Coalition and Labour clash over 'strivers' tax' claim

- Published

George Osborne said he was trying to help people "who want to work hard and get on"

Labour has called government plans to squeeze benefits a "strivers' tax" which make a mockery of claims the Autumn Statement changes are fair.

It says most of the benefits savings will come from working people.

But the coalition hit back, saying "strivers" would be better off when all the changes - such as raising tax thresholds - were taken into account.

Lib Dem minister Steve Webb said Labour liked to "sound angry" but had no polices for fixing the public finances.

The prime minister admitted the government had to make "difficult decisions", but insisted the statement was about "being on the side of people who work hard and want to get on".

All working age benefits, including tax credits and child benefit, will go up by 1% a year, less than the rate of inflation, for the next three years.

In his statement, Mr Osborne confirmed it would take longer to clear the country's debts than he previously thought - and this means spending cuts will go on for longer than planned.

Pensioners have been protected with pensions going up by 2.5%.

'Feckless'

The chancellor said a further squeeze on the welfare budget was needed to help pay off the deficit - but he said other moves, such as a £1bn raid on the pension pots of the wealthy, meant the "richest 20% have paid most".

He said measures such as raising the level at which people start paying income tax and scrapping a planned 3p rise rise in fuel duty would also help the low paid and proved "we're all in this together".

The government was also reclaiming tax on billions of pounds "hidden" in Swiss bank accounts by UK citizens, the chancellor said.

He sought to justify the squeeze on benefit payments by suggesting working people would support it.

"I think people getting ready to go out to work, they are frustrated that they pay their taxes, that they work long hours and a lot of that money, frankly too much of that money, goes into a welfare system that supports out-of-worklessness," Mr Osborne told BBC News.

But Shadow Chancellor Ed Balls said the majority of people affected by the move were not unemployed - and a working family with children on £20,000 a year would lose £279 a year from April.

"He (Mr Osborne) somehow wants to attack people he thinks are workshy and feckless but if you look at the facts 60% of the people who are affected by that 1% freeze are in work,"

He said a below-inflation 1% increase in maternity pay and an upcoming cut in the top rate of income tax made a mockery of Mr Osborne's claim to be cutting fairly, saying: "Where's the fairness in that?"

Shadow Work and Pensions Secretary Liam Byrne attacked the benefit squeeze as a "strivers' tax" saying it made a mockery of David Cameron's claim that he was on the side of Britain's hard working families.

Just 23% of the £6.7bn saved by the benefits squeeze will come from Jobseekers Allowance and other out-of-work benefits, with the rest to come from tax credits, maternity pay, sick pay and other benefits claimed by working people, Mr Byrne told MPs.

"These are the strivers and battlers the prime minister promised to defend at his party conference and they are the people paying the price for this government's failure."

But Steve Webb, the Lib Dem pensions minister, said the nation's "strivers" would be better off when all of the tax and benefit changes announced on Wednesday were taken into account, saying a "record" £1,300 increase in personal tax allowances will boost the earnings of poor households by £5 a week.

He accused Labour of having no alternative policy for making up the shortfall in the public finances and of "sounding angry" about the benefits squeeze but not doing anything about it.

MPs will vote on the policy next year, but Labour has yet to decide whether it will oppose the bill.

'Child poverty'

"We will look at the details over the next week, because we have not even seen the legislation yet," Mr Balls told BBC Radio 4's Today programme.

"The test for me will be, is this hitting working families on low incomes, does it lead to rising child poverty, is it fair for him to take billions of pounds from low and middle-income families when he is spending £3bn next April on a tax cut for (earnings) over £150,000?"

According to the Treasury's own figures, external, households in the highest income bracket will be most affected by the tax and benefit changes announced by the chancellor, although all groups, from the richest to the poorest, will take a hit.

Mr Osborne and Mr Balls also clashed over who was to blame for the state of the UK's economy and the fact that after two and half years of spending cuts the country was still five years away from balancing its books and had slipped back into negative economic growth.

The chancellor said Mr Balls, who was Gordon Brown's chief adviser and a Treasury minister during Labour's time in power, was responsible as his government had borrowed too much during the boom years.

But Mr Balls said the chancellor's "failing" economic policies were to blame and he urged the government to change course.

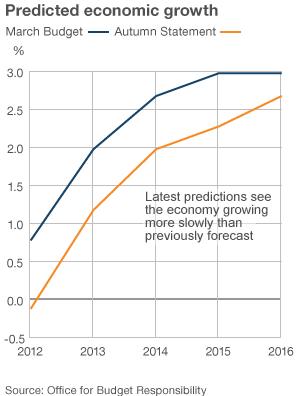

The Office for Budgetary Responsibility (OBR) said the UK's economy would shrink by 0.1% this year - after saying in March that it would grow by 0.8%.

Credit rating

The OBR, a body set up by Mr Osborne to provide independent analysis of the nation's finances, said in a report, external that the economic recovery was taking longer than expected because of a slump in consumer spending, business investment and trade with eurozone countries.

Weaker growth tends to make the public finances worse as the government receives less income from tax and has to spend more on unemployment benefit.

Mr Osborne announced measures aimed at boosting growth in his Autumn Statement, including a £5bn road and school building programme, paid for by fresh cuts to the budget of most government departments.

But on Wednesday credit rating agency Fitch said the UK's AAA status was under threat after the chancellor had said the coalition would miss its debt-reduction target.

A cut to the credit rating would mean the country was perceived as more risky to lend to, thereby raising the cost of borrowing from international investors.

Other leading economies have lost their AAA rating in recent years including, according to the Standard and Poor's agency, the United States.

Asked about the possibility of credit downgrade, Mr Osborne told BBC News: "It wouldn't be a good thing but the credit rating is one of a number of ways in which people look at countries."

Britain was facing a "tough economic situation... but it could be much worse," he added.

-

Autumn Statement in six minutes

06:29

Autumn Statement in six minutes

06:29

-

Osborne: Britain is on the right track

02:15

Osborne: Britain is on the right track

02:15

-

Ed Balls: 'Worst-off paying the price'

01:06

Ed Balls: 'Worst-off paying the price'

01:06

-

BBC editors' analysis

08:08

BBC editors' analysis

08:08

-

Fuel tax rise 'cancelled'

01:00

Fuel tax rise 'cancelled'

01:00

-

'Employment set to go on rising'

00:56

'Employment set to go on rising'

00:56

-

Chancellor on pension pots

02:02

Chancellor on pension pots

02:02

-

Below-inflation benefits increase

02:29

Below-inflation benefits increase

02:29

-

Corporation tax cut 'advert for UK'

01:55

Corporation tax cut 'advert for UK'

01:55

-

'More action' to tackle tax avoidance

02:02

'More action' to tackle tax avoidance

02:02

-

Road, rail and broadband plans

03:29

Road, rail and broadband plans

03:29