Spending Review: George Osborne defends tax credits U-turn

- Published

- comments

George Osborne: I listened to concerns over cuts

Chancellor George Osborne has denied his Spending Review U-turn on tax credits was a sign of weakness.

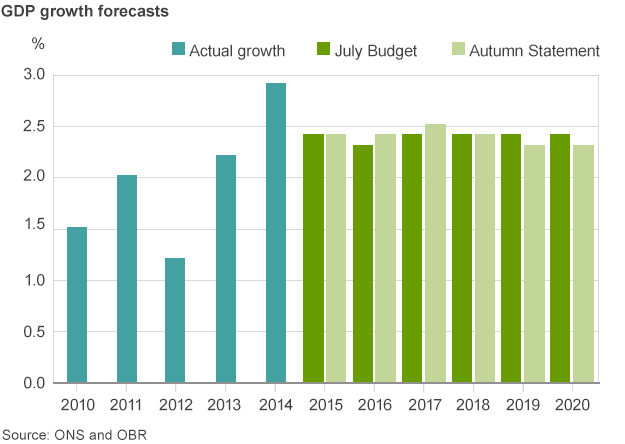

He said he had listened to critics of the planned cuts and was "able to help" because the economy is stronger.

Economists claim low paid families will still be out of pocket due to other changes announced on Wednesday.

Labour's John McDonnell has meanwhile lashed out at "hypocrites" who mocked him for brandishing Chairman Mao's Little Red Book in the Commons.

The shadow chancellor insisted he was being "ironic" and the stunt, during his response to Mr Osborne's Spending Review, had raised an important issue about the sale of UK assets to China in a "flamboyant and jocular" way.

However, he did apologise to a former prisoner in a Maoist labour camp who said she found his use of the communist dictator's words "chilling".

Follow the latest political updates on BBC Politics Live

Mr Osborne used an unexpected £27bn windfall caused by lower debt interest payments and projected higher tax receipts to scrap tax credit cuts and protect police budgets, which had been expected to be cut by 20%, prompting some commentators to declare "the end of austerity".

The chancellor's Spending Review in 60 seconds

But a string of Whitehall departments will still have to find savings totalling £21.5bn and Mr Osborne pushed ahead with £12bn cuts to welfare, including a fresh squeeze on housing benefit.

He also paved the way for council tax rises by allowing councils to levy 2% on bills to pay for social care and introduced a new tax on business to pay for apprenticeships and new property taxes on buy-to-let landlords.

The figures suggest he will still meet his target of running a surplus by 2020, although he will breach his own welfare spending cap in the early years of this Parliament.

'Difficult decisions'

Paul Johnson, the director of the Institute for Fiscal Studies, said Mr Osborne had "got a bit lucky" with the revised estimates for tax receipts but in the long run the reduction to the welfare bill would be the same as previously planned because the new Universal Credit, which will replace tax credits and other benefits, will simply be less generous than it would have been.

Speaking to BBC Radio 4's Today programme, Mr Osborne denied the government was being pushed around by its opponents over tax credits.

He insisted that his central judgement - to save £12bn in welfare spending by 2020 - was the right one but that "people raised concerns and I listened to them".

Improved public finances and a stronger economy have enabled him to "smooth the transition" to a lower welfare, higher wage economy, he added.

But the Spending Review was "not an end to difficult decisions" and he said that government departments still faced tough choices.

The chancellor was forced to rethink plans to cut £4.4bn from tax credits from April after they were rejected by the House of Lords.

Council tax

Both the SNP and Labour claimed scrapping tax credit cuts was a victory for their parties, who had called for them to be reversed, but they said a fresh squeeze on housing benefits announced on Wednesday and the move to Universal Credit will hit low paid families.

John McDonnell says his actions got people talking

BBC editors on the Spending Review

The Resolution Foundation think tank has calculated that once the welfare cuts work their way through, working households on Universal Credit, the replacement for tax credits will lose an average of £1,200 in 2020, rising to £1,300 for those with children. For some families, they say, the loss will be as much as £3,000.

The think tank has also worked out that families at the bottom half will lose on average, £650 from all of the changes made in the Summer Budget and the Autumn Statement.

Analysis by the Office for Budget Responsibility suggests householders are set to pay £2.7bn more in council tax by 2020/2, despite a Conservative manifesto promise to help keep council taxes low.

Other Spending Review announcements include:

Police budgets in England and Wales will be protected in real terms, Mr Osborne said in a surprise announcement

Plans to hand billions to private developers to build 400,000 new homes in England

A real terms increase for education funding - including early years and further and higher education, and big regional differences in per pupil funding removed

Buy-to-let landlords and people buying second homes will have to pay more in stamp duty

A levy on companies to fund apprenticeships is being set at 0.5% of an employer's pay bill

Basic state pension to rise by £3.35 next year to £119.30 a week

Tax free childcare for families earning more than £100,000 to be scrapped

Money for new road and rail projects, including the electrification of TransPennine, Midland Mainline and Great Western

Holloway women's prison in London, is to close as part of a plan to modernise Britain's jails

Housing benefit for new social tenants to be capped at same level as private sector

NHS to deliver £22bn efficiency savings in England and Department of Health to cut 25% from its Whitehall budget

Proposals to raise £5bn in a fresh crackdown on tax avoidance

Using £15m a year from VAT on sanitary products to fund women's health charities

- Published26 November 2015

- Published24 November 2015

- Published23 November 2015

- Published24 November 2015

- Published20 November 2015

- Published24 November 2015