowance rates to rise in line with existing policy next April but increases in the following two years capped at 1%

Changes to welfare to save £3.7bn by 2015/16

TAXES AND ALLOWANCES

Basic income tax threshold to be raised by £235 more than previously announced next year, to £9,440

Threshold for 40% rate of income tax to rise by 1% in 2014 and 2015, from £41,450 to £41,865 and then £42,285

Main rate of corporation tax to be cut by extra 1% to 21% from April 2014

Temporary doubling of small business rate relief scheme to be extended by further year to April 2014

Inheritance tax threshold to be increased by 1% next year

Bank levy rate to be increased to 0.130% next year.

£5bn over six years expected from treaty with Switzerland to deal with undisclosed bank accounts

HM Revenue and Customs budget will not be cut

ISA contribution limit to be raised to £11,520 from next April

Prosecutions for tax evasions up 80% - with anti-abuse rule to come in next year

No new tax on property value

No net rise in taxes in Autumn Statement

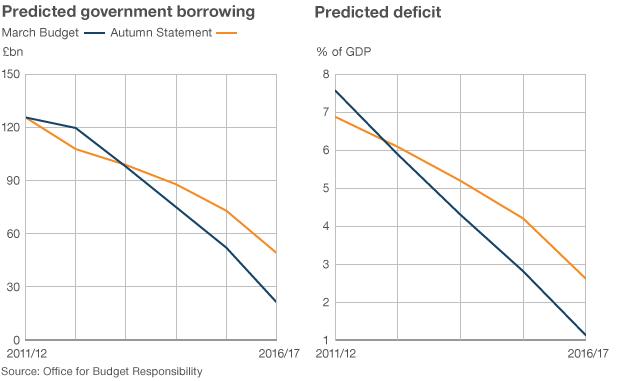

GOVERNMENT BORROWING

Point at which debt predicted to begin falling delayed by a year to 2016/17

Deficit fallen by a quarter in last two years

Deficit forecast to fall this year, as is cash borrowing

Deficit to fall from 7.9% to 6.9% of GDP this year, and to continue falling to 1.6% by 2017/18

Borrowing forecast to fall from £108bn this year to £31bn in 2017/18

£33bn saving to be made on interest debt payment predicted two years ago

Bradford and Bingley and Northern Rock Asset Management brought on to balance sheet, adding £70bn to national debt

GOVERNMENT SPENDING

Period of austerity to be extended by another year to 2017/18

Departments to reduce spending by 1% next year and 2% year after

Local government budgets to be cut by 2% in 2014

Government spending as share of GDP predicted to fall from 48% in 2009/10 to 39.5% in 2017/18

Spending review to take place in first half of next year

JOBS AND TRAINING

Unemployment expected to peak at 8.3%, lower than the previous prediction of 8.7%

Employment set to rise in each year of the parliament

Since general election, 1.2 million jobs created in the private sector

TRANSPORT

Extra £1bn to roads, including upgrading A1, A30, and M25

£1bn loan to extend London's Northern Line to Battersea

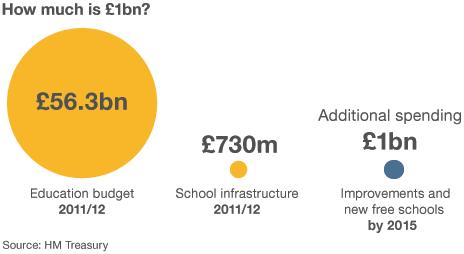

EDUCATION AND FAMILIES

£1bn to improve good schools and build 100 new free schools and academies

£270m for further education colleges

Teachers' pay to be linked to performance

INFRASTRUCTURE

Ultra-fast broadband expansion in 12 cities: Brighton and Hove, Cambridge, Coventry, Derby, Oxford, Portsmouth, Salford, York, Newport, Aberdeen, Perth and Derry-Londonderry

£600m for scientific research

Annual infrastructure investment now £33bn

£1bn extra capital for Business Bank

Gas Strategy to include consultation on incentives for shale gas

HOUSING

Funding to assist building of up to 120,000 homes

OVERSEAS AID

Promise to spend 0.7% on development to be honoured next year, but not exceeded