Benefit cuts - coming soon

- Published

Iain Duncan Smith and George Osborne held a meeting with the prime minister last week

"You identify a million people who you'd like to take £1,000 away from and I'll do it."

That's what a former Tory benefits axeman in the 1990s used to tell fellow MPs who urged him to find an easy £1bn cut from the nation's welfare bills.

So, "all" that his successor, Iain Duncan Smith, and the Chancellor, George Osborne, have to do now is identify 12 million people they'd like to take £1,000 away from.

The two men met with the prime minister last Thursday to find agreement on how to find the £12bn they've promised to cut from the nation's benefit bill in the next two years. It is not clear that they have yet found it.

'Perverse incentives'

They have agreed the total sum they want to save; they've agreed the cuts the prime minister will not let them make - to pensioner and child benefits; they've heard his worries about targeting disability benefits; they've agreed some small popular down payments but they've a way to go before reaching detailed proposals to produce that sum.

That's one reason why the Budget on 8 July will only unveil some of the proposed welfare cuts. Others will have to wait until the Spending Review this autumn.

What, you might ask, about the promise to cut the benefit cap? Or to take housing benefit away from the under 25s? And how about freezing tax credits. Between them those measures would raise less than £1.5bn. Not nearly enough.

So, that's why the prime minister's speech signalled that tax credits are in his sights. They're worth around £30bn of the unprotected welfare spending bill of £77bn a year.

That's why he attacked what he called the "merry-go-round" of the Treasury giving cash to working people with one hand and taking it away with the other. He pledged to "remove perverse incentives" which discourage people from leaving benefits and returning to work and criticised the idea of handing a few pounds to poor people to get them above the poverty line.

'Pitch rolling'

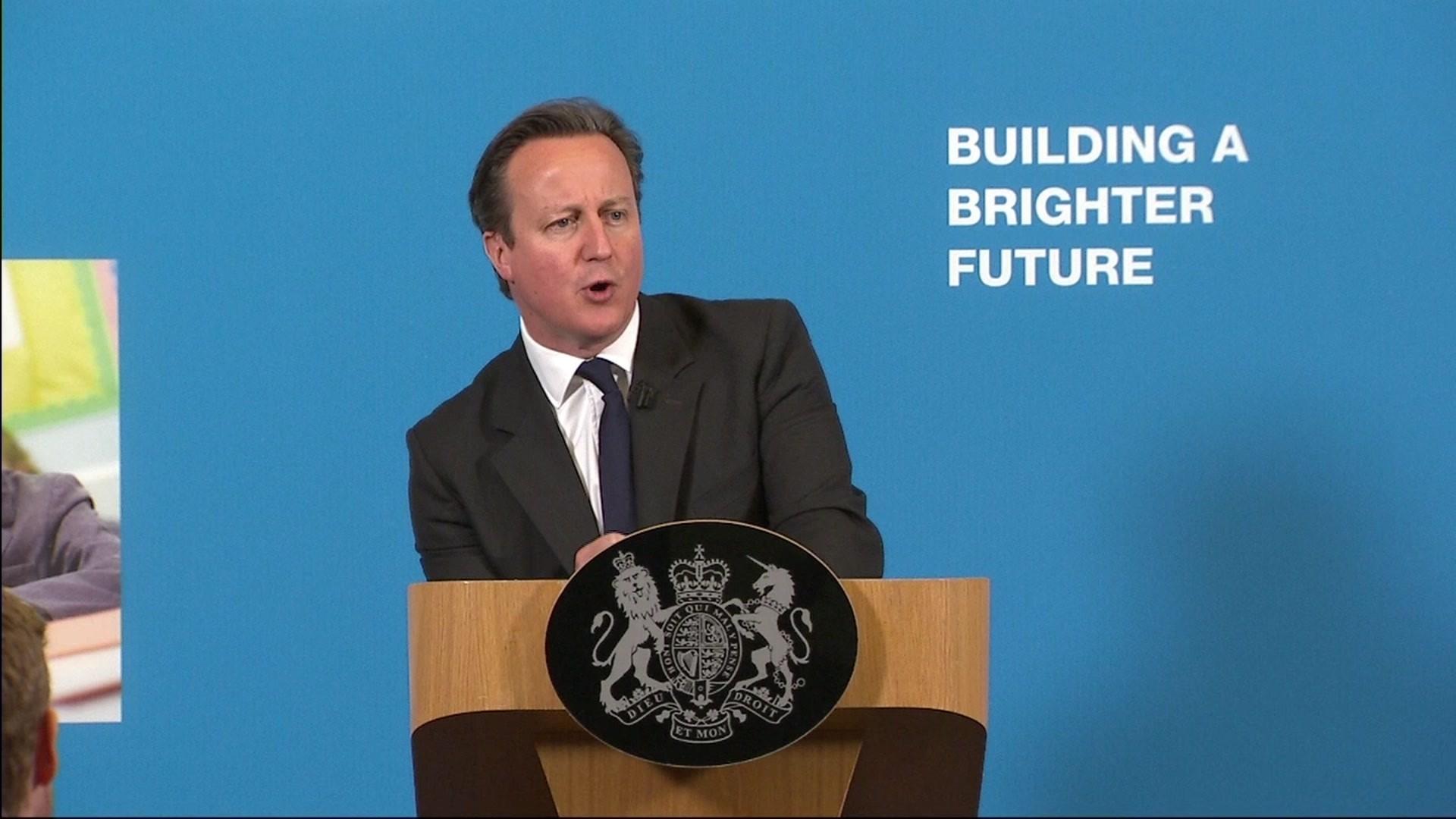

This is what David Cameron calls "pitch rolling", preparing the ground for what is to come.

The likeliest target appears to be child tax credit, which is paid to those on low incomes who are both in and out of work.

Newsnight's Allegra Stratton got the first whiff of this a couple of weeks ago. She reported that ministers were studying the work of the Institute for Fiscal Studies, external which noted that £5bn a year could be saved by returning child tax credit to the level it was just over a decade ago. The IFS estimates that this would hit 3.7 million low income families by £845 per child - producing an average loss of £1,400 per year - although some of these would be future rather than current recipients.

The government have the IFS's backing for saying this would increase work incentives although critics at the Resolution Foundation , externalhave pointed out that it would be the 30% of the poorest usually out of work families who would suffer most.

The devil will, as they say, be in the detail. It's worth remembering that it is sometimes the smallest, apparently least controversial cuts that cause the most political pain.

Ministers are well aware that when it was first proposed the "bedroom tax" was regarded in Whitehall as a tidying-up measure and not a symbol of the government's wickedness.

Taking cash away from people who've yet to receive it by cancelling future entitlements or increases is usually easy to do, particularly when inflation is low and when real wages and the minimum wage are rising. What really hurts - people and governments - is taking cash away from families which have already got it.

So, anyone want to start drawing up that list of 12 million people?

- Published22 June 2015

- Published17 June 2015