Q&A: Green taxes

- Published

The past few months have been dominated by a debate over energy prices, with all the political parties coming up with ideas to try to bring them down.

The prime minister has announced a review into how the government's climate change policies - so-called green levies or taxes - affect bills and whether they are delivering value for money.

But what exactly are these green taxes and how do they affect our bills?

How much does an average energy bill cost?

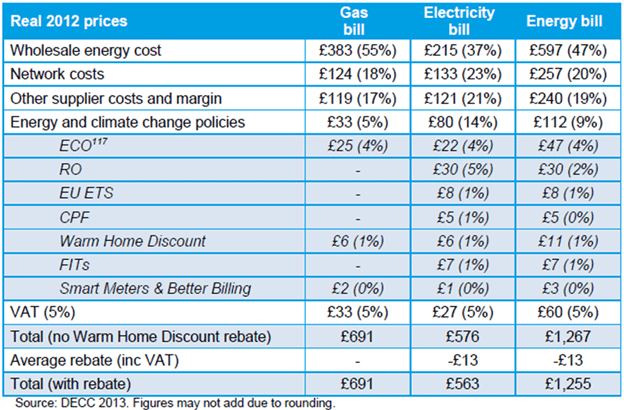

UK household dual fuel - electricity and gas - energy bills in 2013 are estimated to be about £1,267, based on average levels of energy consumption.

What is that made up of?

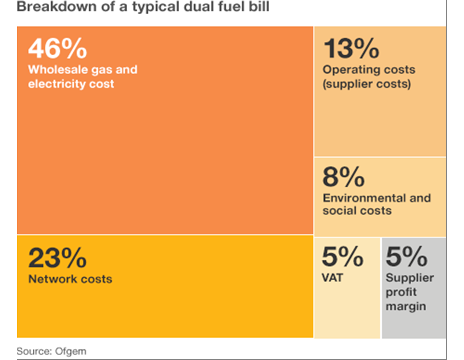

The chart below shows what the Department of Energy and Climate Change says makes up (in % terms) the average household energy bill. So green energy measures make up 9% of that cost, or £112.

What has driven the increase in costs?

The average price of gas and electricity paid by UK households has risen by about 18% and 9% in real terms since 2010 and by about 41% and 20% in real terms since 2007.

Wholesale energy costs are estimated to have contributed at least 60% of the increase in household energy bills over this period.

Network costs, supplier operating costs and margins are estimated to have contributed about 25% of the increase.

The costs of energy and climate change policies are estimated to have contributed about 15% of the increase.

What exactly are these green taxes?

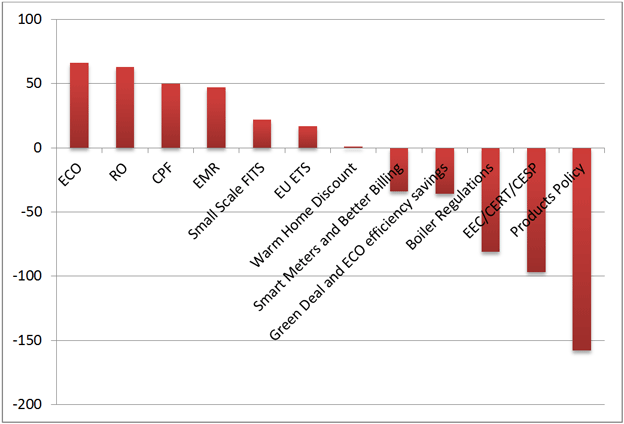

The chart below shows all of the climate change policies that in some way increase energy bills.

Breakdown of an average household gas, electricity and energy bill in 2013

Renewals Obligation (RO) Support Cost: The RO was introduced in 2002 to provide incentives for the deployment of large-scale renewable electricity in the UK. The RO requires licensed UK electricity suppliers to source a specified proportion of the electricity they provide to customers from eligible renewable sources. This proportion (known as the "obligation") is set each year and has increased annually.

EU European Trading Scheme (ETS) and Carbon Price Floor (CPF): The EU European Trading Scheme is a mandatory cap-and-trade scheme which is central to the EU's climate change target of reducing carbon emissions by 20% by 2020. It sets a cap for emissions for energy intensive industries and gives them allowances which can be trade on the open market. CPF is a tax on fossil fuels used to generate electricity. It sets a minimum price for carbon to supplement the European Union Emissions Trading Scheme which requires industry to trade its carbon emissions. In response to criticism that the price for carbon was too low the Coalition announced a price floor in April 2013. Although this is effectively a tax on industry DECC's figures say it has an impact on household bills.

Warm Home Discount: This is an energy rebate which is paid directly to vulnerable and low income households.

Smart Meters and Better Billing: Better meters designed to end estimated billing.

Green Deal and ECO: The Green Deal provides loans and grants for people to make energy improvements to their homes. The Energy Companies Obligation provides insulation and green measures to people in fuel poverty and on low incomes.

Boiler Regulations and Products Policy: Introduced in 2002, they tightened up the impact on boilers and cavity insulation.

So people talk about green levies, but there are in fact lots of different things introduced over the past decade and a half. Some cost people money, some save people money and some do both for different groups of people. It wouldn't therefore be easy to repeal all of them at all (many, like the Green Deal are halfway through their operation and would presumably cost more to get rid of it in the short term than it would to keep longer term).

So how much do they save?

Well, the government says that by 2020 the cumulative impact of their measures will save the average household some 11%. The graph below shows all of the policies and how much they will add or take away from a household bill.

So with all those things taken together the Department for Energy and Climate Change say that this is what their effect will be on household bills:

So far so good, the policies are saving households' money. But if we look at the effect the policy has on retail prices (rather than bills) - how much each household pays for every unit of energy it consumes - we have a very different picture.

Impact of levies on Retail Prices (% change from baseline)

On that picture households will be paying 41% more for their electricity bills as a result of green policies than the retail price is expected to be.

How is that circle squared? Well, it comes down to government's projections that:

we will use less energy over time as a result of higher prices (which has been true over the last few years

the money that they and we are paying for in insulation and other green measures will mean we lose less energy than we otherwise would

So although the retail price will be higher as a result of green measures we'll also use less energy thanks to them.

Moreover even if we take the initial figure of 11%, nearly half of that actually comes from changes to boiler regulations all the way back in 2002. If those are removed, then the other measures in place save much less - only about 6%.

So if the government has got it sums wrong on how much energy insulation will save, householders could find themselves with a rather big headache in the years to come.

And what about business?

The impact of green measures is more considerable on business than for householders. Businesses that are medium-sized users of energy currently face energy (gas plus electricity) costs that are on average between 15% and 21% higher as a result of policies. By 2020 the impact is estimated to be between 23% and 26%.

Policies are estimated to be adding between 1% and 14% to energy bills for high-energy users in 2013 and between 6% and 37% in 2020. The range depends on their electricity/gas mix. The government has put several measures in place to compensate the most intensive users so as to try to prevent them from becoming uncompetitive in world markets.