Cameron would like to 'go further' on inheritance tax

- Published

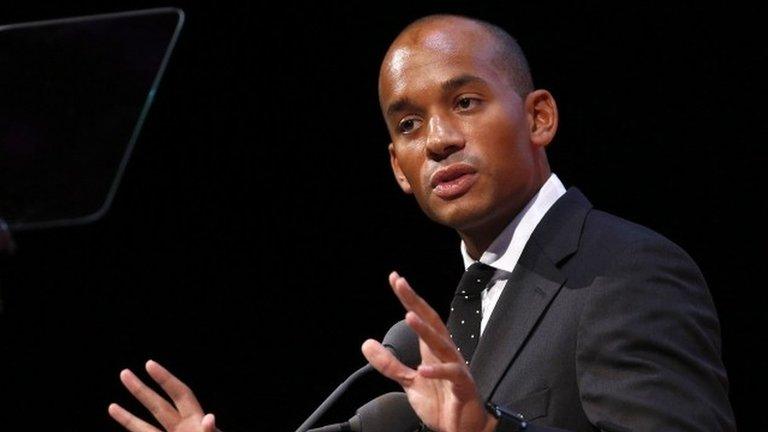

David Cameron: "We should be encouraging people to pass things on to their children"

David Cameron has said his ambition remains to lift many more people out of inheritance tax, suggesting it should only be paid by "the rich".

In opposition, the Conservatives pledged to raise the threshold at which people pay the tax to £1m.

Speaking at a meeting in East Sussex, the prime minister said he had not been able to do it in government because of Liberal Democrat opposition.

But he hinted it would be looked at in the party's 2015 election manifesto.

In 2007, the then shadow chancellor George Osborne pledged to triple the inheritance tax threshold from £300,000 to £1m if the Conservatives won the next election.

'Passing down'

Shortly afterwards, the then Labour prime minister Gordon Brown announced changes to inheritance tax, allowing married couples and registered civil partners to effectively increase the threshold on their estates to £650,000 when the second partner dies.

In nearly all other cases, inheritance tax at 40% is currently liable on estates worth more than £325,000.

On a visit to Peacehaven, a town near Brighton, Mr Cameron was asked about whether the 2007 pledge still stood, particularly in light of the sharp rise in house prices in parts of southern England since then.

"Would I like to go further in future - yes I would," he told a question and answer session hosted by Saga.

"I believe in people being able to pass money down through the generations and pass things on to their children. You build a stronger society like that.

"Of course you have to have caps and limits and you have to think about those - but generally we should be encouraging people to pass things on to their children."

'Family houses'

The prime minister said he had been unable to fulfil the 2007 pledge, which was included in the party's 2010 election manifesto, because his coalition partners had been "very opposed".

But he gave a strong hint that it could be revived in the run-up to next year's general election.

"Quite a lot of hard-working families, who had worked hard and saved, and put money into their house were being caught by inheritance tax.

"Inheritance tax should only really be paid by the rich. It should not be paid by people who have worked hard and saved and who have bought a family house, say in Peacehaven.

"The ambition is still there. I would like to go further. It is better than it was... and it is something we will have to address in our manifesto."

Pension changes

He also defended proposed changes in the Budget which will make it easier for many people to take their private pension in a single lump sum after the age of 55 rather than having to use it to buy an annuity, which gives an annual payment.

Concerns have been raised that some people could spend the money in one go and have very little to fall back on for the rest of their retirement.

The PM said he believed people were "fundamentally responsible" and would not "blow it all".

"It is deeply condescending to say to people who have worked hard and saved all their lives... that you can't trust them to spend their own money," he said.

He acknowledged that pension income taken as a lump sum would be included in an assessment of people's assets when it came to considering their eligibility for social care support.

"That is the case. You have the choice - you can leave it in your pension pot or take it out."

But he said the maximum that anyone would have to pay towards their care costs would be capped at £75,000 as part of steps to boost "dignity and security in old age".

- Published4 March 2014

- Published4 March 2014