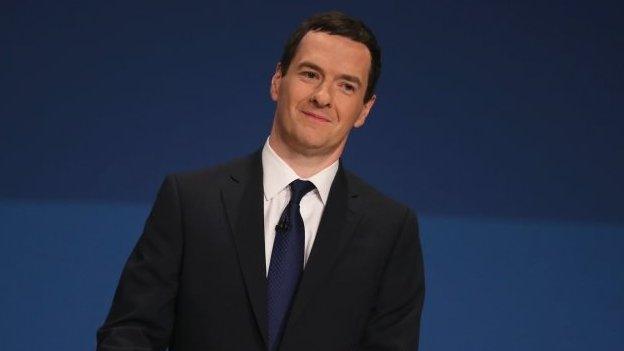

Osborne - Benefit freeze and 'Google tax'

- Published

There is nothing George Osborne likes more than making twin pack announcements designed to make him look tough but fair.

So it is that he has just announced that a future Conservative government would freeze benefits paid to people of working age for two years at the same time as what will quickly become known as the "Google Tax" - a crackdown on what accountants and tax lawyers call the double Irish arrangement - a tax avoidance strategy that multinational corporations use to lower their corporate tax liability first used by Apple.

The proposed benefit freeze would come into effect if the Conservatives are re-elected and would start in 2016 - the first full year of a new government.

It would include Jobseeker's Allowance, Income support, Child Tax Credit and Working Tax Credit, Child Benefit and Employment Support Allowance paid to those judged capable of work but it would not affect pensions, disability benefits and maternity pay.

The chancellor's political objective is clear - to put Labour on the spot by saying, in effect, "here's how I would save £3bn to cut the deficit - what would you do?".

'Fair cut'

Furniture warehouse volunteer, Martin: "If you freeze benefits all you are doing is hurting the people"

Labour, of course, do not have to cut the deficit as fast as the Tories are proposing since they have adopted looser borrowing rules which, according to the Independent Institute of Fiscal Studies, allow them to borrow up to £28 bn more each year.

When the Chancellor decided to limit increases in benefits to 1% in 2012 - less than inflation and a real terms cut - Ed Balls attacked the Tories for believing you "make low-paid working people work harder by cutting their tax credits but you only make millionaires work harder by cutting their taxes".

However, last week the shadow chancellor showed he would contemplate some benefit cuts by announcing that he would continue with the coalition's policy of increasing child benefit by 1% for one more year if he moved into the Treasury.

The government has previously considered freezing benefits in 2010 and again in 2012 but the idea has always been vetoed by the Liberal Democrats.

George Osborne argues that this cut is fair because pay has gone up less than benefits since the recession began.

'Double Irish'

His aides say that earnings have increased by 14% since 2007 whereas out of work benefits have gone up by over 22% in the same period.

Of course, however, it will impact many of the poorest in the country and if earnings start to increase the gap between those in work and out of work will widen.

It is hard without more detail to know what impact the move to tackle tax avoidance by large US tech firms will have. The US and Irish governments have already taken some moves to tackle the so-called "double Irish" arrangement.

Treasury aides say that the move may raise a few hundred million pounds but more details will be given in the Chancellor's Autumn Statement. Just as appealing to the chancellor as the money, though, will be the headline - Osborne introduces "Google Tax".