Budget 2014: Chancellor freezes duty on Scotch whisky

- Published

Chancellor George Osborne leaves 11 Downing Street for the House of Commons with the traditional red box

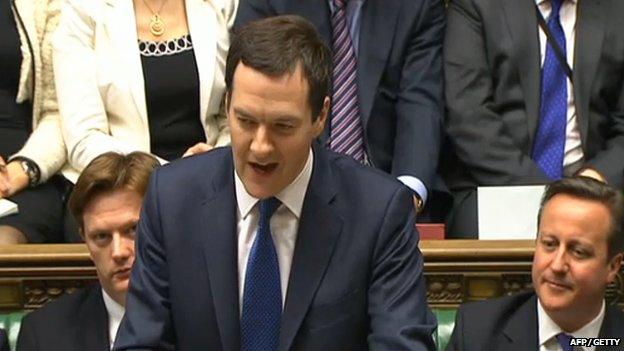

Duty on Scotch whisky is to be frozen, Chancellor George Osborne has said.

In his budget speech - the last before September's independence referendum - the chancellor said the measure would help the whisky industry thrive.

Scottish Conservative leader Ruth Davidson said Mr Osborne had "given the whisky industry a break".

But Scottish Finance Secretary John Swinney said sticking with the Westminster system would "leave Scotland with a severe hangover".

Speaking to a packed House of Commons, the chancellor scrapped the alcohol duty escalator which has increased duty annually by inflation plus 2% since 2008.

Meanwhile, on North Sea oil and gas, Mr Osborne announced "new allowances" to support investment, and said the fiscal regime for the industry would be reviewed.

He also highlighted that the Office for Budget Responsibility (OBR) had downgraded forecasts for North Sea tax receipts by £3.3bn.

During his Budget speech to MPs in the House of Commons, Chancellor George Osborne announced new allowances to support North Sea Oil investment

Mr Osborne said this was a reminder of "how precarious the budget of an independent Scotland would be" and claimed it would leave a budget shortfall of £1,000 for every Scot.

The Scottish government has previously questioned the veracity of OBR oil and gas figures, and criticised the UK government for failing to create an oil fund.

'Tax boost'

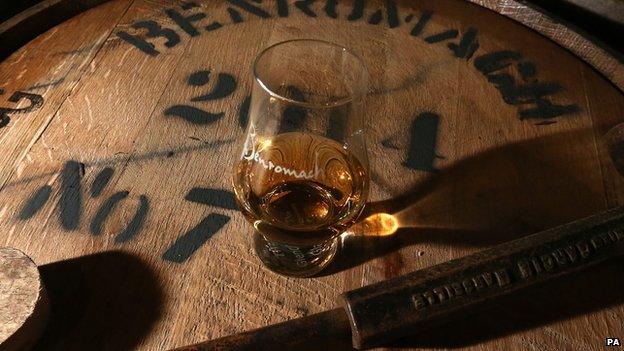

Earlier this month, Ms Davidson called on Mr Osborne to scrap the planned increase in whisky duty after figures revealed sales of the spirit in the UK had fallen by 3% over the past year.

The alcohol escalator was introduced six years ago and the whisky industry has consistently called for it to be scrapped, saying it damages the UK market for Scotland's national drink.

Whisky duty has been frozen by Chancellor George Osborne, and the alcohol duty escalator was scrapped

Many blended bottles now cost about £20, while the average cost of a bottle of malt whisky is £37.50 - of which about 80% is tax.

About 90% of Scotch whisky is exported to countries around the world.

The Scottish Conservative leader said: "I am pleased the chancellor has given the whisky industry a break by freezing duty and scrapping the alcohol duty escalator.

Ms Davidson added: "This tax boost will not only benefit the big players, but also the small independent distilleries right across Scotland who rely on our domestic market for sales."

David Frost, chief executive of the Scotch Whisky Association, also welcomed the duty freeze.

He said: "It is a move that supports hard-pressed consumers, a major manufacturing and export industry and the wider hospitality sector.

"This fairer tax treatment in the UK, the third biggest market for Scotch, also sends the right signal on excise policy to the governments of the 200 countries to which we export."

'Years of austerity'

In what he described as a Budget for "makers, doers and savers", Mr Osborne announced a scheme to boost exports and doubled the annual amount businesses are allowed to invest before being taxed.

He said more funding would be made available for new routes at regional airports.

According to the Scotland Office, spending decisions outlined in the Budget would lead to more than £63m for the Scottish government.

The SNP broadly welcomed the announcement on whisky, but the party's Westminster leader Angus Robertson pointed out that tax on Scotch has risen by 44% over five years.

And looking at the Chancellor's budget as a whole, Mr Swinney told the BBC: "What the Chancellor set out essentially was a continuation of the austerity agenda that has become the familiar backdrop to the recent budgets.

"I think what it also demonstrated was the fact that the chancellor's economic plans have substantially undershot in terms of the performance that was expected in 2010.

"If the chancellor's plans in 2010 had been fulfilled the economy would be 5% larger than it is today and that's a demonstration of the degree of economic failure that the chancellor has presided over."

Scottish Secretary Alistair Carmichael urged voters to vote 'No' and remain part of the "fast-growing UK economy".

He said: "The Budget means the consequences of our referendum decision are becoming clearer.

"Do we want to gamble our place in a UK that is working well for Scotland in return for a go-it-alone option with no UK pound and falling oil revenues?"

Andy Willox, Scottish policy convenor of the Federation of Small Businesses said his members were "ready to grow".

He added: "Today's Budget offered a clear signal to business that the UK government wants to support this objective."

Industry trade body Oil & Gas UK warmly welcomed the government's support for the recommendations of the Wood Report on the future of the North sea, and the review of the industry's tax regime.

But it said it was "perplexed" by the move to change the basis for taxation of drilling rigs and accommodation vessels supplied using bareboat chartering arrangements to the UK's offshore oil and gas industry, despite evidence that this new tax measure could prove damaging to exploration and development activity.